Brazil CT Scan Market Analysis

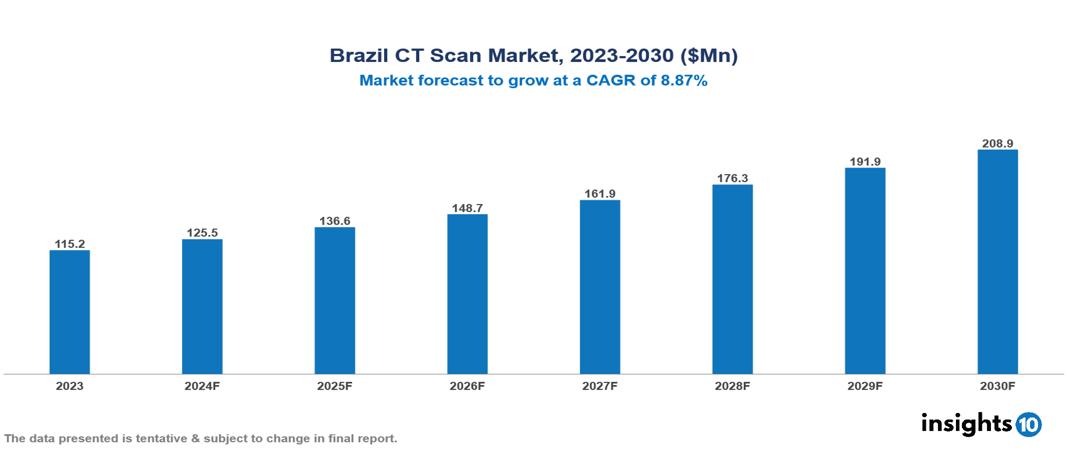

Brazil CT Scan Market was valued at $115.25 Mn in 2023 and is predicted to grow at a CAGR of 8.87% from 2023 to 2030, to $208.93 Mn by 2030. The key drivers of this industry include the rising prevalence of chronic diseases, increasing population and aging, and government initiatives. The industry is primarily dominated by GE HealthCare, Siemens Healthineers, Canon Medical Systems, and NeuroLogica Corp. among others.

Buy Now

Brazil CT Scan Market Executive Summary

Brazil CT Scan Market was valued at $115.25 Mn in 2023 and is predicted to grow at a CAGR of 8.87% from 2023 to 2030, to $208.93 Mn by 2030.

A CT scan, or computed tomography scan, is a sophisticated imaging procedure that uses X-rays to produce detailed cross-sectional images of the body. Unlike traditional X-rays, CT scans capture multiple views from various angles, which a computer then processes into a three-dimensional representation of internal structures such as organs, bones, and soft tissues. Before the scan, patients may prepare by wearing a gown and removing metal objects. Depending on the type of scan, they might need to ingest a contrast material to enhance the visibility of specific tissues. During the scan, patients lie on a table that moves through a donut-shaped scanner while X-ray images are taken. Afterward, a radiologist interprets the images to diagnose conditions like cancer, heart disease, bone fractures, internal bleeding, and injuries. While CT scans offer detailed diagnostic capabilities, they involve radiation exposure and can be costly, though advancements have minimized risks and enhanced safety. Other imaging options like X-rays, ultrasound, and MRI scans are considered based on specific medical needs and radiation concerns.

In Brazil, chronic noncommunicable diseases (NCDs) like cardiovascular diseases, cancers, chronic respiratory diseases, and diabetes have caused 62.4% of all deaths, with multimorbidity being more prevalent among the less educated population. Significant predictors of severe respiratory failure and death among elderly Brazilians hospitalized with COVID-19 include chronic diseases such as hypertension, diabetes, heart failure, and chronic kidney disease. The number of CT and MRI devices and examinations has steadily increased in both public and private sectors, with PET/CT scans introduced to the public healthcare system in 2014 and growing to 118 units by 2022, primarily in the Southeast region. The demand for chest CT scans surged during the COVID-19 pandemic, playing a crucial role in patient management.

