Brazil Hepatitis A Therapeutics Market Analysis

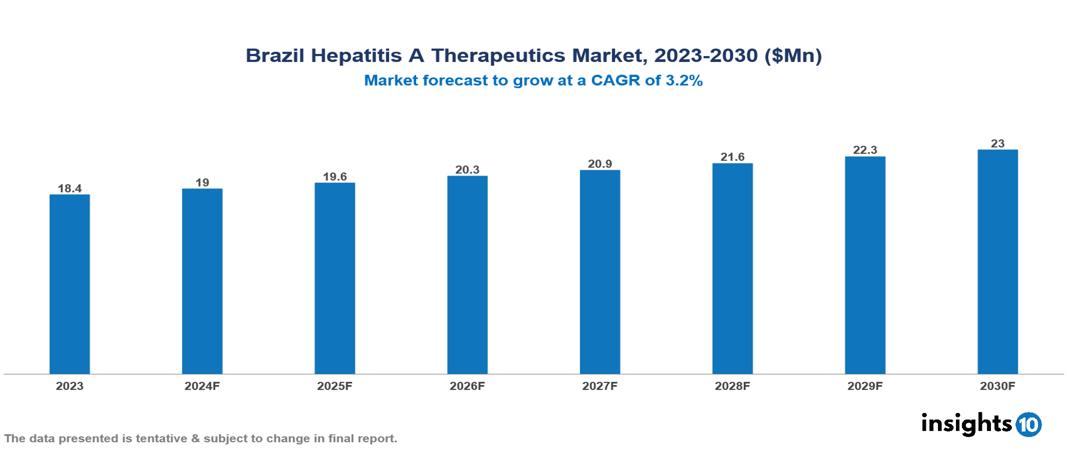

The Brazil Hepatitis A Therapeutics Market was valued at $18.43 Mn in 2023 and is predicted to grow at a CAGR of 3.2% from 2023 to 2030 to $22.98 Mn by 2030. Key drivers of this market include increasing prevalence, successful vaccination programs, and various public health initiatives. Prominent companies in this sector include Eurofarma and EMS Pharmaceuticals, among others.

Buy Now

Brazil Hepatitis A Therapeutics Market Executive Summary

The Brazil Hepatitis A Therapeutics Market was valued at $18.43 Mn in 2023 and is predicted to grow at a CAGR of 3.2% from 2023 to 2030 to $22.98 Mn by 2030.

Hepatitis A, caused by the Hepatitis A virus (HAV), is a contagious liver infection primarily transmitted through contaminated food or water. While outbreaks can occur sporadically or as epidemics, infection rates are generally lower in high-income countries like Brazil. Nevertheless, the disease remains a risk, with sporadic outbreaks persisting, especially in regions with poor sanitation. Prevention efforts focus on improving sanitation, food safety practices, and vaccination. The Hepatitis A vaccine provides at least 90% protection and is recommended for those at increased risk, including travelers to endemic regions and patients with chronic liver disease.

Brazil has a high prevalence of hepatitis A infection, with 87% of the population having total anti-HAV antibodies. The prevalence varies across regions, with 56% in the South and Southeast, 93% in the North, and 87% in indigenous populations. The prevalence increases with age, reaching 100% in individuals over 30. In Brazil, vaccination is recommended for individuals over six months old to prevent Hepatitis A. Increasing prevalence, successful vaccination programs, and public health initiatives drive the market, whereas a fragmented healthcare system, limited access to diagnostics, and affordability challenges restrain the market.

Market Dynamics

Market Growth Drivers

Increasing Prevalence of Hepatitis A: 87% of the population has total anti-HAV antibodies, indicating a high prevalence of hepatitis A infection. The prevalence varies greatly across Brazilian regions, with 56% in the South and Southeast, 93% in the North, and 87% in indigenous populations. The prevalence increases with age, with 100% in individuals over 30. Although Brazil is classified as low-intermediate endemic for Hepatitis A, there has been a significant prevalence of the virus in the country, leading to a demand for effective therapeutics.

Vaccination Programs: Incorporating Hepatitis A vaccination into the National Immunization Program in Brazil has significantly reduced the incidence of the disease. Vaccination against hepatitis A showed a positive cost-benefit relation, saving $2.26 in treatment for each dollar invested in the vaccine. This indicates that successful vaccination programs can drive the demand for Hepatitis A therapeutics, particularly vaccines.

Supportive Public Health Initiatives: Government initiatives such as expanding vaccination programs, implementing the National Viral Hepatitis Plan, including the Hepatitis A vaccine in the National Immunization Calendar, targeted strategies focusing on children, collaboration with medical societies, close monitoring of incidence rates for interventions, continued investment in public health measures and awareness campaigns, drive the demand for effective therapeutics.

Market Restraints

Fragmented Healthcare System: The healthcare system in Brazil is fragmented, with public and private providers coexisting. This can complicate access and delivery of liver cancer medicines, including Hepatitis A therapeutics, for patients and clinicians. This complexity in Brazil's healthcare system poses market restraints by complicating the access and delivery of Hepatitis A therapeutics, creating barriers for patients and clinicians.

Limited Access to Diagnostics: Access to accurate and timely diagnostics for Hepatitis A remains limited in certain regions of Brazil, particularly in underserved and remote areas. This limitation can delay diagnosis and treatment initiation, hindering effective disease management. This complexity in Brazil's healthcare system poses market restraints by complicating the access and delivery of Hepatitis A therapeutics, creating barriers for patients and clinicians.

Affordability Challenges: The high costs of Hepatitis A therapeutics can pose affordability challenges for some patients in Brazil, especially those without adequate health insurance coverage or access to government-subsidized programs. This financial barrier can limit treatment adherence and overall access to care, thus acting as a market restraint.

Regulatory Landscape and Reimbursement Scenario

In Brazil, the reimbursement scenario for hepatitis A therapeutics is influenced by the country's universal public healthcare system (SUS) and private health insurance plans. Under SUS, most people access drugs without direct reimbursement for drug prices, as the system provides healthcare services free of charge. The Brazilian model for drug price controls includes government-established price ceilings, and no public mechanism exists for reimbursing drug development expenses or prices.

The regulatory body responsible for drug approval and oversight is the Agência Nacional de Vigilância Sanitária (ANVISA), which ensures that medicinal products in Brazil are safe, effective, and compliant with regulations before they are made available to the public. ANVISA evaluates drugs' safety, efficacy, and quality through a rigorous scientific evaluation and collaborates with international regulatory agencies to share information and harmonize regulations.

Competitive Landscape

Key Players

Here are some of the major key players in the Hepatitis A Therapeutics Market:

- Eurofarma

- EMS Pharmaceuticals

- F. Hoffmann-La Roche Ltd.

- Merck & Co. Inc.

- Sanofi

- GlaxoSmithKline (GSK)

- Takeda

- CVS Health Corporation

- Zydus Cadilla

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Brazil Hepatitis A Therapeutics Market Segmentation

By Distribution Channel

- Hospital-based pharmacies

- Retail pharmacies

- Online pharmacies

By Route of Administration

- Oral Medications

- Intravenous Therapy

By Healthcare Setting

- Outpatient Care

- Inpatient Care

By Age

- Children

- Adults

- Senior Citizens

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.