Australia Diabetes Therapeutics Market Analysis

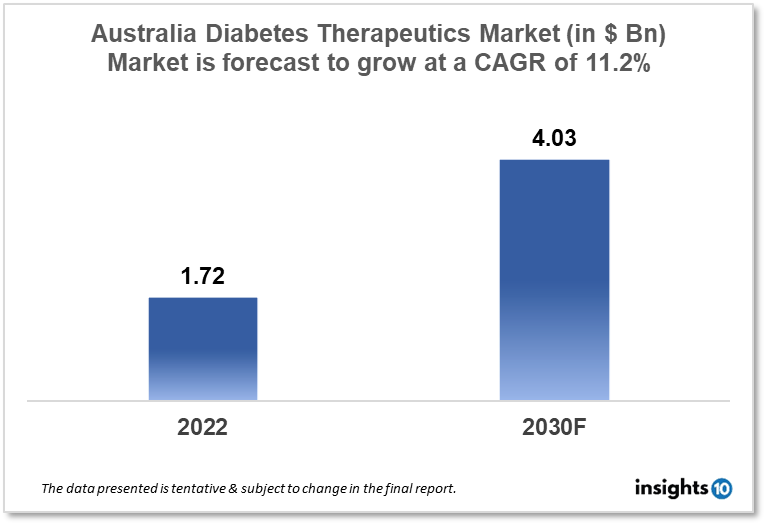

Australia's diabetes therapeutics market is expected to grow from $1.72 Bn in 2022 to $4.03 Bn in 2030 with a CAGR of 11.2% for the forecasted year 2022-30. Various government initiatives such as the National Diabetes Services Scheme, the Pharmaceutical Benefits Scheme, the Insulin Pump Program, and Medicare provide diabetes assistance to Australian citizens, a significant factor driving the market's growth. The Australian diabetes therapeutics market is segmented by type, application, drug, route of administration, and distribution channel. MycRx, Cynapse Bio, and Novartis are the major players in the Australian diabetes therapeutics market.

Buy Now

Australia Diabetes Therapeutics Market Executive Analysis

Australia's diabetes therapeutics market size is at around $1.72 Bn in 2022 and is projected to reach $4.03 Bn in 2030, exhibiting a CAGR of 11.2% during the forecast period. The Australian government has unveiled its first budget, allocating $104.1 Bn in total to healthcare, including $30.6 Bn for elder care. A $2.9 Bn initiative will result in a systemic overhaul of primary healthcare in Australia. The beginning of the rollout will be supported by $235 Mn in funding from 2022 to 2023, which will include $100 Mn over two years from 2022 to 2023 for co-developing and testing cutting-edge solutions with states and territories to improve treatment pathways and direct the rollout of the urgent care program. To support the recommendations of the Improving Medicare Taskforce, the government has set aside $750 Mn for its Strengthening Medicare Fund. The Australian Medical Association (AMA) also applauded the government's $143.3 Mn pledge to support healthcare services in rural and regional areas.

Australia is rated sixth highest for incidence and seventh highest for type 1 diabetes prevalence in children worldwide. Due to its increasing prevalence and the heavy burden of diabetes-related complications, many of which are preventable, type 2 diabetes (T2D) is a public health priority in Australia. The overwhelming majority of T2D care, from preventing diabetes in those at risk to providing care for those nearing the end of their lives, takes place in general practice. Recent advancements in therapeutic choices have significantly altered the landscape of diabetes therapy.

Due to their beneficial effects on cardiovascular and renal disease, as well as metabolic risk profile, the prescribing of newer classes of glucose-lowering medications, such as sodium-glucose co-transporter-2 (SGLT2) inhibitors and glucagon-like peptide-1 receptor agonists (GLP1-RAs), is rapidly rising. According to Australian recommendations, metformin should be used as the first line of medication unless it is contraindicated or not tolerated. Five treatment classes are now recommended for second-line dual therapy: SGLT2 inhibitors, GLP1-RA, dipeptidyl peptidase-4 (DPP-4) inhibitors, sulphonylureas, and insulin. These groups each have several available agents. Although there is more complexity, the advantage is that clinicians are better able to customize evidence-based treatment for each unique patient.

