APAC Physiotherapy Market Analysis

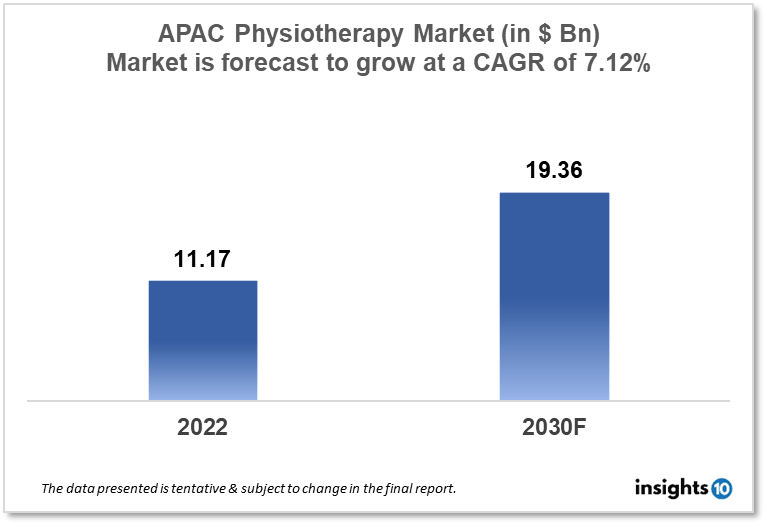

The APAC physiotherapy market size was valued at $11.17 Bn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 7.12% from 2022 to 2030 and will reach $19.36 Bn in 2030. APAC's physiotherapy market is expected to grow due to several factors, a growing focus on preventative care, including an aging population, and an increase in chronic diseases. The market is segmented by Product Type, Application Type, and End User. The major players in the APAC physiotherapy market are PhysioGlobal, BTL, EMS Physio Ltd., Dynatronics Corporation, RICHMAR, and others.

Buy Now

APAC Physiotherapy Market Executive Summary

The APAC physiotherapy market size was valued at $11.17 Bn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 7.12% from 2022 to 2030 and will reach $19.36 Bn in 2030. The ageing of the population, the rising prevalence of chronic diseases, and the rising demand for high-quality healthcare services have all contributed to an increase in the APAC region's healthcare spending in recent years. Healthcare spending as a share of GDP varies greatly in different APAC nations, according to data from the World Health Organization (WHO). Healthcare spending as a percentage of GDP is quite high in certain nations, like Japan and South Korea, and relatively low in others, like India and Indonesia.

Overall, the APAC region is expected to continue to see growth in healthcare expenditure in the coming years, as the demand for healthcare services continues to increase and the region invests in the development and adoption of advanced healthcare technologies.

In the APAC region, the importance of physiotherapy-based rehabilitative care is increasing as more individuals have access to cutting-edge medical, emergency, and trauma care. Rehabilitation therapy is an essential part of patient care for those who have or are at risk of having short- or long-term disabilities as a result of their illnesses or accidents. The inclusion of rehabilitative therapy in the continuum of care has had significant positive effects on patients and carers alike. By providing better treatment and hastening patient recovery, shorter patient admission times enable healthcare providers to meet the requirements for value-based care. Additionally, patients can ensure the greatest outcomes for both medical and surgical procedures. As a result, many healthcare facilities now consider rehabilitation therapy to be an essential part of their overall care strategy. As a result, there is now a greater need for physiotherapy equipment as well as equipment for rehabilitation.

Market Dynamics

Market Growth Drivers

The number of people who have chronic disorders including arthritis, osteoporosis, and other age-related conditions that require physiotherapy is growing as the population is getting older. A growing number of people are now suffering from chronic illnesses like obesity, diabetes, and heart disease, which also call for the use of physiotherapy to treat symptoms and enhance general health.

Moreover, physiotherapy can both prevent and treat injuries, especially in athletes and other physically active persons. As more people engage in sports and physical activity, physiotherapy services are becoming more and more essential to help manage and prevent injuries. Physiotherapy is also used in the recovery process for patients who have undergone surgeries and other medical treatments. As more surgeries and medical procedures are performed, there is an increasing need for physiotherapy services to help patients recuperate and return to their regular activities. ageing populations.

