Australia Physiotherapy Market Analysis

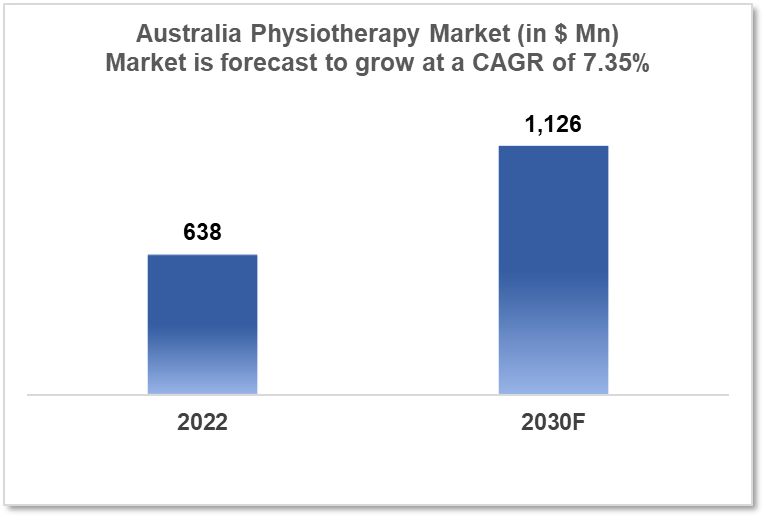

The physiotherapy market in Australia is a growing industry currently valued at $638 Mn in 2022, and the market is estimated to grow to $1,126 Mn at a CAGR of 7.35% for the forecasted period 2022-30. With the increasing demand for physiotherapy services due to an ageing population of over 4.5 Mn and an increase in chronic conditions such as obesity and diabetes. The skyward growth trend is sustained by major players like CPL, Spinal Life Australia, and APE Medical Physiotherapy Equipment.

Buy Now

Australia Physiotherapy Market Executive Summary

The Australia Physiotherapy market size is at around $638 Mn in 2022 and is projected to reach $1,126 Mn in 2030, exhibiting a CAGR of 7.35% during the forecast period. In 2021–2022, the Australia government spent a total of $98.3 Bn on health, or 16.7% of the overall budget, one of the many countries to have healthcare spending in double digits. In 2021–22, the Australia government allocated $13.7 Bn, or 13.9% of all health funding, only on health services, which include spending for population health, medical research, mental health, blood and blood products, other allied health services, and health infrastructure. Australia has 4 Mn individuals between the ages of 65 and 84 by 2022, with some age groups (65-85) experiencing a significant acceleration in the following 10 years. It is predicted that there would be over 4.5 Mn persons in the age group of 65-74 by 2066 - indicating the aging population is a serious concern.

Physiotherapy helps them regain movement and function when someone suffers from an injury, illness, or handicap. Australian Physiotherapists conduct more than 23 Mn consultations every year, with the largest allied health workforce of 31,600 registered physiotherapists. In rural Australia, where privately managed allied health enterprises are most common, physiotherapy is the fourth-largest profession.

Among the geriatric population, the incidence of cardiovascular, neurological, and musculoskeletal illnesses is expected to drive market growth. Patients’ physical strength and mobility can be restored by physiotherapists using a variety of treatments by enhancing the ease of movement and thus enhanced agility. In general, these methods can be delivered as manual therapy or aided physiotherapy, instruction and physical awareness, and bodily movement. Entities entering this sector may benefit from being able to take advantage of the expanding channels for getting such services.

Market Dynamics

Market Growth Drivers

Physiotherapy-led services are increasing in demand with an aging population set to expand to over 4 Mn by 2022 and higher in subsequent years. Musculoskeletal conditions mainly addressed by physiotherapy are the most common cause of severe long-term pain and physical disability. They impact on all aspects of life through pain and by limiting activities of daily living typically by affecting dexterity and mobility. Many are affected by lifestyle factors, such as obesity and lack of physical activity. White-collar jobs climbed by 160,000 in Australia in 2021–2022 and are expected to increase by 200,000 in 2023 and by 1.4% a year until 2030. This has strong development potential because physiotherapy is a treatment for disorders linked to a sedentary lifestyle. Furthermore, Increased focus on wellness and preventative treatments from the government initiatives will also support long-term market growth.

