Belgium Dental Care Market Analysis

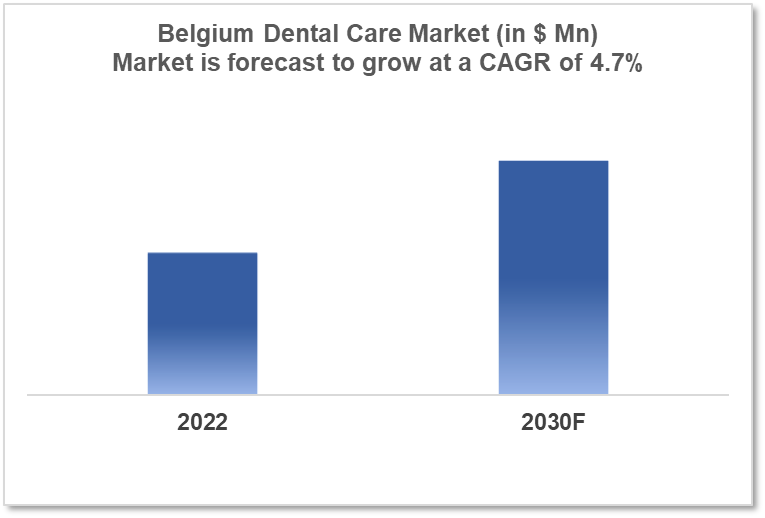

Belgium's dental care market size is at around $xx Bn in 2022 and is projected to reach $xx Bn in 2030, exhibiting a CAGR of 4.7% during the forecast period. The world’s most advanced healthcare system encourages innovation in dental care and with high standards of care demanded the market is a flourishing ground for players like Dentale, Dental Avenue, and Dental Health Group. This report is segmented by treatment type, age group, clinical setup, and by demography and provides rich insights.

Buy Now

Belgium Dental Care Market Executive Summary

Belgium's dental care market size is at around $xx Bn in 2022 and is projected to reach $xx Bn in 2030, exhibiting a CAGR of 4.7% during the forecast period. The Belgian economy is considered to be one of the most developed and diversified in the world. It is a member of the European Union and the eurozone and is heavily reliant on international trade. Belgium has a high GDP per capita and a high standard of living. The economy is characterized by a strong service sector, which accounts for the majority of GDP. The service sector includes finance, insurance, real estate, and business services. The industrial sector, which includes manufacturing, construction, and mining, also plays an important role in the economy. The country is also known for its high-quality chocolate and beer exports. Belgium is also home to several major international companies and the headquarters of multinational corporations, and the country has a well-developed transportation infrastructure that allows for easy access to other European markets. The Belgian economy is stable and has a low unemployment rate, however, the country has struggled with high public debt and budget deficits in recent years.

The healthcare system in Belgium is a publicly funded system that is considered to be one of the best in the world. The public healthcare funds are called “mutuelle” in French and “ziekenfonds” in Flemish. It is a universal system, which means that all residents of Belgium are covered by national healthcare insurance. Belgium is located in Northwestern Europe and spent 10.66% of its GDP in 2020 on the healthcare sector. There were 6 doctors available in the country for every 1,000 Belgian citizens. Belgium’s corporate health sector comprises companies like Janssen Pharmaceuticals, which is headquartered in Beerse, and owned by Johnson & Johnson. With regard to R&D in medicine, universities like Ghent University and the Catholic University of Leuven stand out. The system is financed through taxes and social security contributions and is administered by the federal government, regional governments, and private healthcare providers. Medical care is provided by a combination of general practitioners, specialists, and hospitals. Prescription drugs are also covered by national healthcare insurance. Overall, the healthcare system in Belgium is known for its accessibility, high quality, and good outcomes.

There are both public and private healthcare providers. The public healthcare system is financed through taxes and social security contributions and is available to all residents of Belgium. Private healthcare providers also exist and operate alongside the public system. Individuals can choose to use private providers, but they will need to pay for the service themselves or through their own insurance. They are also free to choose their own General Practitioner (GP) or Specialist, whether it is in the public or private sector. Private providers also offer additional services that are not covered by national healthcare insurance, such as dental care, physiotherapy, and alternative medicine.

Dental care services are available through both public facilities and private practices. In the public sector, dental care is covered by national healthcare insurance, but it is not considered a priority and there are usually long waiting times to see a dentist. Generally, people in the public sector can access dental care services through a referral from a general practitioner (GP) or by contacting a dental clinic directly. Services provided by public dental clinics include routine check-ups, cleanings, fillings, and extractions. In the private sector, dental care is not covered by national healthcare insurance, and individuals will need to pay for the services themselves or through their own insurance. Private practices offer a wider range of services than public clinics, including orthodontics, cosmetic dentistry, and dental implants. They also tend to have shorter waiting times for appointments. Individuals can choose their own dentist, whether it is in the public or private sector, and it is common for people to have a mix of both public and private dental care.

