Brazil Constipation Therapeutics Market Analysis

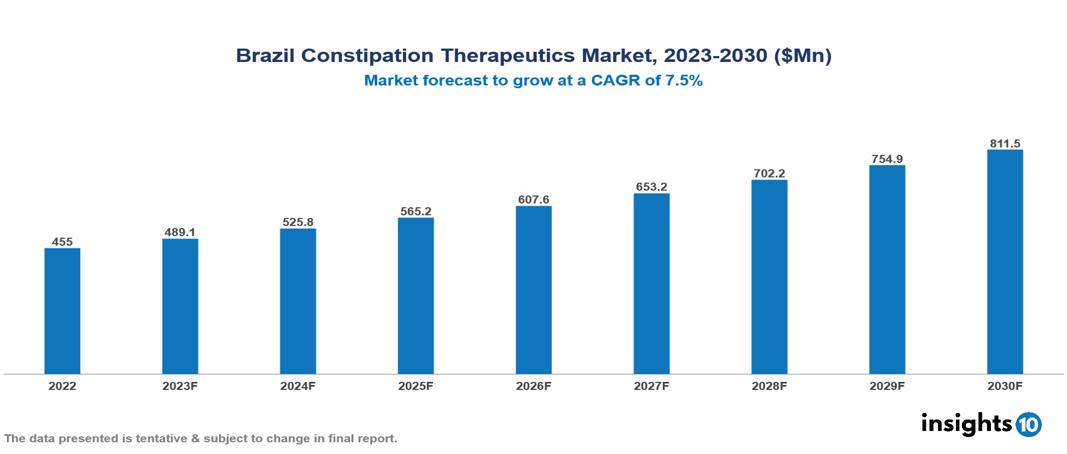

Brazil Constipation Therapeutics Market was valued at $455 Mn in 2022 and is estimated to reach $811 Mn in 2030, exhibiting a CAGR of 7.5% during the forecast period. The constipation therapeutics market is growing driven by the global rise in constipation prevalence associated with aging, sedentary lifestyles, and poor dietary habits, and further fuelled by an expanding elderly population more prone to chronic conditions. Key players in this industry include AbbVie, Allergan, Boehringer Ingelheim, EMS, Farmoquímica, Grünenthal, Johnson & Johnson, Norgine, Pfizer, and Sanofi.

Buy Now

Brazil Constipation Therapeutics Market Executive Summary

Brazil Constipation Therapeutics Market was valued at $455 Mn in 2022 and is estimated to reach $811 Mn in 2030, exhibiting a CAGR of 7.5% during the forecast period.

Constipation is a digestive condition characterized by irregular bowel movements, difficulty in stool passage, or the discharge of hard and dry stool. This condition arises when the transit of stool through the colon (large intestine) slows down, resulting in increased water absorption and stool hardening. Typical symptoms of constipation include straining during bowel movements, a feeling of incomplete evacuation, abdominal discomfort, and irregular or infrequent bowel habits. Multiple factors, such as a low-fiber diet, insufficient fluid intake, lack of physical activity, specific medications, and underlying medical issues, can contribute to constipation. Addressing constipation often involves lifestyle modifications, dietary changes, increased physical activity, and, when necessary, the use of medications to manage and alleviate symptoms.

In Brazil, the prevalence of constipation is notable, particularly among women, with a mean age of 42.6 years. Self-reported constipation stands at 25.2%, and women exhibit a higher prevalence (37.2%) compared to men (10.2%). The overall prevalence of constipation is 14.6%, with a consistent trend of higher prevalence among women. These findings underscore the significance of constipation as a health concern in Brazil, emphasizing the need for targeted interventions and healthcare initiatives, especially for the female population.

Inhibiting ileal bile acid transporters represents a strategy aimed at increasing the concentration of bile acids in the colon. This intentional exposure leads to enhanced secretion of water into the colonic lumen, ultimately facilitating accelerated colonic transit. This approach is noteworthy for its potential impact on promoting more efficient bowel movements and could be a promising avenue in the development of therapeutic interventions for conditions related to colonic dysfunction like constipation.

Market Dynamics

Market Growth Drivers

Prevalence and Lifestyle Factors: The constipation therapeutics market in Brazil is growing due to a higher prevalence of constipation linked to sedentary lifestyles and poor dietary habits. This increased prevalence creates a substantial demand for therapeutic solutions, driving market growth as individuals seek effective remedies for constipation-related issues.

Public Awareness and Recognition: Growing awareness of constipation as a significant health concern in Brazil is fuelling demand for effective therapeutics. This increased awareness is leading individuals to seek medical interventions, driving the market growth for constipation therapeutics in the country.

Advancements in Medical Research and Technology: Advancements in medical research and technology are fostering the development of innovative constipation treatments in Brazil. These efficient therapeutic solutions create opportunities for market expansion by meeting the growing demand for advanced healthcare options and attracting the attention of both healthcare providers and individuals seeking more effective constipation management. This trend contributes significantly to the overall growth of the constipation therapeutics market in Brazil.

Market Restraints

Regulatory Challenges: Stringent approval processes and regulatory hurdles in Brazil pose a significant obstacle to the timely introduction of new constipation therapeutics, slowing market expansion by delaying the availability of innovative treatments.

Economic Factors: Fluctuating currency values and economic instability create financial barriers, limiting the affordability and accessibility of constipation treatments for a significant population. This acts as a market restraint by constraining the potential reach and growth of the Constipation Therapeutics Market.

Cultural Factors: Cultural influences on dietary habits and lifestyle choices contribute to a high incidence of constipation, posing a challenge for constipation therapeutics to effectively address underlying causes. Preferences for low-fiber diets and sedentary lifestyles prevalent in the culture create a barrier for these therapeutics, requiring tailored approaches to align with the specific cultural context and improve market acceptance. This cultural factor acts as a significant restraint, emphasizing the need for strategic adaptation to effectively tackle constipation-related challenges in the Brazilian market.

Healthcare Policies and Regulatory Landscape

In Brazil, the National Health Surveillance Agency (Agência Nacional de Vigilância Sanitária- ANVISA) is the primary agency responsible for regulatory control over therapeutic drugs and oversight of healthcare policies. Ensuring the effectiveness, safety, and quality of pharmaceuticals is the responsibility of ANVISA. While regulatory bodies like the Brazilian Pharmaceutical Market Regulation Chamber and the Brazilian Health Regulatory Chamber (CMED) contribute to pricing regulations, the ANVISA-affiliated Chamber of Medicines evaluates the introduction of new drugs into the public health system. The National Cancer Institute (INCA) plays a part in forming cancer-related policies and guidelines, and the Ministry of Health collaborates with ANVISA to develop healthcare strategies and policies. The National Health Council (CNS) is in charge of ensuring community involvement in health-related decisions, and the National Commission for Ethics in Research (CONEP) is in charge of managing the ethical aspects of clinical trials.

Competitive Landscape

Key Players

- AbbVie

- Allergan

- Boehringer Ingelheim

- EMS

- Farmoquímica

- Grünenthal

- Johnson & Johnson

- Norgine

- Pfizer

- Sanofi

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Brazil Constipation Therapeutics Market Segmentation

By Therapeutic

- Laxatives

- Chloride Channel Activators

- Peripherally Acting Mu-Opioid Receptor Antagonists

- GC-C Agonists

- 5-HT4 Receptor Agonists

By Disease

- Chronic Idiopathic Constipation

- Irritable Bowel Syndrome with Constipation

- Opioid-Induced Constipation

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.