Australia Connected Healthcare Market Analysis

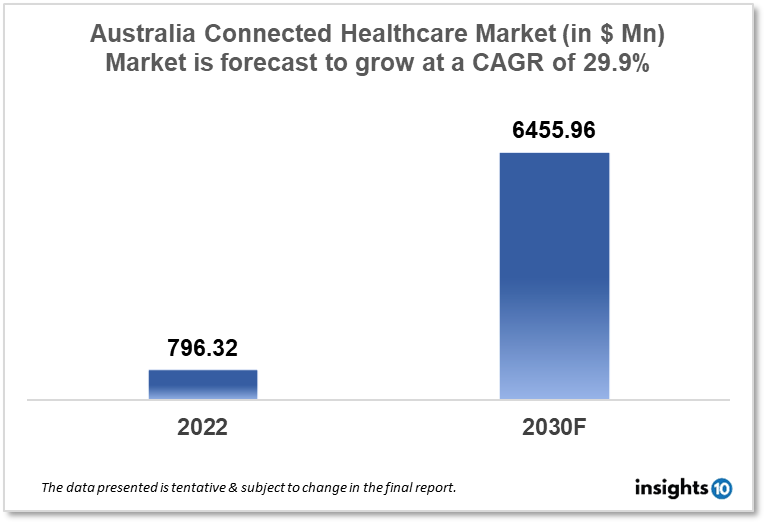

The Australia-connected healthcare market is projected to grow from $796.32 Mn in 2022 to $6444.96 Mn by 2030, registering a CAGR of 29.9% during the forecast period of 2022-30. The main factors driving the growth would be the rising geriatric population, geographic challenges, technological innovation, and government investment. The market is segmented by type, function, and application. Some of the major players include Telstra Health, HealthEngine, ResApp, MyHealth1st, Apple, IBM and Microsoft.

Buy Now

Australia Connected Healthcare Market Executive Summary

The Australia-connected healthcare market is projected to grow from $796.32 Mn in 2022 to $6444.96 Mn by 2030, registering a CAGR of 29.9% during the forecast period of 2022-30. Australia spent $202.5 Bn, or $7,926 per person, on healthcare in 2019–20. The real rise in healthcare spending was 1.8%, which was less than the 3.4% decade average. The majority of the funding for healthcare in Australia is provided by the government, but patients also foot a considerable chunk of the bill.

The term connected healthcare refers to the application of digital tools and technologies to the remote diagnosis, monitoring, and management of medical disorders. Australia has the essential infrastructure in place to enable and support standardisation and connected health systems, such as national healthcare identities and is continuing to make progress, as evidenced by the rapid national uptake of electronic prescribing, spurred by the tough COVID environment.

At the University of New South Wales, the Australian Research Council has officially opened its latest connected health research hub. This new research centre, which became operational in August, brings together seven institutions and 26 Australian companies to develop a national end-to-end ecosystem that will design, manufacture, and commercialise clinical-grade sensors and predictive analytics. It incorporates the country's current expertise in sensor technology, security, software, data analytics, and digital health.

Market Dynamics

Market Growth Drivers

The Australia-connected healthcare market is expected to be driven by factors such as:

- Rising geriatric population- Australia has an ageing population, with an increase in the number of citizens over 65. The need for healthcare services is rising as a result of the changing demographics, especially in fields like chronic disease management and remote patient monitoring

- Geographic challenges- Australia is a huge country with a small population, which makes it difficult for healthcare providers to give services to isolated and rural locations. Telemedicine and remote patient monitoring are two connected healthcare options that can assist in overcoming these obstacles and enhancing access to healthcare for all Australians

- Technological innovation- With a strong entrepreneurial culture and a robust startup environment, Australia is a centre for technical innovation. This has prompted the creation of a variety of cutting-edge connected healthcare solutions, including wearable technology and mobile health applications

- Government investment- The development of a national electronic health record system and support for telehealth services are some examples of the considerable expenditures the Australian government has made in digital health initiatives. The adoption of connected healthcare solutions in the nation is being accelerated by these initiatives

Market Restraints

The following factors are expected to limit the growth of the connected healthcare market in Australia:

