Australia Neurology Clinical Trials Market Analysis

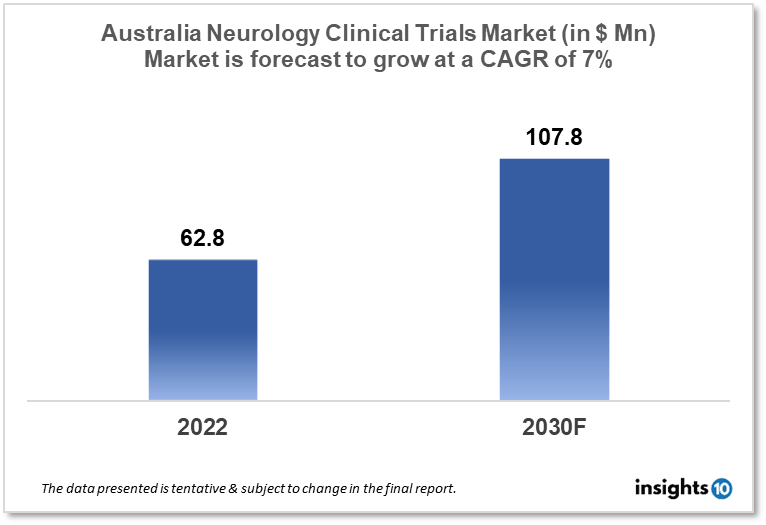

The Australia Neurology Clinical Trials market is projected to grow from $62.8 Mn in 2022 to $107.8 Mn by 2030, registering a CAGR of 7% during the forecast period of 2022 - 2030. The market will be driven by internationally competitive government subsidies for R&D investment and a well-developed infrastructure to support clinical trials. The market is segmented by phase, by study design & by indication. Some of the major players include Novartis AG, Biogen Inc, Neuroscience Trials Australia & Prana Biotechnology Limited.

Buy Now

Australia Neurology Clinical Trials Market Executive Summary

The Australia Neurology Clinical Trials market is projected to grow from $62.8 Mn in 2022 to $107.8 Mn by 2030, registering a CAGR of 7% during the forecast period of 2022 - 2030. Sydney, NSW, Melbourne, VIC, Brisbane, QLD, Perth, WA, and Adelaide, SA were considered the top five healthiest cities in Australia in 2021. According to the Australian Bureau of Statistics, the percentage of the population aged 65 and above has climbed from 12.3% to 15.9% in the last two decades. The growing senior population is at high risk of acquiring neurological ailments such as Alzheimer's disease, Parkinson's disease, and others. According to the 'Dementia in Australia' 2022 report, there will be 487,500 Australians living with dementia in 2022. Without a medical breakthrough, the number of dementia patients is anticipated to rise to about 1.1 million by 2058.

Clinical research in Australia is well-established and growing, notably in the area of neurology. The nation offers a robust regulatory framework and a well-developed infrastructure to support clinical trials, making it an appealing site for clinical trials for both global pharmaceutical corporations and local biotech startups. There are a number of active neurology clinical trials in Australia, including trials looking at potential therapies for Alzheimer's disease, Parkinson's disease, multiple sclerosis, and epilepsy, among other disorders.

Novartis, Biogen, Roche, Eli Lilly, and Pfizer are among the leading pharmaceutical firms performing neurology clinical studies in Australia. These firms are focusing on creating novel medicines for a variety of neurological disorders, and they are conducting clinical studies in collaboration with local research groups and hospitals. Moreover, a number of Australian biotech firms are operating in the neurology field, including Prana Biotechnology, which is investigating a therapy for Huntington's disease, and Cogstate, which is focused on producing cognitive evaluation tools for clinical trials.

Market Dynamics

Market Growth Drivers

Some of the world's foremost researchers, doctors, and healthcare professionals are based in Australia. It has world-class medical research and healthcare facilities, a stable socioeconomic climate, a diversified ethnic population, and a robust intellectual property system. An efficient regulatory structure, including a swift clinical trial approval process, well-established clinical trial infrastructure, skilled and well-qualified professionals, and internationally competitive government subsidies for R&D investment all contribute to Australia's position as a leading destination for clinical trials. Pharmaceutical, biotechnology, and medical device businesses start about 1000 new clinical studies in Australia each year.

Market Restraints

There are various factors influencing the neurology clinical trials industry in Australia. One of the most significant problems is the relatively small population size, which might restrict the number of individuals who are eligible for clinical studies. This is especially true for uncommon neurological disorders, where locating qualified individuals might be difficult. The high expense of conducting clinical trials in Australia is another barrier. Because of the country's high cost of living and highly qualified workforce, clinical trials may be more costly than in other nations. This may be an impediment to admission for smaller biotech firms that lack the capacity to undertake research in the nation.

Competitive Landscape

Global Key Players

- Novartis AG

- Biogen Inc.

- Roche Holding AG

- Pfizer Inc.

- Eli Lilly and Company

- Sanofi S.A

- Johnson & Johnson

- Merck & Co., Inc.

- AbbVie Inc.

- AstraZeneca plc

Local Key Players

- NeuClone Pharmaceuticals (AUS) - NeuClone is a clinical-stage biopharmaceutical firm dedicated only to the development and commercialization of high-quality biosimilar pharmaceuticals

- Prana Biotechnology Limited (AUS) - Focussed on first-in-class therapies to treat neurodegenerative disease

- Cogstate (AUS) - Cogstate is a firm that develops neuroscience technologies. Clinical and academic research, healthcare, biopharmaceuticals, computerised cognitive testing, central monitoring, scientific consultation, and other services

- Neuroscience Trials Australia (AUS) - is one of the world's few CROs that specialises in CNS projects. Epilepsy, stroke and stroke-related conditions, multiple sclerosis, Alzheimer's disease/ cognitive disease studies, Motor Neurone Disease/ALS, mental health and associated conditions, Parkinson's disease, spinal cord injuries, Huntington's disease, neurosurgery, pain, neuromuscular disease, and migraine companies are among the therapeutic areas of expertise

- NeuRA (AUS) - A non-profit, independent medical research centre devoted to improving the lives of those suffering from brain and nervous system illnesses

Notable Insights

September 2022, The Neurosciences Clinical Research Suite (NCRS) at the University of Queensland’s Centre for Clinical Research (UQCCR), will be a go-to location for scientists, physicians, and health professionals to engage directly with clinical trial patients to help develop innovative therapies for brain illnesses.

August 2022, In collaboration with South Australia's Medical and Health Institute (SAHMRI), the Hospital Research Foundation is contributing $300,000 to the new project. The new South Australian research aims to detect Parkinson's disease sooner by measuring dopamine levels in the brain.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Clinical Trials Regulation in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

6. Methodology and Scope

Neurology Clinical Trials Market Segmentation

By Phase (Revenue, USD Billion):

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design Outlook (Revenue, USD Billion):

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle regeneration

- Others

By Indication Outlook (Revenue, USD Billion):

- Interventional

- Observational

- Expanded Access

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.