Canada Breastfeeding Accessories Market Analysis

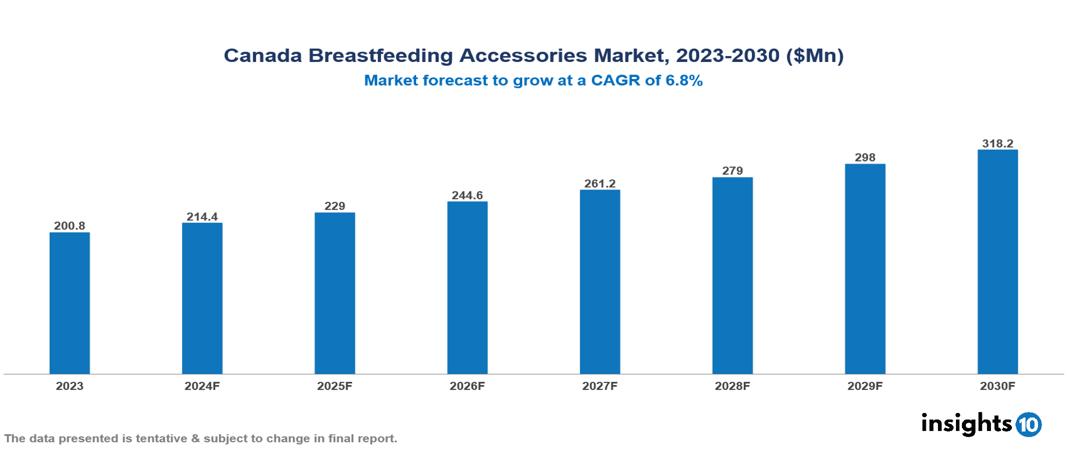

Canada Breastfeeding Accessories Market was valued at $200.80 Mn in 2023 and is predicted to grow at a CAGR of 6.80% from 2023 to 2030, to $318.25 Mn by 2030. The key drivers of this industry include early disease detection, personalized medicine, and government funding. The industry is primarily dominated by Medala, Elvie, Willow Innovations, and Koninklijke Philips among others.

Buy Now

Canada Breastfeeding Accessories Market Executive Summary

Canada Breastfeeding Accessories Market was valued at $200.80 Mn in 2023 and is predicted to grow at a CAGR of 6.80% from 2023 to 2030, to $318.25 Mn by 2030.

Breastfeeding accessories are essential tools that aim to improve the overall breastfeeding experience for both mothers and babies, addressing various needs from comfort to convenience. Key categories include manual, electric, and hospital-grade breast pumps, which cater to different pumping needs and frequencies, while nursing pads and nipple shields provide comfort by managing milk leaks and protecting sore nipples. Breast shells help collect excess milk and shield sensitive areas, and milk storage containers ensure the safe storage of expressed milk. Nursing bras and covers offer support and discreet breastfeeding options, and breastfeeding pillows provide ergonomic support to both mother and baby during feeds. Additionally, nipple creams soothe and protect against irritation. These accessories not only enhance comfort and ease for mothers but also support health by preventing infections and maintaining milk quality, ultimately contributing to a more positive, manageable, and flexible breastfeeding experience.

In Canada, over 80% of mothers initiate breastfeeding, but the duration and exclusivity rates can vary due to factors like returning to work and perceived milk supply issues. Breastfeeding rates also differ by region. Common breastfeeding accessories include breast pumps, nursing bras, nipple creams, and breast pads, which are widely available through stores, pharmacies, and online. Some provinces offer financial support for these items through healthcare plans.

The market is therefore driven by significant factors like high breastfeeding rates, increasing awareness, and growing innovation. However, high cost of accessories, reimbursement challenges, and complexities in usage restrict the growth and potential of the market.

A prominent player in this field is Medala, in 2024, Medela AG launched a new line of breast pumps with smart technology for real-time tracking and personalized support, enhancing milk production and breastfeeding practices. Similarly, Elvie introduced an updated wearable breast pump featuring improved suction technology and longer battery life, offering greater comfort and efficiency based on user feedback. Other contributors include Willow Innovations, and Koninklijke Philips among others.

Market Dynamics

Market Growth Drivers

High Breastfeeding Initiation Rates: With over 80% of Canadian mothers starting breastfeeding in 2023 according to Statistics Canada, the demand for breastfeeding accessories is high. This high initiation rate reflects a strong cultural and health commitment to breastfeeding, encouraging the purchase of various accessories to support and enhance the experience.

Increasing Awareness: The growing emphasis on the benefits of breastfeeding, including improved infant health and maternal bonding, drives the demand for breastfeeding accessories. Public health campaigns and educational programs contribute to increased awareness and usage of products that support successful breastfeeding.

Convenience and Innovation: Technological advancements, such as electric breast pumps and ergonomic nursing bras, enhance the convenience and efficiency of breastfeeding. Innovations in design and functionality make accessories more user-friendly, leading to increased market adoption.

Market Restraints

Cost of Accessories: High-quality breastfeeding accessories can be expensive, which may deter some mothers from purchasing them. The financial burden of buying multiple accessories can be a significant barrier for families, particularly those on a tight budget.

Limited Insurance Coverage: Inadequate insurance coverage for breastfeeding accessories limits their affordability for many families. Without sufficient reimbursement or financial support, some mothers may struggle to access the necessary products to support breastfeeding.

Complexity of Use: Some breastfeeding accessories can be complex to use or maintain, which may discourage their adoption. Difficulties with product setup, cleaning, or operation can create frustration for mothers and affect their willingness to use these items regularly.

Regulatory Landscape and Reimbursement Scenario

In Canada, breastfeeding accessories are regulated under Health Canada's Medical Devices Regulations (MDR), which apply to licensing, manufacturing, and sale. These products are typically classified as Class I or II medical devices, based on their risk level, and manufacturers must secure the necessary licenses and registrations. Labelling and advertising are closely regulated to ensure accurate consumer information.

Reimbursement for breastfeeding accessories varies significantly across Canada. Public health insurance generally does not cover these costs, though exceptions exist for Indigenous populations and specific provincial programs for low-income families. Private health insurance coverage is inconsistent, and while tax benefits may apply, direct reimbursement is limited. Challenges include financial barriers for families and ensuring equitable access, while opportunities lie in promoting awareness, addressing diverse needs with innovative products, and enhancing accessibility.

Competitive Landscape

Key Players

Here are some of the major key players in the Canada Breastfeeding Accessories

- Medela AG

- Ameda, Inc.

- Willow Innovations, Inc.

- Koninklijke Philips N.V.

- Elvie (Chiaro Technology)

- Freemie

- Spectra Baby

- Hygeia Health

- NUK USA

- Mayborn Group (Tommee Tippee)

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Canada Breastfeeding Accessories Market Segmentation

By Product Type

- Nipple Care Products

- Breast Pumps

- Breast Shells

- Breastmilk Storage & Feeding Products

- Others

By Distribution Channel

- Online retail

- Offline retail

- Hospital pharmacies

By End User

- Hospitals

- Clinics

- Homecare Settings

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.