Australia Telemedicine Market Analysis

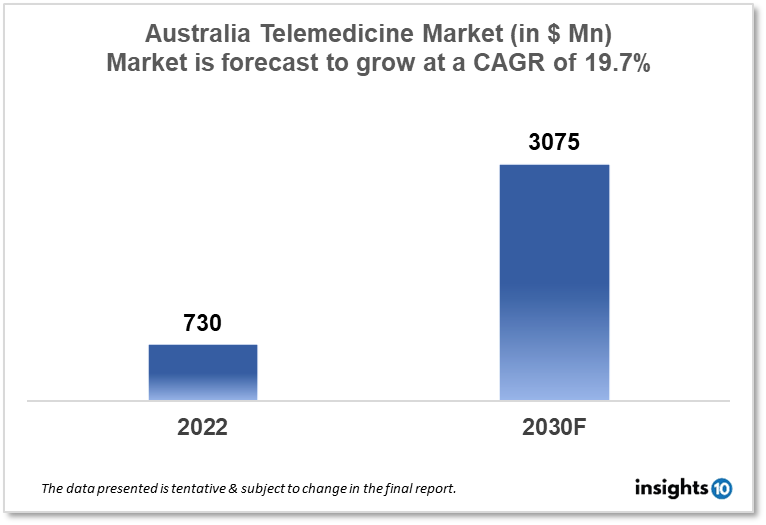

Telemedicine is a sector of immense growth potential with a market size of about $730 Mn in 2022 with a CAGR of about 19.7% and is expected to grow to $3,075 Mn in 2030 as predicted by Insights10 report on the Australia Telemedicine Market Analysis. The inclusion of telemedicine services by general practitioners and telemedicine coverage in Medicare Australia are major growth drivers. The market is segmented by component, modality, application, and end user. Doxy.me Inc. and Teladoc Health are major market players in telemedicine.

Buy Now

Australia Telemedicine Market Executive Analysis

Australia's telemedicine market size is at around $730 Mn in 2022 and is projected to reach $3,075 Mn in 2030, exhibiting a CAGR of 19.7% during the forecast period 2022-30. In 2022-2023, the Australian government spent $105.8 Bn on health, or 16.8% of all expenditures. The cost of medical services and benefits, which primarily include Medicare and Private Health Insurance Rebate expenses, will account for $39.5 Bn, or 37.3% of overall costs associated with healthcare. Between 2022-2023 and 2025-2026, spending is projected to rise by 2.5% in real terms, mostly due to rising medicare costs. Between 2021-2023, expenses are projected to rise by 11.3% in real terms, primarily as a result of COVID-19 responses and the use of the Indigenous Australians Health Program. After that, spending is anticipated to decline by 8.4% in real terms between 2022-2026 as a result of the expiration of COVID–19 measures and lower payments made to states and territories under a national partnership agreement that is about to expire.

For countless Australian patients, telemedicine has proven essential in ensuring quality care. Healthcare can be accessed through telemedicine at any point in time. Over 100 Mn telemedicine services were delivered nationally to approximately 17 Mn Australians between March 13, 2020, and March 16, 2022. Medicare benefits worth more than $5 Bn have been paid, and more than 92,000 doctors are currently using telemedicine services to support their patients. General practitioner (GP) has delivered about 83 Mn of these services, specialists nearly 11 Mn, and allied health professionals about 5 Mn.

Market Dynamics

Market Growth Drivers

Over the subsequent five years, it is anticipated that the telemedicine sector would keep growing in Australia. For patients who rely on bulk-billed medications, the continued inclusion of telemedicine options for GP as well as some specialist consultations is largely responsible for this development in Australia. A number of healthcare providers are listed on the Medicare Benefits Schedule (MBS), and Medicare pays all or part of the cost of the services they offer. The scope of telemedicine services on the MBS has always been substantially constrained, however, during the COVID-19 pandemic, the number of telemedicine services that were eligible for Medicare funding significantly grew. Therefore, an increase in financing for Medicare offers telemedicine providers a chance. In 2022-2023, an increase in Medicare funding is predicted.

Market Restraints

Lack of technology infrastructure, problems with accessibility, restrictions on completing physical examinations, and worries about privacy and confidentiality are some of the potential obstacles to telemedicine in Australia. Healthcare fraud in Australia is also one of the major restraints of telemedicine. Continuous exposure to a variety of clinical, legislative, insurance, educational, regulatory, and interoperability issues and solutions, motivated by necessity, may lead to changes in patients' and physicians' expectations of what is desirable and attainable.

Competitive Landscape

Key Players

- Instant Consult (AUS)

- GP2U Telemedicine (AUS)

- Doctoroo (AUS)

- iCliniq (AUS)

- Docto Online Hospital (AUS)

- Zoom

- Cisco Systems

- American Well

- Doxy.me

- Teladoc

- Vidyo

Healthcare Policies and Regulatory Landscape

In Australia, Medicare and public hospital systems are the citizens' main providers of low-cost services. The Medicare Benefits Schedule (MBS) includes a list of all government-provided health services. It can assist by ensuring that you pay less for treatments if you exceed a certain threshold for out-of-pocket expenses. MBS has now started including telemedicine services by GPs and Other Medical Practitioners (OMPs) for people living in flood-affected areas from 1st Jan 2022. All Australians who are eligible for Medicare will continue to be able to access telemedicine services according to the ongoing arrangements.

Reimbursement Scenario

The Pharmaceutical Benefits Scheme (PBS) is accessible to all Australian citizens with a valid Medicare card as well as some international residents with whom Australia has a reciprocal health care agreement. A Safety Net is also included in the Act. In the event that a patient fills additional prescriptions than the applicable Safety Net Threshold for a calendar year, concessional patients will continue to get PBS medications at no added charge for the rest of the year, while general patients would be required to pay at the concessional co-payment rate.

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Australia Telemedicine Market Segmentation

Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

Modality

The industry is driven by three concepts, which include real-time (synchronous), store and forward (asynchronous), and others comprising remote patient monitoring, etc.

- Store and forward

- Real-time

- Others

Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call centers

Facility

- Tele-hospital

- Tele-home

End-user

- Providers

- Payers

- Patients

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.