Canada Alzheimer’s Disease Drugs Market Analysis

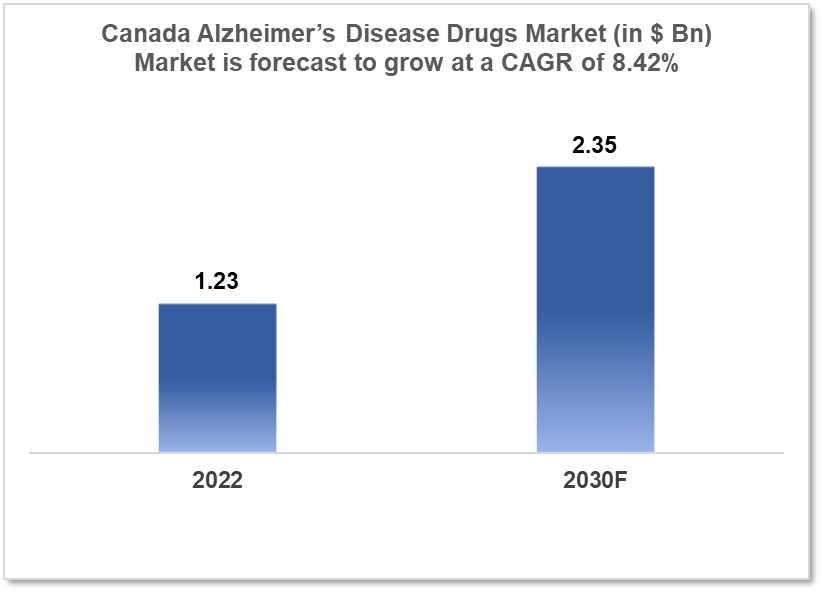

Canada's Alzheimer’s disease drugs market was valued at $1.23 Bn in 2022 and is estimated to expand at a CAGR of 8.42% from 2022-30 and will reach $2.35 Bn in 2030. One of the main reasons propelling the growth of this market is the introduction of newer technologies, and the aging population. The market is segmented by drug classes and by Distribution Channels. Some key players in this market are Pfizer, Biogen, Eli Lilly and Company, Novartis International AG, Merck & Co, AstraZeneca, Roche Holding AG, Johnson & Johnson, AbbVie, and Sanofi among others.

Buy Now

Canada Alzheimer’s Disease Drugs Market Executive Summary

The Canada Alzheimer’s disease drugs market was valued at $1.23 Bn in 2022 and is estimated to expand at a Compound Annual Growth Rate (CAGR) of 8.42% from 2022 to 2030 and will reach $2.35 Bn in 2030. Alzheimer's disease (AD) is a neurological illness that often begins slowly and progresses over time. It is the cause of 60-70% of dementia cases. The most common initial symptom is trouble recalling recent events. Language impairments, disorientation (including easily getting lost), mood changes, loss of motivation, self-neglect, and behavioral concerns can all occur as the disease progresses. As a person's health deteriorates, they frequently retreat from family and society. Body functions gradually deteriorate, eventually leading to death. Although the rate of progression varies, the average life expectancy after diagnosis is three to nine years.

According to the Alzheimer Society of Canada (ASC), an estimated 564,000 Canadians are currently living with dementia, and this number is expected to increase to 937,000 by 2031. The organization estimates that there are also more than 1 Mn Canadians who provide care for someone with dementia. The ASC's programs and services reach an estimated 1.3 Mn Canadians each year.

Market Dynamics

Market Growth Drivers

Alzheimer's disease is most typically diagnosed in those over the age of 65, and Canada's population is aging. The need for Alzheimer's medications is predicted to rise as the population ages. Alzheimer's disease and its symptoms are becoming more widely known, which is contributing to an increase in diagnosis and treatment. This pattern is predicted to continue as more people become aware of the disease and seek treatment. The Canadian government is funding in research and development of new Alzheimer's disease treatments. This investment is expected to hasten the development and market availability of new medications. Given technological breakthroughs, there is an increasing prospect of discovering new medications that can halt or even reverse the progression of Alzheimer's disease. This is projected to drive future growth in the Alzheimer's medications industry. Canada's overall healthcare spending is rising, which is likely to fuel demand for Alzheimer's medications. Given the rising frequency of Alzheimer's disease, there is a greater demand for financing for the research and development of novel treatments, resulting in market expansion.

