Brazil Atherosclerosis Therapeutics Market Analysis

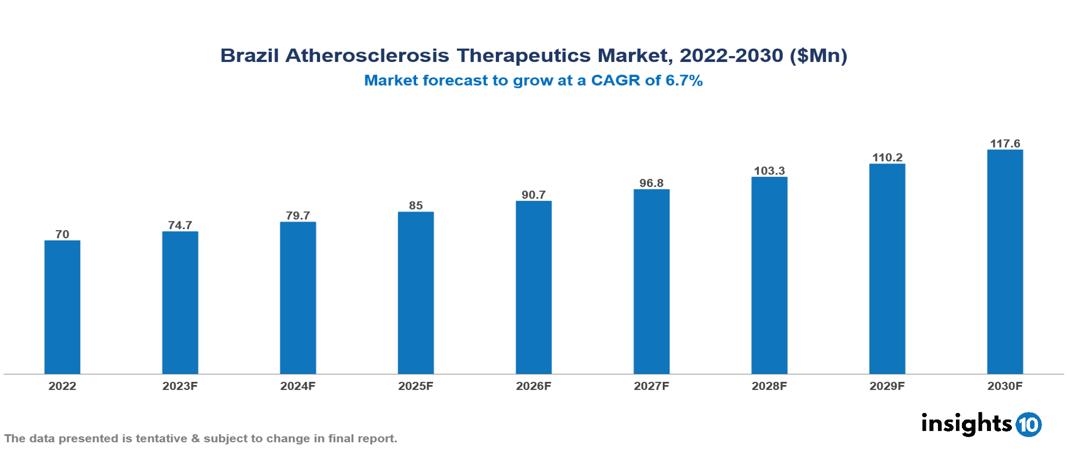

Brazil Atherosclerosis Therapeutics Market was valued at $70 Mn in 2022 and is estimated to reach $118 Mn in 2030, exhibiting a CAGR of 6.7% during the forecast period. The market for atherosclerosis therapeutics is expected to grow as a result of the growing incidence of cardiovascular diseases, which are being exacerbated by sedentary lifestyles, poor eating habits, and an aging population worldwide. The leading pharmaceutical companies presently operating in the market are Pfizer, Novartis, AstraZeneca, Sanofi, Bayer, Abbott, Johnson & Johnson, Teva Pharmaceutical, Roche, and Merck & Co.

Buy Now

Brazil Atherosclerosis Therapeutics Market Executive Summary

Brazil Atherosclerosis Therapeutics Market was valued at $70 Mn in 2022 and is estimated to reach $118 Mn in 2030, exhibiting a CAGR of 6.7% during the forecast period.

Atherosclerosis is a condition characterized by the buildup of plaque, which is a sticky substance made of cholesterol, fat, calcium, and other materials, inside the walls of arteries. This buildup can lead to the narrowing or obstruction of blood vessels, reducing blood flow and increasing the risk of serious conditions such as heart attacks and strokes. The development of atherosclerosis is influenced by various factors, including high blood pressure, elevated cholesterol levels, diabetes, obesity, smoking, a family history of heart disease, physical inactivity, and an unhealthy diet. Several drugs have demonstrated effectiveness in reducing or preventing the progression of atherosclerosis, including beta-blockers, aspirin, and statins.

In Brazil, the main cause of death, cardiovascular diseases (CVDs), accounts for about one-third of all deaths, while noncommunicable diseases account for 72% of all deaths. Nearly 400,000 deaths are caused by CVDs, with heart failure accounting for 8.9% of these deaths, myocardial infarction accounting for 23.9%, and stroke accounting for 14.1%. For these diseases, the age-standardized mortality rates have consistently decreased by 17.5%, 42.7%, and 42.0%, respectively. With over 222,000 admissions, heart failure is by far the most common reason for hospital stays in Brazil. Age-standardized rates of 475 and 5454 per 100,000 people for the incidence and prevalence of CVD, respectively, show a 26.8% increase in the disease's prevalence.

The Phase 2b clinical trial conducted by DARA Biosciences (DARB3A) to examine the plaque-stabilizing characteristics of its drug candidate, Dara017, for coronary atherosclerosis has been concluded. A Phase 2 clinical trial is presently being conducted by Hyperbranch Polymers Tecnologia (Hybran) to evaluate the safety and effectiveness of HB Therapeutics in individuals suffering from carotid artery stenosis, an indication of atherosclerosis. In July 2023, Biomm (BOMM3) partnered with the University of California, San Diego, to pursue novel treatments for atherosclerosis and other cardiovascular disorders. The ongoing and completed clinical trials, along with collaborative efforts, indicate significant progress in developing innovative therapies for atherosclerosis. This progress fosters optimism for improved treatment options and better outcomes in cardiovascular health.