- Funding and reimbursement- Securing funding and reimbursement for digital health solutions are one of the biggest problems for Australia's connected healthcare business. Since the majority of the Australian healthcare system is supported by the government, digital health solutions must be able to show that they are both cost-effective and acceptable for government reimbursement

- Regulatory barriers- Australia's rigorous regulatory requirements for digital health solutions might be an entry hurdle for smaller businesses and startups. Standards for data security and privacy are part of these requirements, in addition to an endorsement from regulatory agencies like the Therapeutic Goods Administration

- Limited adoption- Although connected healthcare solutions seem to have advantages, many Australian healthcare organisations have been slow to adopt new technology

Competitive Landscape

Key Players

- Telstra Health (AUS): One of Australia's leading healthcare organisations, Telstra Health, provides a variety of digital health solutions, such as telemedicine platforms, electronic health records, and patient monitoring devices

- HealthEngine (AUS): HealthEngine is a web-based platform that connects patients with healthcare professionals by providing services such as online booking, telehealth consultations, and patient feedback

- ResApp (AUS): ResApp Health is a digital health startup that specialises in developing and commercializing smartphone-based diagnostic tests for respiratory disorders

- MyHealth1st (AUS): Health1st is an online platform that gives individuals access to their medical records and allows them to schedule appointments with healthcare professionals, including telehealth consultations

- Apple: Apple has been establishing a stronger presence in the healthcare industry by creating health-related products and services, such as the apple watch and the health app, which let users keep track of their fitness and health data

- IBM: IBM is a prominent player in the worldwide healthcare technology market, and it has collaborations with a number of Australian healthcare institutions to provide solutions such as artificial intelligence-powered patient monitoring systems

- Microsoft: Microsoft is a significant player in the Australian connected healthcare business, providing services like telemedicine platforms and cloud-based electronic health records

Notable Deals

August 2021: Telstra has agreed to acquire MedicalDirector, a business that specialises in the software used by general practitioners to run their offices. The company's current portfolio of digital health solutions utilised by hospitals, pharmacies, and the aged care industry has been expanded by the acquisition.

Healthcare Policies and Regulatory Landscape

The Connecting Australian Health Care — National Healthcare Interoperability Plan is an innovative, broadly supported, and well-coordinated initiative that intends to expedite the digital transformation of healthcare delivery. Ten principles, five priority areas, and 44 actions are outlined in the plan, which will advance over the following five years. The initiatives were created after extensive collaboration with key players in the health and care industries. The Plan's execution will be supervised and coordinated by the Australian Digital Health Agency (the Agency). Furthermore, medical devices and other therapeutic products in Australia are subject to regulation by the Therapeutic Goods Administration (TGA).

Reimbursement Scenario

In Australia, the government-funded Medicare system, which offers all Australians access to medical services and treatments, mostly regulates reimbursement policies for healthcare services. The Australian government has recently implemented a number of payment regulations intended to encourage the usage of digital health technologies. For instance, the government offers Medicare Benefits Schedule (MBS) reimbursements for telehealth services, which let patients use video conferencing technology to communicate with their doctors remotely.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Connected Healthcare Market Segmentation

By Type (Revenue, USD Billion):

Based on the Type the market is segmented into mHealth services, mHealth Devices, and E- Prescription

- MHealth services

- mHealth Devices

- E- Prescription

By FunctionType (Revenue, USD Billion):

- Remote patient monitoring

- Clinical monitoring

- Telemedicine

- Others (Assisted Living)

By Application Type (Revenue, USD Billion):

- Diagnosis and Treatment

- Monitoring Application

- Wellness and Prevention

- Healthcare management

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

The Australia-connected healthcare market is projected to grow from $796.32 Mn in 2022 to $6444.96 Mn by 2030, registering a CAGR of 29.9% during the forecast period of 2022 - 2030.

Australian connected healthcare market is segmented by type (m-health services, m-health devices and e-prescription), by function (remote patient monitoring, clinical monitoring, telemedicine and others), and by application type (diagnosis and treatment, monitoring application, wellness and prevention, healthcare management and others).

Some of the major players in Australia's connected healthcare market are Telstra Health, HealthEngine, ResApp, MyHealth1st, Apple, IBM and Microsoft.