Market Dynamics

Market Growth Drivers

The Australian government plays a crucial part in preserving access to reasonably priced, high-quality tools and services that aid diabetics in self-care and treatment. Through the National Diabetes Services Scheme, the Pharmaceutical Benefits Scheme, the Insulin Pump Program, and Medicare, the Australian government offers assistance to those who have diabetes which results in the expansion of the Australian diabetes therapeutics market. Patients are increasingly looking for treatments that are individualized to meet their unique requirements, which is driving a rise in the demand for personalized medicine in diabetes therapeutics. New, more efficient, and targeted treatments and therapies are being developed as a result of this.

Market Restraints

The pharmaceutical industry in Australia is highly regulated, and before new treatments are authorized for use, they must go through extensive testing and clinical trials. The number of new products that can reach the market may be constrained because this procedure can be time-consuming and expensive. Therapeutics for diabetes can be quite expensive, particularly for those who need continuous, regular care. Some patients may find this to be a major obstacle because they may not be able to afford the necessary treatments, which could restrain the Australian diabetes therapeutics market expansion.

Competitive Landscape

Key Players

- Mayne Pharma (AUS)

- Vifor Pharma (AUS)

- Isis Pacific (AUS)

- MycRx (AUS)

- Cynapse Bio (AUS)

- Novartis

- Novo Nordisk

- Sanofi

- Takeda Pharmaceutical

- Johnson and Johnson

- Merck

Healthcare Policies and Regulatory Landscape

The Australian Department of Health and Ageing's Therapeutic Goods Administration (TGA) is one of its divisions. Its main responsibility is to serve as the country's regulator of therapeutic goods, a category that includes medications, medical equipment, and some associated products. The Therapeutic Goods Act of 1989 is administered by the TGA, and among its goals is a national system of controls relating to the quality, safety, efficacy, and timely availability of therapeutic goods used in Australia, whether produced in Australia or elsewhere or exported from Australia. Fees for checks, assessments, and yearly registrations cover all costs associated with these operations. Any medicinal good must be listed on the Australian Register of Medicinal Goods in order to be legally supplied in Australia (ARTG). The ARTG accepts two different kinds of entries. AUST R numbers are printed on the labels of some goods that have been registered. Other goods have an AUST L number and are "listed." Products are either appropriate for listing or need to be registered, according to the TGA.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Therapeutics Segmentation

By Type (Revenue, USD Billion):

- Diabetes 1

- Diabetes 2

By Application (Revenue, USD Billion):

- Preventive

- Prediabetes

- Nutrition

- Obesity

- Lifestyle Management

- Treatment/Care

- Diabetes

- Smoking Cessation

- Musculoskeletal Disorders

- Central Nervous System Disorders

- Cardiovascular Disease

- Medication Adherence

- Chronic Respiratory Disorders

- Gastrointestinal Disorders

- Rehabilitation

- Substance Use Disorders & Addiction Management

By Drug (Revenue, USD Billion):

- Oral Anti-diabetic Drugs

- Insulin

- Non-insulin Injectable Drug

- Combination Drug

By Route of Administration (Revenue, USD Billion):

- Oral

- Subcutaneous

- Intravenous

By Distribution Channel (Revenue, USD Billion):

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

MycRx, Cynapse Bio, and Novartis are the major players in the Australia diabetes therapeutics market.

The Australian diabetes therapeutics market is expected to grow from $1.72 Bn in 2022 to $4.03 Bn in 2030 with a CAGR of 11.2% for the forecasted year 2022-2030.

The Australian diabetes therapeutics market is segmented by type, application, drug, route of administration, and distribution channel.