Brazil Alcohol Addiction Therapeutics Market Analysis

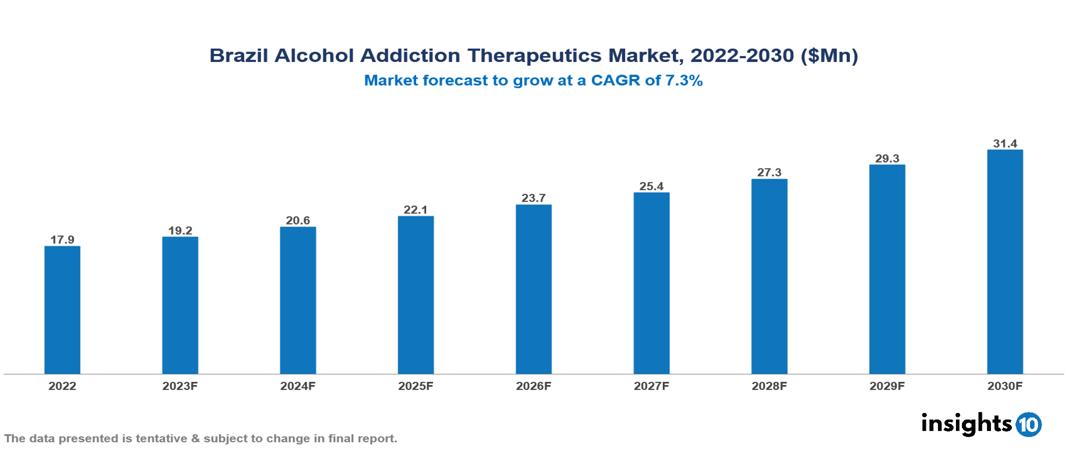

The Brazil Alcohol Addiction Therapeutics Market is valued at around $18 Mn in 2022 and is projected to reach $31 Mn by 2030, exhibiting a CAGR of 7.3% during the forecast period. The intensified commitment of the Brazilian government to mental health, coupled with the urbanization-induced surge in alcohol consumption, is fuelling a rising need for treatment solutions. The key players involved in the research, development, and distribution of Alcohol Addiction Therapeutics in Brazil are Alkermes, TEVA, Otsuka, GlaxoSmithKline, BioCorRx, Adial Pharmaceuticals, Kinnov Therapeutics, Opiant, MediciNova, Corcept Therapeutics, among others

Buy Now

Brazil Alcohol Addiction Therapeutics Market Executive Summary

The Brazil Alcohol Addiction Therapeutics Market is valued at around $18 Mn in 2022 and is projected to reach $31 Mn by 2030, exhibiting a CAGR of 7.3% during the forecast period.

Alcohol addiction, also known as alcoholism or alcohol use disorder (AUD), is a chronic, debilitating condition characterized by an individual's compulsive consumption of alcohol despite the negative consequences. This disorder is classified as a substance use disorder and is recognized by various treatment methods, including behavioural therapy, counselling, support groups, and medical interventions. Treatment for alcohol addiction often involves detoxification, medication-assisted therapy, counselling, and participation in support groups such as Alcoholics Anonymous (AA). Pharmacological treatments, such as benzodiazepines, disulfiram, naltrexone, acamprosate, and topiramate, are frequently used in conjunction with these approaches. The choice of treatment method and medication is influenced by factors such as the severity of the addiction, co-occurring mental health disorders, and the individual's general health. Comprehensive treatment strategies often incorporate these drugs and approaches to address the various aspects of alcohol addiction.

Alcohol use problems affect around 18.4% of Brazilians aged 18 and above. This corresponds to around 38 million individuals. Men are substantially more afflicted than women, with a frequency of 29.9% vs. 9.3%. Additionally, younger people are more impacted than older adults. The intensified commitment of the Brazilian government to mental health, coupled with the urbanization-induced surge in alcohol consumption, is fueling a rising need for treatment solutions.

Alkermes, Teva, and Otsuka are well-known for their established drugs, such as naltrexone injections and implants. Upcoming companies, such as CorRx and Adial, presently hold a lesser market share. Biotech companies such as MediciNova and Corcept, although remaining niche players, provide innovative goods such as naltrexone implants, carving out a significant market position.

Market Dynamics

Market Drivers

Government Efforts and Mental Health Focus: The Brazilian government's heightened attention to mental health, encompassing alcohol dependence, results in increased funding, awareness campaigns, and policy adjustments. These initiatives not only spur market growth but also create opportunities for therapeutic interventions to reach a broader audience through public health programs targeting early intervention, harm reduction, and stigma reduction.

Impact of Urbanization: The swift urbanization and changing lifestyles characterized by heightened stress and social isolation contribute to a surge in alcohol consumption and dependence. This, in turn, leads to a growing demand for treatment solutions. Advances in healthcare infrastructure and expanded insurance coverage are widening access to effective therapies for a larger segment of the population.

Growing AUD Incidences: Brazil confronts a significant public health challenge, with an estimated 18.4% of adults grappling with AUD. This substantial and increasing patient population serves as a key driver for the expansion of the market. The escalating awareness about the adverse health consequences and societal impacts of alcohol dependence further propels the demand for viable treatment options.

Market Restraints

Lack of Infrastructure: Inadequate healthcare infrastructure, especially in distant places, makes it difficult for many people to get treatment. Inadequate availability of trained addiction specialists and therapists further limits access to appropriate treatment.

Fragmented System: A fragmented healthcare system that lacks coordination between general care, mental health services, and addiction treatment programs prevents complete and integrated care delivery. The lack of communication and data exchange among healthcare professionals impedes efficient patient treatment and referral channels.

Limited Funding and Reimbursement: Limited government financing for addiction treatment programs limits program expansion and viability in areas of need. Inconsistent insurance coverage for addiction treatment, particularly non-pharmacological therapies, is a costly obstacle for many people and families, as it can burn a hole in their pockets.

Healthcare Policies and Regulatory Landscape

Brazil's healthcare policy is managed by the Brazilian Health Regulatory Agency, often known as ANVISA, which regulates and oversees a variety of health goods and services such as medicines, medical devices, food, cosmetics, and tobacco. As the biggest country in South America and the second largest pharmaceutical market in the emerging world, Brazil's healthcare regulatory framework is critical to assuring the safety, efficacy, and quality of healthcare goods available to its nearly 200 million people. Along with ensuring the ethical and legal compliance of clinical studies carried out in the nation, the agency collaborates with other organizations like CONEP (National Research Ethics Commission) and CEP (Research Ethics Committee) to oversee, approve, and inspect medications and clinical trials that are registered in Brazil.

Competitive Landscape

Key Players

- Alkermes

- TEVA

- Otsuka Pharmaceuticals

- GlaxoSmithKline

- BioCorRx

- Adial Pharmaceuticals

- Kinnov Therapeutics

- Opiant

- MediciNova

- Corcept Therapeutics

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Brazil Alcohol Addiction Therapeutics Market Segmentation

By Therapy Type

- Pharmacological Therapy

- Behavioural Therapy

- Digital Health Interventions

- Others

By Disease Stage

- Mild Alcohol Dependence

- Moderate Alcohol Dependence

- Severe Alcohol Dependence

By Route of Administration

- Oral

- Parenteral

- Topical

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By End User

- In-Patient Centres

- Out-Patient Speciality Clinics

- Residential Treatment Centres

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.