Market Dynamics

Market Growth Drivers

Belgium's location in the heart of Europe and its reputation as a hub for international trade and commerce make it an attractive destination for foreign investment in the dental industry. The Belgian economy is considered to be one of the most developed and diversified in the world. With a strong service sector, high GDP per capita, and a high standard of living, the country has a growing middle-class population with disposable income to spend on dental care. As the population ages and awareness of oral health increases, there is a growing demand for dental services in the country. This increase in demand is also driven by the fact that many services are not covered by national healthcare insurance, and people are willing to pay for dental services out of pocket.

Market Restraints

The public healthcare system in Belgium, while considered to be one of the best in the world, has limited funding for dental services. This means that dental care is not considered a priority, and there are often long waiting times to see a dentist at public facilities. This phenomenon pushes people to reach out to private providers, like clinics or corporate chains, for treatment. While private dental care in Belgium is generally of high quality, it can be expensive, making it less accessible to some individuals. The national healthcare insurance in Belgium does not cover many dental services, and reimbursement policies for private insurance can be complex and vary depending on the insurance provider, making it difficult for dental corporations to predict their revenue. Dental corporations in Belgium face competition from both domestic and foreign companies, which can make it difficult for them to maintain market share. The government plays an active role in the economy and regulates various sectors, including dental care. Dental corporations may find it difficult to comply with the regulations set in place by the government and this can limit their growth. There is a shortage of dental specialists in the country and the high cost of living in Belgium can make it difficult to attract and retain employees.

Competitive Landscape

Key Players

- Dental Clinics

- Dental Health Group

- Dentale

- Dental Avenue

- Dental World

Healthcare Policies and Regulatory Landscape

In Belgium, the regulatory body for dental services is the "Ordre des Médecins Dentistes/ Orde van Tandartsen" (Order of Dentists). The Order of Dentists is responsible for overseeing the practice of dentistry in the country and ensuring that dental professionals meet the standards of education, training, and ethics required to provide safe and effective care to patients. The main roles and responsibilities of the Order of Dentists include issuing and renewing licenses for dental professionals, investigating complaints against dental professionals and taking disciplinary action when necessary, setting and enforcing standards for education and training, providing guidelines and best practices for dental care, provide advice and assistance to dental professionals on a range of issues, such as insurance and reimbursement policies. They may even be involved in imposing fines, revoking licenses, and issuing reprimands.

Reimbursement Scenario

Dental services given by private providers are not covered by government healthcare insurance in Belgium. Many people, however, have private health insurance coverage that covers some or all of the cost of dental services. The coverage and reimbursement policies differ based on the insurance company and the policy. Some private health insurance policies in Belgium include dental coverage as part of the regular package, while others provide it as an optional extra. The level of coverage can also vary, with some policies just covering basic treatments like routine check-ups and cleanings, whereas others may cover more expensive procedures like orthodontics or cosmetic dentistry. It is vital to highlight that in Belgium, private health insurance coverage is distinct from government healthcare insurance. Individuals must often pay a monthly subscription for private insurance, as well as deductibles or co-payments for services. Dental care in Belgium is compensated by the government for up to 75% of the treatment costs. Prices vary greatly amongst dentists; the cost of your dental care may be determined by your age, the type of therapy, and the intensity of the procedures. Another significant price aspect is whether or not the dentist has agreed to set charges for their services. Patients with private insurance can receive additional payment for dental procedures for which public healthcare only provides minimal or no reimbursement. This includes costly treatments like orthodontics and dental prosthesis. In Belgium, a yearly oral examination by a dentist cost $65 for adults aged 18 to 67. A patient with public health insurance will receive $61 in reimbursement. Private insurance will reimburse the patient in full.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Dental Care Market Segmentation

By Product (Revenue, USD Billion):

In terms of product category, the toothbrush had the highest revenue share (26% in 2020). The rising incidence of cavities, sensitivity, and gingivitis has increased toothpaste usage significantly in both emerging and wealthy countries. As a result, toothpaste is now an essential part of good dental health. In the oral care sector, toothpaste thus commands the biggest market share.

- Toothbrush

- Toothpaste

- Mouthwash

- Dental Floss

- Denture Care

By Age Group (Revenue, USD Billion):

Adults lead the oral care market over the projection period based on age group. The overall expansion of the oral care industry is being driven by adults' increasing consumer knowledge of mouth cleanliness and care. Adult oral care products come in a variety on the market.

- Children

- Adults

- Geriatric

By Sales Channel (Revenue, USD Billion):

The specialty stores dominate the oral care market over the projection period based on the sales channel. Specialty shops carry a broad selection of goods. The employees of specialty businesses provide customers with precise product information. With the aid of specialty shops, customers can also find all types of dental care items under one roof.

- Hypermarkets/Supermarkets

- Specialty Stores

- Drug Stores &Pharmacies

- Convenience Stores

- Online Sales Channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.