Canada Asthma and COPD Therapeutics Market Analysis

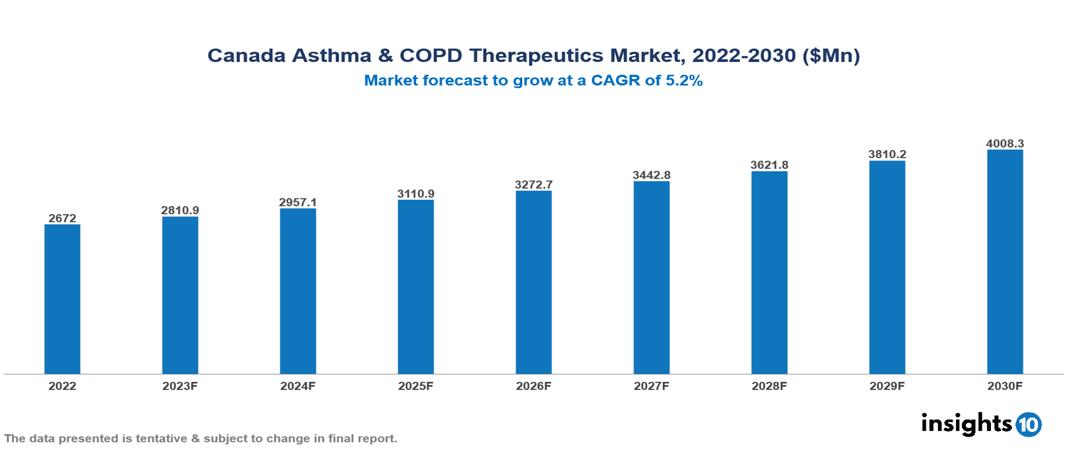

The Canada Asthma and COPD Therapeutics Market was valued at US $2.67 Bn in 2022, and is predicted to grow at (CAGR) of 5.20% from 2023 to 2030, to US $4.00 Bn by 2030. The key drivers of this industry include the upward trend in the prevalence of COPD and asthma, the adverse effects of COVID-19, rising healthcare expenses, and others. The industry is primarily dominated by players such as AstraZeneca, Abbott, GSK, Novartis Pfizer, and Boehringer Ingelheim, among others.

Buy Now

Canada Asthma and COPD Therapeutics Market Analysis: Executive Summary

The Canada Asthma and COPD Therapeutics Market is at around US $2.67 Bn in 2022 and is projected to reach US $4.00 Bn in 2030, exhibiting a CAGR of 5.20% during the forecast period.

Asthma is an inflammatory condition that causes the airways to hyperreact and narrow, resulting in symptoms such as wheezing, coughing, and shortness of breath. Triggers like allergens or exercise often provoke these symptoms, which can be intermittent. In contrast, COPD progressively damages the lungs, making airflow difficult due to emphysema (destruction of air sacs) and chronic bronchitis (inflamed airways). Symptoms like a persistent cough and worsening shortness of breath develop gradually. Risk factors for both conditions include smoking, family history, and exposure to air pollution. Treatment for both conditions involves the use of bronchodilators and inhaled corticosteroids. However, asthma may also benefit from allergy medications and immunotherapy, while COPD might require oxygen therapy and pulmonary rehabilitation. Key companies such as AstraZeneca, Boehringer Ingelheim, and GlaxoSmithKline manufacture treatments for both conditions.

The approximate prevalence of COPD is estimated to be about 9.5%, while the prevalence of asthma is around 14% in Canada. These estimates are directly correlated to the risk factor of increased smoking in the population. The market is propelled by significant factors such as the increased prevalence of asthma and COPD, improved focus on quality of life, and rising healthcare expenditure in the therapeutics industry. However, high treatment costs for long term management, increased market competition, and limited human resources are a few factors that limit the market's potential.

Market Dynamics

Market Growth Drivers

Increasing prevalence: It is estimated that the age-standardised prevalence of COPD is around 9.5%, accounting for approximately 2 million Canadians suffering from the condition. Subsequently, the prevalence of asthma is about 14% in the age group 0–20 years, affecting a population of around 4 million people in Canada. This translates to an increased number of patients in need of treatment, contributing to a growing demand for therapeutics. The aging population in Canada is especially vulnerable to COPD because smoking, which was more widespread in older generations,. This demographic shift further enhances the market's potential.

