Brazil Acromegaly Therapeutics Market Analysis

Brazil Acromegaly Therapeutics Market is projected to grow from $xx Mn in 2023 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2023-30. The prevalence and incidence of acromegaly and pituitary tumours are rising, as is global awareness of the disease. Technological advances in the development of new acromegaly medications are also key contributors to the market's growth. The high prevalence of hormonal problems, evolving lifestyles, and rising genetic disease incidence are all anticipated to fuel market expansion.Some of the key players in the global acromegaly therapeutics Market include Roche, Sanofi, GSK, Pfizer INC., Ipsen, Chiasma Inc, Validus pharmaceuticals LLC., Novartis AG, Amryt, Recordati, Sun Pharma, Crinetics Pharmaceuticals, Camurus, Ionis Pharmaceuticals , and Others.

Buy Now

Brazil Acromegaly Therapeutics Market Analysis Summary

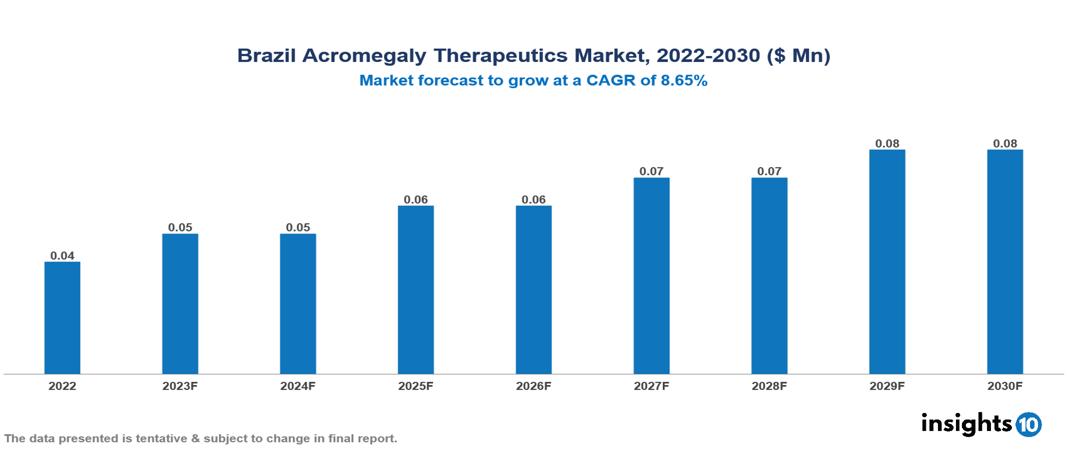

Brazil Acromegaly Therapeutics Market is valued at around $0.04 Mn in 2022 and is projected to reach $0.08 Mn by 2030, exhibiting a CAGR of 8.65% during the forecast period 2023-2030.

Acromegaly is a condition brought on by the anterior pituitary gland's excessive secretion of the hormone that promotes tissue development and other metabolic abnormalities. Primary GH excess, ectopic or iatrogenic GH excess, and excessive growth hormone-releasing hormone can all be considered acromegaly causes (GHRH). Adult individuals with acromegaly typically have a big lower jaw, a prominent forehead, and enormous hands and feet as well as other distinctive facial traits. This distinguishes acromegaly from gigantism, which takes place prior to the fusion of growth plates, as it happens after the growth plates have united. In this exercise, the interprofessional team's role in treating patients with acromegaly is reviewed along with its assessment and management.

With around 116.9 new cases per million people each year, acromegaly has a prevalence of roughly 4,600 per million people worldwide, and its incidence is rising. Men and women are diagnosed on average around ages 40 and 45, respectively. In the third decade of life, acromegaly typically manifests.

Generally, biochemical diagnosis of acromegaly is established on the basis of elevated IGF-1 concentrations in serum and absence of growth hormone suppression after glucose load during an OGTT.4. Approximately 70% of somatotroph adenomas are macroadenomas at diagnosis and are readily detected on pituitary MRI. Mortality in patients with acromegaly is approximately two times higher than mortality in people without acromegaly. Treatment of patients with acromegaly is aimed at normalizing GH and/or IGF1 levels to ameliorate signs and symptoms of the disease and reduce excess mortality. Some of the key players in the global acromegaly therapeutics Market include Roche, Sanofi, GSK, Pfizer INC., Ipsen, Chiasma Inc, Validus Pharmaceuticals LLC., Novartis AG, Amryt, Recordati, Sun Pharma, Crinetics Pharmaceuticals, Camurus, Ionis Pharmaceuticals, and Others.

Market Dynamics

Market Restraints

Growing Incidence and Prevalence of Acromegaly Disease: Greater than 95% of acromegaly cases are caused by a benign GH-secreting pituitary adenoma (involving somatotroph cells). Less than 5% of acromegaly cases will be caused by an ectopic source, including ectopic secretion by an ectopic GHRH tumour, a hypothalamic-secreting GHRH tumour or an ectopic GH-secreting tumour. More than 95% of pituitary adenomas occur sporadically, and only a small number are based on already-known germline mutations. The treatment of acromegaly primarily consists of tumour removal, ideally by an experienced neurosurgeon. Tumour size represents a major prognostic factor in terms of surgical cure. As most cases present with macroadenomas, the overall remission rate after surgery is only about 50%. This means that one in two patients will need further treatment, and pharmacological therapy is usually initiated first.

Developments Market

- Medical therapy aims to normalise insulin-like growth factor 1 (IGF-1) levels within an age-specific reference range, preventing the emergence of disease-related comorbidities, and achieving optimal disease control from a clinical and biochemical perspective. Treatment seeks to stop tumour growth or, ideally, cause tumour reduction in addition to biochemical control.

- Somatostatin analogues (SSAs), dopamine agonists, and GHR antagonists look to be the top three therapeutics for acromegaly in the 7mn market in 2018. According to reports, the entire market value of SSAs was USD 782.87 mn, that of GHR was USD 199.07 mn, and that of dopamine agonists was roughly USD 34.94 mn.

- Somatostatin analogues are the main class of drugs used to treat acromegaly in patients (SSA).

- For a long time, the only agents available were octreotide and lanreotide, but a few years ago, pasireotide was authorised as a third SSA.

- These medications are particularly well suited for a variety of uses even in challenging clinical situations due to the ability to combine them with other therapy.

Acromegaly Pipeline Therapies

- Octreotide Capsules

- IONIS-GHR-LRx

- ATL1103

- CAM2029

- Veldoreotide

- Paltusotine

- Lanreotide PRF

Key players

Novartis Pfizer Sanofi Intercept Pharmaceuticals Ipsen Lilly Genzyme Merck & Co. Amgen Novo Nordisk1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Brazil Acromegaly Therapeutics Market Segmentation

By Medication

- Somatostatin Analogues

- Dopamine Agonists

- Growth Hormone Receptor Antagonists

- Other

By Sales Channel

- Hospitals & Clinics

- Pharma companies

- Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.