Market Dynamics

Market Growth Drivers

Increasing Cardiovascular Disease Burden: One of the main causes of CVD, atherosclerosis, is largely responsible for the rising need for alternative forms of treatment. Nearly 400,000 deaths are caused by CVDs in Brazil. Better atherosclerosis treatment methods are required in addition to the growing burden of CVD and the increasing incidence of risk factors such as diabetes, high blood pressure, and unhealthy cholesterol levels.

Aging Population: There is a growing need for atherosclerosis-related therapeutics since the aging of the population greatly increases the susceptibility of the elderly to atherosclerosis. Brazil's aging population is expanding quickly. By 2030, this age group is projected to reach around 50 Mn, making up almost 24% of the population. Since atherosclerosis is more common in the elderly population, there is an increasing need to address the condition's therapeutic needs.

Advancements in Drug Development: The market is expanding because new medications like RNA interference therapy-based cholesterol-lowering drugs like inclisiran and PCSK9 inhibitors provide more and better therapeutic choices. The growing emphasis on atherosclerosis genetic susceptibilities and specific patient profiles taken into consideration for customized treatment regimens creates opportunities for market expansion.

Market Restraints

High Drug Cost: A significant barrier for many people, especially those with lower incomes or less access to healthcare, is the high cost of the medications used to treat atherosclerosis. High prescription medication costs are an issue since they limit market penetration and impede overall growth.

Lack of Awareness: Insufficient knowledge about atherosclerosis and its preventive methods might make it difficult to intervene early and deter people from getting medical attention as soon as possible. People who lack knowledge of atherosclerosis and its prevention strategies may fail to identify the disease's symptoms or act promptly to take preventive action, which could prolong the need for medical intervention and care. The growth of the market is hampered by this lack of knowledge.

Regulatory Hurdles: Prolonged clinical trials and strict regulatory processes can provide obstacles and extra costs for pharmaceutical companies, delaying the arrival of new medications into the market. Businesses may find it challenging to effectively manage the system and plan for approval dates due to the uncertainty created by vague regulations. The regulatory approval process is filled with uncertainty, making it difficult for innovators to forecast needs and review periods. This intricacy necessitates careful planning and coordination at several phases, including clinical trials, manufacturing, and marketing approval, and can result in significant delays in medication development. The market's ability to grow is hampered by regulatory uncertainty.

Healthcare Policies and Regulatory Landscape

The licensing, distribution, and oversight of treatment pharmaceuticals are significantly influenced by healthcare policy and regulatory bodies in Brazil. The National Health Surveillance Agency (Agência Nacional de Vigilância Sanitária, or ANVISA) is the regulatory body in Brazil in charge of drug approval and oversight. Pharmaceutical products, including treatment medications, must be evaluated and approved by ANVISA, a regulatory body under the Brazilian Ministry of Health. Before pharmaceuticals are made available to the general public, the FDA makes sure medicines meet safety, effectiveness, and quality requirements. To track a drug's efficacy and safety after it is put on the market, ANVISA also conducts post-marketing surveillance. The Ministry of Health in Brazil is responsible for creating healthcare policies that cover a range of issues, including drug prices, reimbursement guidelines, and healthcare service accessibility. The Unified Health System, also known as Sistema Único de Saúde (SUS), is Brazil's public healthcare system that strives to give all inhabitants access to healthcare services.

Competitive Landscape

Key Players

- Pfizer

- Novartis

- AstraZeneca

- Sanofi

- Bayer

- Abbott

- Johnson & Johnson

- Teva Pharmaceutical

- Roche

- Merck & Co.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Brazil Atherosclerosis Therapeutics Market Segmentation

By Therapy

- Atherosclerosis Medications

- Cholesterol-lowering Medications

- Antiplatelet drugs and Anticoagulants

- Atherosclerosis Beta Blockers

- Diuretics or Water Pills

- Angiotensin Converting Enzyme (Ace) Inhibitors

- Other Atherosclerosis Treatment Therapies

By Surgery

- Bypass Surgery (Coronary Artery Bypass Grafting (CABG))

- Angioplasty

- Atherectomy

By Drug Class

- Cholinesterase Inhibitors

- NMDA Receptor Antagonists

- Manufactured Combination

By End-Users

- Hospitals

- Specialty Clinics

- Homecare

- Others

By Distribution Channel

- Hospital pharmacies

- Clinics

- Drug stores

- Retail pharmacies

- Online pharmacies

- Other distribution channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.