Market Restraints

Alzheimer's medications can be highly expensive in Canada, making it difficult for people to purchase them. This may limit some patients access to treatment. While there are medications available to treat the symptoms of Alzheimer's disease, there is presently no cure. Also, some of the existing medications may be ineffective in some people. In recent years, there has been a paucity of significant new drug discoveries in the Alzheimer's pharmaceuticals market. This may limit patients' treatment options and slow the market's growth. Alzheimer's disease may be stigmatized, making it difficult for patients and their families to seek medical assistance. Also, there may be a lack of knowledge regarding the disease, which can cause delays in diagnosis and treatment.

Competitive Landscape

Key Players

- Pfizer

- Biogen

- Eli Lilly and Company

- Novartis International AG

- Merck & Co

- AstraZeneca

- Roche Holding AG

- Johnson & Johnson

- AbbVie

- Sanofi

Healthcare Policies and Regulatory Landscape

The Alzheimer Society of Canada (ASC) is a non-profit organization that provides support and education to people living with Alzheimer's disease and other dementias, as well as their families and caregivers. The main of ASC is to support people living with dementia, advance research on the disease, and promote public awareness and understanding of dementia. It offers a range of services to people living with dementia, including education and training, support groups, and assistance with accessing community resources. The organization also advocates for policy and program changes to improve the lives of people living with dementia. The ASC is funded through donations from individuals, corporations, and foundations, as well as through government grants. In the 2020-2021 fiscal year, the organization had a total revenue of approximately $40.5 million.

Reimbursement Scenario

Canadian Agency for Drugs and Technologies in Health (CADTH) is a non-profit organization that is funded by federal, provincial, and territorial governments (except Quebec). Its primary function is to give evidence and advice to Canadian healthcare decision-makers regarding medication financing decisions and the appropriate use of health technologies. To commercialize a medication in Canada, the manufacturer must obtain a Notice of Compliance (NOC) or a Notice of Compliance with Conditions (NOC/c) from Health Canada. The Patented Medication Pricing Review Board (PMPRB) must be notified of its sale price upon the first sale anywhere in the country, regardless of regulatory status, and must be kept up to date on other ongoing reporting requirements.

Canada's ten provinces and three territories are in charge of providing and funding healthcare. Provinces vary in their ability to implement recommendations and may have distinct demographics, insurance structures, or agencies covering specific disease areas (e.g., British Columbia's Centre for Excellence in HIV/AIDS or Cancer Care Ontario), as well as formulary eligibility, resulting in distinct reimbursement environments. Even provinces with comparable drug plans may take different approaches to list a particular therapeutic area because of cumulative changes in priority over time or disparities in affordability or HTA procedures.

Public programs primarily cover seniors, welfare users, and other groups (e.g., HIV patients) who face considerable financial hardship due to drug expenses, however, this varies by province, with some provinces providing universal coverage through a combination of public and private insurance. Throughout Canada, all inpatient medications are covered. Also, there are nationally sponsored and provided prescription plans for first nations (non-insured health benefits), veterans, prison convicts, armed forces employees, and federal police.

Private payers, who account for around two-thirds of working Canadians, are covered by private insurance for medications and other healthcare procedures. In Canada, there are 22 private payers.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Alzheimer's Disease Drugs Market Segmentation

By Drug Class (Revenue, USD Billion):

- Cholinesterase Inhibitors (Donepezil, Rivastigmine, Galantamine)

- N-Methyl-D-Aspartate (NMDA) Receptor Antagonists (Memantine)

- Combination Drugs

- Others (Lecanemab, Aducanumab)

Drug segmentation is the process of dividing a set of drugs into different categories or classes based on their pharmacological properties, therapeutic uses, and other characteristics. Here, Alzheimer’s Disease Drugs Market is segmented into Cholinesterase Inhibitors, N-Methyl-D-Aspartate (NMDA) Receptor Antagonists, Combination Drugs, and others like (Lecanemab, Aducanumab)

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Route of Administration

- Oral

- Transdermal

- Intravenous

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.