Brazil Oncology Clinical Trials Market Analysis

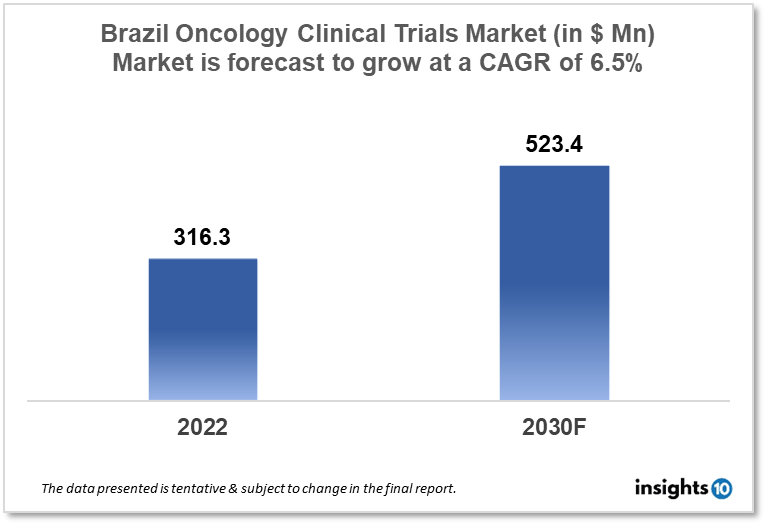

Brazil's oncology clinical trials market is projected to grow from $316.3 Mn in 2022 to $523.4 Mn by 2030, registering a CAGR of 6.5% during the forecast period of 2022-30. The market will be driven by the increased investment in healthcare and research and the rise in oncology clinical trials owing to rising cancer cases in Brazil. The market is segmented by phase, by study design & by indication. Some of the major players include Pfizer Inc., Novartis International AG & Eurofarma Laboratórios S.A.

Buy Now

Brazil Oncology Clinical Trials Market Executive Summary

Brazil's oncology clinical trials market is projected to grow from $316.3 Mn in 2022 to $523.4 Mn by 2030, registering a CAGR of 6.5% during the forecast period of 2022-30. Brazil is a vast nation with a population of over 200 Mn people, distinct geographical characteristics, and substantial health inequities. Although 25% of the Brazilian population has some sort of private insurance, the vast majority of people are served by the public system, known as the Sistema Nacional de Sade (SUS). Most, but not all, private insurance plans give access to cutting-edge cancer therapies. The public system, on the other hand, has generally denied coverage for newer, more expensive cancer treatments. As a consequence, treating patients based on current clinical trial findings, which have demonstrated tremendous improvements in outcomes in many cancer types, is helpful yet not feasible for the bulk of the country's population. According to Globocan 2020, In Brazil 5,92,212 new incidences of cancer were recorded with 2,59,949 fatalities.

Brazil is one of Latin America's biggest and fastest-growing pharmaceutical markets, and the country has a strong clinical trial infrastructure, making it an appealing venue for oncology clinical trials. Oncology clinical trials are conducted in Brazil by a variety of prestigious academic and research institutes. The major institutes are;

- Brazilian National Cancer Institute (INCA)

- Hospital das Clinicas in So Paulo

- Instituto do Câncer do Estado de So Paulo (ICESP)

With a solid infrastructure, a diversified patient population, and a supportive regulatory framework, the oncology clinical trials picture in Brazil is promising. Ongoing investment in research infrastructure, patient education, and international partnerships may assist to propel clinical trials in Brazil forward.

Market Dynamics

Market Growth Drivers

In recent years, Brazil has increased its investment in healthcare and research, including efforts like the Brazilian National Cancer Institute's (INCA) 2020-2023 strategy plan to boost cancer research and treatment. Brazil has a variety of renowned academic and research institutes active in oncology clinical trials, offering knowledge and resources to help with clinical research. Moreover, the rise of oncology clinical trials in Brazil is being driven by a supportive regulatory framework and a big and diversified population, which provides a vast pool of prospective patients for clinical studies.

Market Restraints

Despite the fact that Brazil has a big and diversified population, access to healthcare is restricted in certain locations, notably in rural and low-income areas. This may make recruiting participants for clinical studies difficult and restrict the generalizability of study outcomes. In Brazil, patients and doctors are still unaware of clinical trials, making it difficult to recruit patients for studies and restricting involvement in clinical research. Although the regulatory climate in Brazil for clinical trials is generally favorable, there are certain limitations, such as lengthy approval timeframes and bureaucratic impediments that might delay or hinder clinical trial implementation.

Competitive Landscape

Key Players

- Pfizer Inc.

- Novartis International AG

- Roche Holding AG

- AstraZeneca plc

- Bristol Myers Squibb Company

- Merck & Co., Inc.

- Eli Lilly and Company

- Johnson & Johnson

- Sanofi S.A.

- Aché Laboratórios Farmacêuticos S.A (BRA)

- Cristália Produtos Químicos Farmacêuticos Ltda (BRA)

- Eurofarma Laboratórios S.A. (BRA)

- Libbs Farmacêutica Ltda (BRA)

Notable Insights

- November 2022, BeiGene Reports BRUKINSA® Approval in Brazil for the Treatment of Rare Blood Cancers

- In April 2021, PlantForm Corporation (PlantForm) of Canada struck a deal with Brazilian partners to create a biosimilar of the cancer medicine pembrolizumab (Keytruda). Pembrolizumab is an antibody that is used to treat a variety of cancers, including lung, stomach, and head and neck cancer. It inhibits the immune system's ability to recognize and kill cancer cells by targeting the protein PD-1

Healthcare Policies and Regulatory Landscape

The National Health Surveillance Agency (Agência Nacional de Vigilância Sanitária (ANVISA)) is the regulatory body in charge of clinical trial monitoring, drug licensing, and inspection in Brazil. ANVISA authorizes the conduct of clinical studies. ANVISA is led by a Collegiate Board of Directors comprised of up to five (5) members, one (1) of whom acts as CEO. The Collegiate Board's major tasks include setting ANVISA's strategic guidelines and recommending to the Minister governmental policies and directives in support of the agency's sanitary surveillance goals.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Clinical Trials Regulation in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

6. Methodology and Scope

Oncology Clinical Trials Market Segmentation

By Phase (Revenue, USD Billion):

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design Outlook (Revenue, USD Billion):

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle regeneration

- Others

By Indication Outlook (Revenue, USD Billion):

- Interventional

- Observational

- Expanded Access

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.