Brazil Cardiovascular Diseases Therapeutics Market Analysis

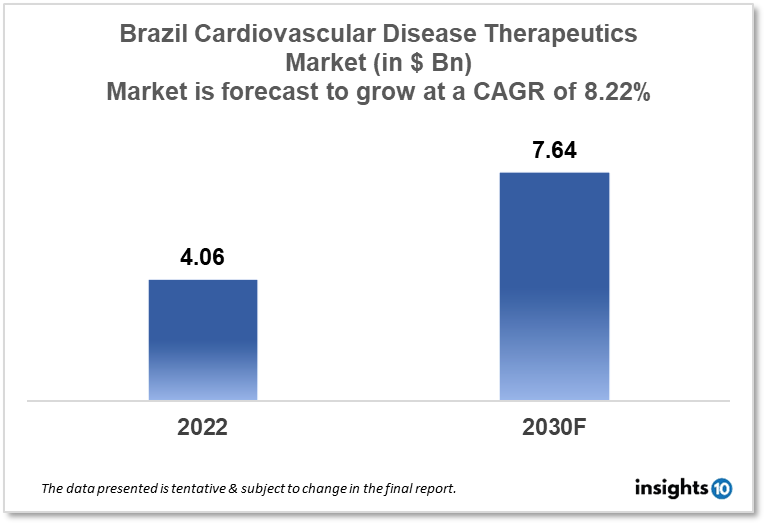

Brazil's cardiovascular disease therapeutics market is expected to witness growth from $4.06 Bn in 2022 to $7.64 Bn in 2030 with a CAGR of 8.22% for the forecasted year 2022-2030 due to the rising geriatric population and their subsequent demand for new and innovative therapeutic options in Brazil are responsible for the growth of the market. The Brazil cardiovascular disease therapeutics market is segmented by disease indication, drug type, route of administration, drug classification, mode of purchase, and by end user. Eurofarma, Cálamo Distribuidora, and Pfizer are the major players in the Brazil cardiovascular disease therapeutics market.

Buy Now

Brazil Cardiovascular Disease Therapeutics Market Executive Analysis

The Brazil cardiovascular disease therapeutics market size is at around $4.06 Bn in 2022 and is projected to reach $7.64 Bn in 2030, exhibiting a CAGR of 8.22% during the forecast period. The Jair Bolsonaro administration's budget in Brazil proposal for 2023 called for a $4.2 Bn cut in investment in the country's health industry. Bolsonaro's parting gift reflects the overall management of the sector by the right-wing government, particularly with regard to the Unified Health System (SUS), while Lula's new health ministry is trying to reformulate the budget. Over 45% of all health expenditures in 2022 were for hospital and outpatient care, with primary care coming in second with an extra 25%. By February 20, 2023, hospital and outpatient care accounted for almost 60% of all health expenditures in 2023.

Brazil recorded a 27.5% national prevalence of cardiovascular disease (CVD). A class of medications known as statins are used to lower blood cholesterol levels and decrease the risk of heart disease. Brazil has access to a number of statins, such as atorvastatin, simvastatin, and rosuvastatin. Blood clots and the chance of heart attack and stroke are prevented by antiplatelet medications like aspirin and clopidogrel. The standard of care for patients with CVD includes the use of these medications, which are readily accessible in Brazil. Blood pressure is lowered and the chance of heart disease is decreased by antihypertensive medications like angiotensin-converting enzyme (ACE) inhibitors, angiotensin II receptor blockers (ARBs), and beta-blockers. As part of the accepted standard of care for patients with hypertension and other CVD risk factors, these medications are readily accessible in Brazil. Abnormal cardiac rhythms, such as atrial fibrillation, are treated with antiarrhythmic medications like amiodarone and sotalol. These medications are accessible in Brazil, but they are typically only used by people who have more severe arrhythmias.

Market Dynamics

Market Growth Drivers

Brazil's population is maturing, with a rising proportion of those over 60. The country's demand for CVD therapeutics is anticipated to increase because CVD is more common in older people. The National Cardiovascular Health Plan is one of the programs the Brazilian government has introduced to enhance CVD prevention, diagnosis, and therapy. As a result, funding for CVD-related study, development, and healthcare services has increased. In order to improve access to care for all citizens, the Brazilian government has been increasing healthcare expenditure. The demand for CVD therapeutics is anticipated to increase as a result, especially among lower-income populations.

Market Restraints

The current economic unrest in Brazil may have an effect on healthcare spending and access to care. This could reduce the demand for CVD treatments, especially among lower-income groups. The expense of treating CVD in Brazil can be high, which may restrict some patients access to care. This may have an effect on the desire for CVD treatments, especially among patients with lower incomes. Hospitals and medical personnel are scarce in Brazil, along with other healthcare supplies. In some regions of the nation, this may have an impact on the accessibility and effectiveness of CVD therapy.

Competitive Landscape

Key Players

- Drogaria West Pharma (BRA)

- Nortec Química (BRA)

- Drogaria do Povo (BRA)

- Eurofarma (BRA)

- Cálamo Distribuidora (BRA)

- Pfizer

- Bayer

- Janssen Pharmaceuticals

- AstraZeneca

- Sanofi

- Novartis

- Merck

Healthcare Policies and Regulatory Landscape

The Unified Health System (Sistema Nico de Sade, or SUS) is the name of Brazil's state healthcare system, which gives all citizens and authorized foreign residents access to medical care and services. A variety of medical operations and services are accessible through the SUS, including cardiovascular treatments like coronary artery bypass surgery, angioplasty, and cardiac rehabilitation. To receive specialized care, patients must submit a referral from their primary care doctor. The responsibility for creating cardiovascular health-related policies and initiatives rests with the Brazilian Ministry of Health. The National Cardiovascular Health Plan is just one of the efforts the Ministry has initiated to improve CVD prevention, diagnosis, and treatment. For the treatment of some chronic diseases, such as high blood pressure and high cholesterol, the Pharmaceutical Assistance Program (Programa Farmácia Popular) offers free or heavily discounted medication. These medications are available to patients with prescriptions at local pharmacies. The Brazilian private health insurance market is governed by the National Supplementary Health Agency (also known as ANS, or Agência Nacional de Sade Suplementar). The ANS establishes benchmarks for pricing and service while also protecting policyholders' rights as consumers.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Cardiovascular Disease Therapeutics Segmentation

By Disease Indication (Revenue, USD Billion):

- Hypertension

- Coronary Artery Disease

- Hyperlipidaemia

- Arrhythmia

- Others

By Drug Type (Revenue, USD Billion):

- Antihypertensive

- Anticoagulants

- Antihyperlipidemic

- Antiplatelet Drugs

- Others

By Route of Administration (Revenue, USD Billion):

- Oral

- Parenteral

- Others

By Drug Classification (Revenue, USD Billion):

- Branded Drugs

- Generic Drugs

By Mode of Purchase (Revenue, USD Billion):

- Prescription-Based Drugs

- Over-The-Counter Drugs

By End Users (Revenue, USD Billion):

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.