Brazil Artificial Intelligence (AI) in Diagnostics Market Analysis

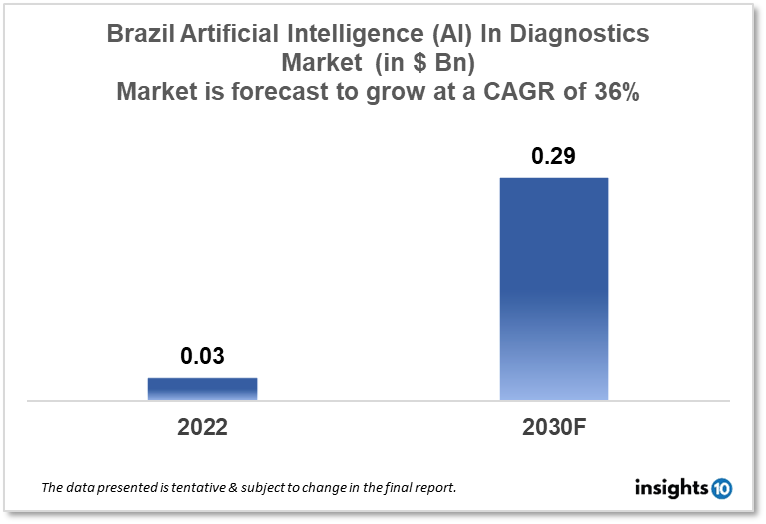

Brazil's Artificial Intelligence (AI) in the diagnostics market is projected to grow from $0.03 Bn in 2022 to $0.29 Bn by 2030, registering a CAGR of 36% during the forecast period of 2022 - 2030. The market will be driven by the rising frequency of chronic illnesses and the growing requirement for more accurate and efficient diagnostic instruments. The market is segmented by component & by diagnosis. Some of the major players include IBM Watson Health, Siemens Healthineers & HiLab.

Buy Now

Brazil Artificial Intelligence (AI) in Diagnostics Market Executive Summary

Brazil's Artificial Intelligence (AI) in the diagnostics market is projected to grow from $0.03 Bn in 2022 to $0.29 Bn by 2030, registering a CAGR of 36% during the forecast period of 2022 - 2030. Brazil has a comprehensive public health system that covers all lawfully residing citizens. The Sistema nico de Salud (SUS) is Brazil's national health system, which aims to provide universal health care throughout the country. Brazil's population is comparable to 2.73% of the world's total. Brazil is ranked sixth in terms of population among nations (including dependencies). According to the International Monetary Fund (IMF), Brazil has the 12th biggest GDP and the 8th largest purchasing power parity in 2022.

Artificial intelligence (AI) is quickly gaining popularity in the medical field in Brazil, which means that many medical devices are beginning to contain AI capabilities. Improved imaging systems, smart robots, wearable technology, AI-based data processing, simulation platforms, and other AI capabilities are some examples. It has applications in a variety of sectors such as Radiology, Pathology, Oncology, Cardiology, Neurology, and others. In January 2022, Pearl, the leader in dental AI solutions, confirmed that its Second Opinion® chairside clinical AI software has been cleared by the Brazilian Health Regulatory Agency (Anvisa). Second Opinion® is the first and only chairside, FDA-cleared AI radiologic detection aid that can guide dental professionals to diagnose a wide variety of common oral diseases, including tooth decay, calculus, and root abscesses.

Market Dynamics

Market Growth Drivers

Many reasons are driving AI in the diagnostics market in Brazil, including the rising frequency of chronic illnesses, the growing desire for more accurate and efficient diagnostic instruments, and the availability of modern computer technology. Furthermore, the Brazilian government has been actively encouraging AI in healthcare development through programs such as Brazil’s National Digital Health Strategy Action, Monitoring and Evaluation Plan 2019-2023, which has supported the development of AI-based diagnostic tools and technology.

Market Restraints

Being the world's sixth biggest country by size and population, providing effective healthcare to all 209 million Brazilians presents enormous obstacles. Despite the emphasis on SUS, the World Health Organization estimates that private healthcare accounts for roughly 57% of total health spending. Out-of-pocket expenditures account for more than half of private spending. Brazil's AI Diagnostics industry is additionally constrained by issues like data privacy and security concerns, as well as the requirement for major investment in AI infrastructure and talent development. Moreover, regulatory obstacles and a lack of standardization may hinder the expansion of the AI in diagnostics market in Brazil.

Competitive Landscape

Key Players

- IBM Watson Health

- Siemens Healthineers

- Philips Healthcare

- GE Healthcare

- Google Health

- Lunit Inc.

- HiLab (BRA)

- DASA (BRA)

- Fleury Group (BRA)

Notable Deals

- February 2023, GE HealthCare to Acquire Caption Health The acquisition adds AI-enabled image guiding to the ultrasound device portfolios of GE HealthCare's $3 billion Ultrasound division

- January 2023, Hospital Israelita Albert Einstein inks a deal for Lunit's AI technology. Lunit's AI solution will be used to screen chest x-ray pictures at the hospital

Healthcare Policies and Regulatory Landscape & Reimbursement Scenario

The Brazilian National Health Surveillance Agency (ANVISA) regulates medical devices in Brazil, with ANVISA and the National Institute of Metrology Standardization and Industrial Quality (INMETRO) setting standards and guidelines with which medical device manufacturers must conform. The Brazilian National Health Surveillance Agency (ANVISA) issued a provisional regulation for the use of artificial intelligence (AI) in medical equipment, including diagnostic imaging devices, in April 2021.

In Brazil, payments are made per service; however, there are attempts underway to establish a fee-per-performance model in order to reduce expenses in both the public and private sectors. The National Agency of Health (ANS) sets a list of treatments and costs that private insurance firms are required to supply to their affiliates.

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Artificial Intelligence (AI) in Diagnostics Market Segmentation

- By Component Outlook Type (Revenue, USD Billion):

- Software

- Hardware

- Services

- By Diagnosis Outlook Type (Revenue, USD Billion):

- Cardiology

- Oncology

- Pathology

- Radiology

- Chest and Lung

- Neurology

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.