Market Restraints

The out-of-pocket costs that people incur are significantly impacted by changes in healthcare insurance coverage and regulations. Depending on the patient's health and needs, physical therapy for painful tissues takes 6 to 8 weeks to heal. The number of sessions required also varies. The financial load on the patient is increased because insurance only pays for a small percentage of the expense. Due to coverage variations between private and federal payers, patients frequently have to pay cash. Patients may be responsible for a co-pay, co-insurance, facility fees, and meeting a high deductible before co-insurance kicks in. Some physiotherapy procedures have relatively high co-pays. This could result in differences in access to services and influence the standards of care.

Competitive Landscape

Key Players

- CPL

- Spinal Life Australia

- APE Medical Physiotherapy Equipment (AUS)

- BTL Industries

- Corporate Health Group Pvt Ltd.

- OPC Health

- Tynor

- Gen Physio

- Zynex Medical Inc.

Notable Recent Deals

January 2022: HBF, one of Australia's fastest-growing private health insurers has purchased 100% of Life Ready Health Group, and has entered the physiotherapy market. With 32 clinics in Western Australia, Victoria, and Queensland, Life Ready is a diversified physiotherapy group. It employs more than 400 people across its three businesses, Life Ready Physio + Pilates, Life Ready Mobile, and Life Ready Biosymm, which provide comprehensive early intervention and work health services for more than 50 corporate clients in Australia and New Zealand, among others. HBF will collaborate closely with Life Ready as part of the acquisition to deliver more value for its members and improve corporate knowledge across a number of fields, including health management, governance, and marketing.

Healthcare Policies and Regulatory Landscape

In Australia, the regulatory body is the Australian Physiotherapy Council (APC). A national program to evaluate the effects of physiotherapy intervention in the private practice context has been launched, according to the Australian Physiotherapy Association (APA), the 26,000+ member strong industry association comprising some of the world's best-skilled physiotherapy practitioners.

Reimbursement Scenario

Five physical therapy treatments per year are only reimbursed at a rate of $56 for Australians with chronic conditions (costs for a physiotherapy consultation range approximately from $80 to $140). In 2021, more than 11 Mn physiotherapy services were claimed on private insurance services in Australia. A referral form that has been issued by the Australian Government Department of Health or a form that has all the components of this form must be used by the patient's General Practitioner (GP) or medical professional in order for Medicare benefits to be paid.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Physiotherapy Market Segmentation

By Product: (Revenue, USD Billion):

Based on product, the physiotherapy equipment market is divided into two major segments, namely, equipment and accessories. The equipment segment accounted for the largest share of the physiotherapy equipment market in 2021. The equipment segment is further segmented into electrotherapy equipment, ultrasound equipment, exercise therapy equipment, heat therapy equipment, cryotherapy equipment, combination therapy equipment, continuous passive motion therapy equipment, shockwave therapy equipment, laser therapy equipment, magnetic pressure therapy equipment, traction therapy, and other physiotherapy equipment (hydrotherapy and vacuum therapy). Owing to the increasing use of electrotherapy equipment in the treatment of musculoskeletal disorders and owing to increasing concerns for patients’ safety and minimal/no side-effects during the physiotherapy treatments.

- Equipment

- Electrotherapy equipment

- Ultrasound equipment

- Exercise therapy equipment

- Heat therapy equipment

- Cryotherapy equipment

- Combination therapy equipment

- Continous passive motion therapy equipment

- Shockwave therapy equipment

- Laser therapy equipment

- Magnetic pressure therapy equipment

- Traction therapy

- Other physiotherapy equipment

- Accessories

- Manual Therapy

- Specialized treatment

- Joint Mobilization Techniques

- Suspension Therapy

By Application (Revenue, USD Billion):

Based on application, the physiotherapy equipment market is segmented into musculoskeletal applications, neurological applications, cardiovascular and pulmonary applications, pediatric applications, gynecological applications, and other applications (including sports and palliative care). The musculoskeletal applications segment holds a dominating share attributed to the increasing adoption of physiotherapies to accelerate recovery of accidental injuries, rising incidence of musculoskeletal disorders, and growth in the geriatric population.

By Applications

- Musculoskeletal applications

- Neurological applications

- Cardiovascular and pulmonary applications

- Pediatric applications

- Gynecological applications

- Other applications

By End-user (Revenue, USD Billion):

Based on end users, the physiotherapy equipment market is segmented into physiotherapy & rehabilitation centers, hospitals, home care settings, physician offices, and other end users (community health centers and elderly care facilities). In 2021, the physiotherapy & rehabilitation centers segment accounted for the largest share of the physiotherapy equipment market due to increasing demand for advanced physiotherapy equipment and their wide usage across the care continuum across these centers.

- Physiotherapy & Rehabilitation centers

- Hospitals

- Home care settings

- Physician offices

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.