Rising healthcare expenditure: The Canadian government and private insurance providers are directing additional resources toward the management of chronic conditions such as COPD and Asthma. This augmented funding facilitates research to groups such as the Lung Association of Canada, development, and the integration of new therapeutics, driving the expansion of the market.

Impact of COVID-19: The COVID-19 pandemic has demonstrated the susceptibility of individuals with respiratory conditions, bringing attention to the effective management of COPD and Asthma. This heightened awareness results in increased demand for therapeutics both in the short and long term.

Focus on quality of life: Individuals with COPD and Asthma are increasingly seeking treatment alternatives that enhance their quality of life and alleviate the burden of the diseases. The rising demand for symptom management and enhanced functionality propels the market for advanced therapeutics.

Market Restraints

High treatment costs: The long-term management of both COPD and Asthma involves the use of medications and devices, imposing a substantial financial strain on both patients and healthcare systems. The cost of newer and more effective medications is high, and not everyone possesses sufficient insurance coverage to afford them. This situation can result in non-adherence to medication and contribute to suboptimal health outcomes.

Lack of specialists: A shortage of pulmonologists and other specialists capable of accurate diagnosing and treating COPD and Asthma exists, especially in rural areas. This restricted accessibility can cause delays in diagnosis and treatment, resulting in the progression of the diseases and potential complications.

Increased market competition: As healthcare investments is rising with economic growth, generic versions of current medications for COPD and Asthma are becoming more accessible and cost-effective. This trend exerts pressure on prices and profit margins for established companies in Canada.

Environmental factors: Exposure to air pollution and various environmental triggers has the potential to exacerbate symptoms of COPD and Asthma, complicating their long-term management and potentially raising healthcare costs.

Notable Updates

October 2022, Canada Health has granted approval to AstraZeneca's Breztri™ Aerosphere® for the long-term maintenance treatment aimed at reducing exacerbations of chronic obstructive pulmonary disease (COPD) and addressing airflow obstruction in COPD patients.

November 2021, Canada granted approval for NUCALA (mepolizumab) by GlaxoSmithKline plc as the first and only biologic treatment designed for adults experiencing hypereosinophilic asthma, as well as adolescents aged 12 years and older. This medication represents a targeted monoclonal therapy specifically designed for asthma.

Healthcare Policies and Regulatory Landscape

Canada's healthcare policy and regulatory landscape is characterized by a division of responsibilities between federal and provincial/territorial entities. Health Canada, at the federal level, oversees national health policy and sets standards for health services and products. Meanwhile, each province and territory manages its own healthcare policies and regulations through dedicated health ministries or departments. Regional health authorities within provinces and territories are responsible for the local operation of healthcare services.

The licensing process for healthcare professionals in Canada is typically regulated at the provincial or territorial level. Various steps are involved, including meeting educational requirements, passing licensing examinations, gaining clinical experience, and submitting applications to the relevant regulatory body. Continuing education and professional development are often required to maintain licenses. For international applicants, additional assessments may be necessary to ensure their qualifications align with Canadian standards. It is crucial to note that specific licensing procedures and healthcare policies may differ between provinces and territories, necessitating consultation with the respective regulatory bodies for the most up-to-date and accurate information.

Competitive Landscape

Key Players

- Abbott Laboratories

- Adamis Pharmaceuticals Corporation

- Astellas Pharma

- AstraZeneca

- Boehringer Ingelheim Pharmaceuticals

- Novartis

- Pfizer

- Teva Canada Limited

- GlaxoSmithKline

- Merck

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Canada Asthma and COPD Therapeutics Market Segmentation

By Disease Type

- Asthma

- COPD

By Medication Class

- Combination drugs

- Short Acting Beta Agonists (SABA)

- Long Acting Beta Agonists (LABA)

- Leukotriene Antagonists (LTA)

- Anticholinergics

- Others

By Delivery Device

- Metered dose inhalers (MDI)

- Dry Powder inhalers (DPI)

- Nebulizers

By Route of Administration

- Inhaled

- Oral

- Others

By End User

- Asthma Patients

- COPD Patients

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.