Australia Alzheimer’s Disease Drug Market Analysis

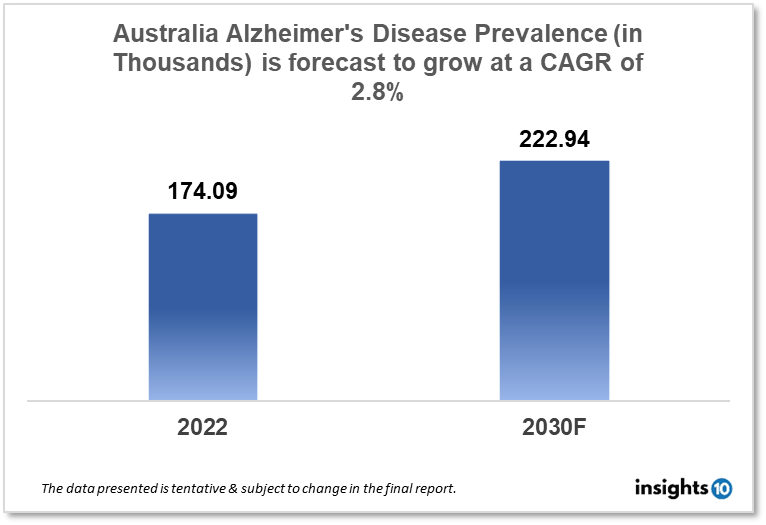

Australia's alzheimer’s disease drug market is expected to grow from $174.09K in 2022 to $222.94K in 2030 with a CAGR of 2.8% for the year 2022-30. Rising Alzheimer’s cases in Australia and increased investments by the government in the development of diagnostics and treatment modalities for Alzheimer’s disease in Australia are major market drivers of the Australia alzheimer’s disease drug market. The market is segmented by product, by drugs, and by distribution channel. Xenexus Pharmaceutical, Mediland Pharm, and Merz Pharma are some of the key players in this market.

Buy Now

Australia Alzheimer’s Disease Drug Market Executive Analysis

The Australia Alzheimer’s disease drug market is at around 174.09K in 2022 and is projected to reach 222.94K in 2030, exhibiting a CAGR of 2.8% during the forecast period. A total of $105.8 Bn, or 16.8% of total government expenditures in Australia, is projected to be spent on health in 2022–2023. Realistically, it is anticipated that overall spending will fall by 8.3% between 2021–22 and 2022–23 and by 4.4% between 2022–23 and 2025–26, principally as a result of the termination of COVID–19-related payments. The government is lowering the cost of medications for Australian families. The $42.50 maximum co-payment will be reduced to $30 as of January 1, 2023. The Australian Government's Pharmaceutical Benefits Scheme (PBS) medicine subsidies will account for the majority of the $17.2 Bn, or 16.3%, in pharmaceutical benefits and services.

The National Institute of Neurological Disorders and Stroke describes Alzheimer's Disease (AD) as a progressive neurodegenerative condition that results from the death of brain nerve cells. Some of the signs of the condition include impaired memory, thinking, and behavior, confusion, restlessness, language deterioration, impaired thought processes involving visual and spatial awareness, and emotional apathy. The most common form of dementia is Alzheimer's disease. Australian research has played a significant role in advancing international efforts to better understand Alzheimer's disease and create technologies and approaches that will result in more effective cures and treatments. According to Dementia Australia, there are currently an estimated 459,000 Australians living with dementia, and by 2058, there are expected to be more than 1.1 Mn. For all Australians, dementia is the second most common cause of death, and it kills more women than any other disease. In 2016, it was anticipated that providing care for Australians with dementia cost $14.25 Bn.

AD currently has no proven treatment, but there are four drugs available through the Pharmaceutical Benefits Scheme (PBS) and the Repatriation Pharmaceutical Benefits Scheme (RPBS). Only those with an Alzheimer's disease diagnosis are currently eligible for these drug subsidies in Australia. For the treatment of mild to severe AD, Australia has approved the use of donepezil, galantamine, and rivastigmine. Australia might get a new Alzheimer's drug called Lecanemab next year. It is a monoclonal antibody that targets amyloid beta, a protein that accumulates in the brains of people with Alzheimer's disease and forms clumps or plaques. Lecanemab is made to bind to and remove these plaques, possibly reducing the disease's course. However, it is yet to be approved by Therapeutic Drugs Administration, Australia.

Market Dynamics

Market Growth Drivers

One of the main factors driving the expansion of the Australia Alzheimer's market is the rise in Alzheimer's cases. Governments and non-governmental organizations are investing heavily in the development of diagnostics and treatments for the condition as a result of the increased prevalence of Alzheimer's disease in Australia, which could spur market growth. The Australia Alzheimer's disease market is witnessing an increase in R&D investments and collaborations as a result of new treatment technologies.

Market Restraints

The development of the Australia market for Alzheimer's disease is anticipated to be hampered by the absence of methods for diagnosing Alzheimer's disease. The diagnosis of AD is difficult since there is no conclusive blood test, brain scan, or physical exam, and so many illnesses can cause symptoms like dementia, which is the main clinical symptom of AD. AD cannot be properly and promptly diagnosed, which limits the Australia Alzheimer's disease market expansion.

Competitive Landscape

Key Players

- Key Pharmaceuticals (AUS)

- Folarix Pharmaceutical (AUS)

- Xenexus Pharmaceutical (AUS)

- Mediland Pharm (AUS)

- Merz Pharma

- H. Lundbeck A/S Biogen

- AstraZeneca

- Eli Lilly

- Teva Pharmaceutical

- Ono Pharmaceutical

Healthcare Policies and Regulatory Landscape

Alzheimer's disease and other types of dementia are categorized as chronic diseases in Australia and are therefore covered by Medicare, the national public health insurance program. This covers all visits to the doctor, diagnostic exams, and hospital care required to identify, treat, and manage the problem. Depending on the drug and the patient's circumstances, Medicare may also pay for some medications used to treat Alzheimer's disease.

The Commonwealth Government's Therapeutic Goods Administration oversees the control of pharmaceuticals and medical equipment. The Australian Register of Therapeutic Goods lists prescription drugs and over-the-counter medications that adhere to Australian criteria for quality, safety, and efficacy. Drugs may be listed or registered. Acetylcholinesterase inhibitors including donepezil, galantamine, and rivastigmine, as well as the NMDA receptor antagonist memantine, have been licensed by the TGA for the treatment of Alzheimer's disease. In addition to these approved pharmaceuticals, there are research drugs being explored for the treatment of Alzheimer's disease, such as monoclonal antibodies that target amyloid beta, such as Lecanemab.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Australia Alzheimer's Disease Drug Market Segmentation

By Product

- Cholinesterase Inhibitors

- NMDA Receptor Antagonist

- Combination Drug

- Pipeline Drugs

By Drugs

- Donepezil

- Rivastigmine

- Memantine

- Galantamine

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Drug Stores

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.