Market Restraints

Despite the physiotherapy market's expansion in APAC, there are a number of challenges that could limit market expansion. Rural locations that may have limited access to physiotherapy services due to a dearth of therapists in these areas are one of the main barriers to the Chinese physiotherapy market. Additionally, some patients may find it difficult to afford physiotherapy treatments and supplies due to the high cost of such items.

Competitive Landscape

Key Players

- BTL

- EMS Physio Ltd.

- Dynatronics Corporation

- RICHMAR

- Performance Health

- Storz Medical AG

- Zimmer MedizinSysteme GmbH

- ITO Co., Ltd.

- Enraf-Nonius B.V.

- Whitehall Manufacturing

Healthcare Policies and Regulatory Landscape

Policy changes and Reimbursement scenario of the APAC Physiotherapy Market

Regulation of physiotherapy equipment in the Asia Pacific (APAC) region varies among countries. Some countries, such as Japan and Australia, have established regulatory systems for medical devices that are similar to those in place in the United States and Canada. However, in many other countries in the APAC region, the regulation of medical devices, including physiotherapy equipment, is less developed.

In Japan, the Ministry of Health, Labour and Welfare (MHLW) regulates the manufacture, import, and sale of medical devices through the Medical Device Act. Medical devices are classified into three categories based on their level of risk and must be registered with the MHLW before they can be sold in Japan.

In Australia, the Therapeutic Goods Administration (TGA) regulates the manufacture, import, and sale of medical devices, including physiotherapy equipment. Medical devices are classified into three classes based on their level of risk and must be registered with the TGA before they can be sold in Australia.

In China, the State Food and Drug Administration (SFDA) regulates the manufacture, import, and sale of medical devices, including physiotherapy equipment. Medical devices are classified into three classes based on their level of risk and must be registered with the SFDA before they can be sold in China.

In India, the Central Drugs Standard Control Organization (CDSCO) regulates the manufacture, import, and sale of medical devices, including physiotherapy equipment. Medical devices are classified into four classes based on their level of risk and must be registered with the CDSCO before they can be sold in India.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Physiotherapy Market Segmentation

By Product: (Revenue, USD Billion):

Based on product, the physiotherapy equipment market is divided into two major segments, namely, equipment and accessories. The equipment segment accounted for the largest share of the physiotherapy equipment market in 2021. The equipment segment is further segmented into electrotherapy equipment, ultrasound equipment, exercise therapy equipment, heat therapy equipment, cryotherapy equipment, combination therapy equipment, continuous passive motion therapy equipment, shockwave therapy equipment, laser therapy equipment, magnetic pressure therapy equipment, traction therapy, and other physiotherapy equipment (hydrotherapy and vacuum therapy). Owing to the increasing use of electrotherapy equipment in the treatment of musculoskeletal disorders and owing to increasing concerns for patients’ safety and minimal/no side-effects during the physiotherapy treatments.

- Equipment

- Electrotherapy equipment

- Ultrasound equipment

- Exercise therapy equipment

- Heat therapy equipment

- Cryotherapy equipment

- Combination therapy equipment

- Continous passive motion therapy equipment

- Shockwave therapy equipment

- Laser therapy equipment

- Magnetic pressure therapy equipment

- Traction therapy

- Other physiotherapy equipment

- Accessories

- Manual Therapy

- Specialized treatment

- Joint Mobilization Techniques

- Suspension Therapy

By Application (Revenue, USD Billion):

Based on application, the physiotherapy equipment market is segmented into musculoskeletal applications, neurological applications, cardiovascular and pulmonary applications, pediatric applications, gynecological applications, and other applications (including sports and palliative care). The musculoskeletal applications segment holds a dominating share attributed to the increasing adoption of physiotherapies to accelerate recovery of accidental injuries, rising incidence of musculoskeletal disorders, and growth in the geriatric population.

By Applications

- Musculoskeletal applications

- Neurological applications

- Cardiovascular and pulmonary applications

- Pediatric applications

- Gynecological applications

- Other applications

By End-user (Revenue, USD Billion):

Based on end users, the physiotherapy equipment market is segmented into physiotherapy & rehabilitation centers, hospitals, home care settings, physician offices, and other end users (community health centers and elderly care facilities). In 2021, the physiotherapy & rehabilitation centers segment accounted for the largest share of the physiotherapy equipment market due to increasing demand for advanced physiotherapy equipment and their wide usage across the care continuum across these centers.

- Physiotherapy & Rehabilitation centers

- Hospitals

- Home care settings

- Physician offices

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.