The market therefore is driven by significant factors like the rising prevalence of chronic diseases, increasing population and aging, and supportive government initiatives. However, high costs, focus on cost-effectiveness, uneven distribution of equipment, and limited public healthcare access restrict the growth and potential of the market.

A prominent player in this field is GE Healthcare, which launched a new refurbishing unit in Bangladesh for A1-Sure Ultrasound Systems, aiming to enhance accessibility to affordable ultrasound technology in developing regions, and Siemens Healthineers partnered with Microsoft to utilize Azure cloud services for AI-powered medical imaging solutions, aimed at advancing healthcare delivery with secure and scalable cloud computing. Other contributors include Canon Medical Systems, and NeuroLogica Corp. among others.

Market Dynamics

Market Growth Drivers

Rising Prevalence of Chronic Diseases: Brazil faces a growing burden of chronic illnesses like heart disease, cancer, and diabetes. These conditions often require CT scans for diagnosis, treatment planning, and monitoring. According to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death in Brazil, accounting for nearly 30% of all deaths.

Increasing Population and Aging: Brazil's population is projected to grow steadily, with a significant rise in the proportion of individuals over 65 years old. This age group is more susceptible to medical conditions often requiring CT scans. The Brazilian Institute of Geography and Statistics (IBGE) estimates that by 2030, over 14% of the population will be 65 or older.

Supportive Government Initiatives: The Brazilian government has implemented initiatives to expand access to healthcare services, including diagnostic imaging. Investments in public health infrastructure and programs like "Rede SUS" (Unified Health System) can contribute to increased utilization of CT scans.

Market Restraints

High Costs: CT scans can be expensive, with the cost varying depending on the type of scan, contrast material used, and facility fees. The cost can be a barrier for some patients, particularly those without adequate health insurance. While specific data on average CT scan costs in Brazil is limited, industry reports suggest a range between $200 - $600 per scan.

Focus on Cost-Effectiveness: The Brazilian healthcare system prioritizes the cost-effective use of resources. Physicians might choose alternative imaging options like X-rays or ultrasounds when appropriate to manage healthcare spending.

Uneven Distribution of Equipment: The availability of CT scanners is concentrated in major urban centers, creating disparities in access for patients in remote areas.

Limited Public Healthcare Access: Despite government initiatives, access to CT scans within the public healthcare system (SUS) can be limited due to long wait times and potential equipment shortages.

Regulatory Landscape and Reimbursement Scenario

In Brazil, the regulatory landscape for CT scanners is overseen by the Brazilian National Health Surveillance Agency (ANVISA). Manufacturers must obtain market authorization from ANVISA, involving technical documentation review, quality control inspections, and adherence to safety standards. Facilities using CT scanners must implement and maintain quality management systems (QMS) as per ANVISA regulations to ensure consistent quality and safe operation. ANVISA enforces radiation safety regulations, including dose limits and operator training requirements, and conducts post-market surveillance to monitor the performance and safety of CT scanners already in use.

The Brazilian healthcare system features both public and private sectors, impacting CT scan reimbursement. The public healthcare system (SUS) provides CT scans when medically necessary, but access can be limited by long wait times and equipment shortages, particularly in remote regions. The government reimburses healthcare providers for CT scans performed on SUS patients at rates established by the Ministry of Health. In the private sector, most health insurance plans cover medically necessary CT scans, with reimbursement depending on plan details, which may include co-pays, deductibles, and pre-authorization requirements.

Competitive Landscape

Key Players

Here are some of the major key players in the Brazil CT Scan Market:

- GE HealthCare

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- Canon Medical Systems

- NeuroLogica Corp.

- Shanghai United Imaging Healthcare Co., Ltd.

- Fujifilm Holdings Corporation

- Shenzhen Anke High-tech Co., Ltd.

- Koning Health

- Carestream Dental LLC.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Brazil CT Scan Market Segmentation

By Technology

- High-end Slice CT

- Mid-end Slice CT

- Low-end Slice CT

- Cone Beam CT (CBCT)

By Application

- Oncology

- Cardiology

- Vascular

- Neurology

- Musculoskeletal

- Others

By Modality

- O-Arms

- C- Arms

By End-User

- Hospitals

- Diagnostic Imaging Centers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.