APAC Dental Care Market Analysis

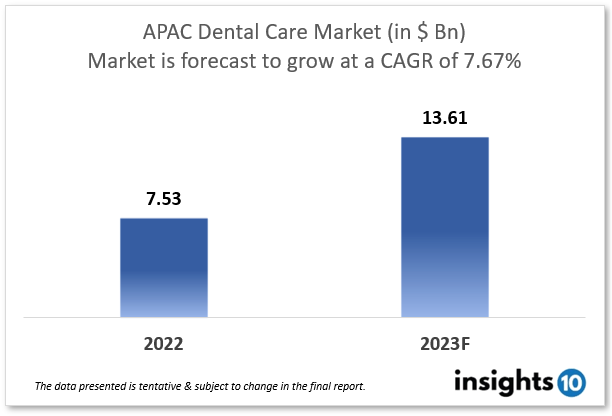

The APAC Dental Care Market size is at around $7.53 Bn in 2022 and is projected to reach $13.61 Bn in 2030, exhibiting a CAGR of 7.67% during the forecast period. The market is driven by the emergence of aesthetic dental care solutions for individuals with high-paying capacity and higher amounts of disposable income by the growing economies. Major players like Pacific Dental, Raffles Medical Group, and Singapore Dental Corporation are pioneering the dental service provision in the APAC region. This report by Insights10 is segmented by treatment type, age group, clinical setup, and by demography and provides in-depth insights into opportunities for targeting profitable prospects.

Buy Now

APAC Dental Care Market Executive Summary

Healthcare systems in the Asia-Pacific (APAC) region are diverse, with significant differences between countries. Some countries, such as Japan and South Korea, have highly developed and technologically advanced healthcare systems that provide universal coverage and easy access to healthcare services. Other nations with less developed healthcare systems, such as Indonesia and the Philippines, confront issues such as inadequate access to healthcare services, particularly in rural areas. In China, India, and Indonesia, the government plays a significant role in the healthcare sector, whereas in Japan, Singapore, and South Korea, the government plays a supportive role, with the private sector providing the majority of healthcare services. Thailand is a leading example of providing Universal Health Coverage by covering essential services despite spending only 3.79% of its GDP as opposed to 10.74% of its GDP in Japan. Out-of-pocket expenditures in Thailand, due to priority-based healthcare spending, amount to only 8.67% of current health expenditures as opposed to 12.91% in Japan's developed economy.

The APAC region paints a drastic contrasting image in terms of access, availability, and quality of healthcare and dental care services differ as per countries. The oral indicators point prevalence of dental caries are the major area of concern for dental caries in Pakistan, China, and Australia due to the high amount of sugar consumption per household. Countries like India and Pakistan with high tobacco dependence suffer more from periodontal concerns and early onset of edentulism. This also affects the demand for specific services like endodontics, periodontal surgeries, prosthodontic rehabilitation of lost or missing teeth, preventive measures among the young population, or orthodontic corrections for functional and aesthetic concerns. According to the study by Insights10, The APAC Dental Care Market size is at around $7.53 Bn in 2022 and is projected to reach $13.61 Bn in 2030, exhibiting a CAGR of 7.67% during the forecast period of 2022-2030.

Japan, Singapore, Hong Kong, Taiwan New Zealand, and Australia report higher utilization of cosmetic needs in dental services than developing countries where essential services of pain management and need-based dental services are the trend. The availability of dental professionals per unit population is also variable across countries with China and India with the highest number of registered dental practitioners and the availability of international immigrants in Hong Kong, Australia, New Zealand, and Singapore has opened up wider avenues than the previous decade. The advancement in technology like lasers and dental implants are growing in demand.

Market Dynamics

Market Growth Drivers

The governments across APAC have started to adopt a number of efforts to enhance access to dental care as advised by the international health agency World Health Organization (WHO) creating opportunities for dental firms to expand their services and get additional funding as a measure of building public and private partnerships. Enhanced Health financing is also a potent driver for people to utilize dental care services which were previously curbed due to fear of high out-of-pocket expenses. Dental firms that offer more advanced and efficient treatments to their patients as technology and materials are known to progress, which could be another path for growth. As a region the growing popularity as a tourist destination, dental tourism may provide an opportunity for dental firms to recruit overseas customers seeking high-quality and economical dental care. Growth of international clear aligners in the APAC region has also resulted in high demand for orthodontic services which were previously dominated by metal braces that were aesthetically compromised as opposed to clear aligners that give the “barely-there” effect and serve the same purpose. This has propelled the expansion of these services to not just young adults in need of teeth corrections but also adults over the age of 40 years who are not satisfied with their appearance and seek sustainable ways to address the problem than adhering to veneers or dental crown that leads to non-conservative preparation of natural teeth. With the increase in population and subsequent rise in demand, the market is set to grow by 2030.

Market Restraints

Barriers to older oral healthcare utilization were observed, with roughly 24.8% focusing on demographic and socioeconomic characteristics, with age, gender, marital status, education, income, and medical check-up in the previous 12 months as linked factors. A limited number of dental professionals in New Zealand, Malaysia, the Philippines, and Pakistan and a clear deficit of provision of services in certain locations especially rural areas may limit dental treatments. In some places, high competition among dental clinics can limit the market potential for new practices. Starting a dental corporation needs significant capital, and small enterprises may have limited access to funding. Dental organizations necessitate costly equipment and supplies, which can be a considerable barrier to entry for new enterprises. Competition with traditional medicine and the population’s preference for the same is also a challenge. There are also some challenges facing the dental care tourism industry of which the main challenge remains the lack of regulation and oversight of dental care providers, which can lead to variations in the quality of care. The coverage of insurance for dental services is also a deterrent to access to services by individuals across countries in the APAC region.

Competitive Landscape

Key Players

- National Dental Centre Singapore (NDCS) (SGP)

- Southern Cross Dental (NZL)

- Dentalcare Group (NZL)

- Pacific Dental (HKG)

- Raffles Medical Group (HKG)

- Singapore Dental Corporation (SGP)

- Dentabay (MYS)

- Living Well Dentistry (MYS)

- J. MORITA Corporation (JPN)

- Mani, Inc. (JPN)

Notable Recent Deals

December 2022 - The Ayala Group is increasing its healthcare investments, with Healthway Philippines aiming to build three more locations in Metro Manila and Cavite by the end of the year. Within the grounds, the new clinics will provide dental services Healthway has 7 primary branches in key Metro Manila cities and a network of over 800 specialists.

October 2022 - Mitsui & Co., Ltd. Based in Tokyo announced an investment in Signature Dental Partners Holdings LLC (SDP), a US-based provider of dental practice management services with operations in over 8. SDP is a rapidly expanding Dental Support Organization (DSO) that provides non-medical practice management services to over 60 dental practices in the US and initiates a collaborative of work environment that allows dental professionals to focus on their medical practice and provide high-quality clinical care whilst managing administration.

February 2022 - BGH Capital and Tasman's dental subsidiary Abano Healthcare have agreed to buy Bupa NZ's dentistry business, boosting their market position in New Zealand. According to estimates, Abano will add 22 clinics to its existing network, which includes more than 100 offices and runs under the 'Lumino' name.

Healthcare Policies and Regulatory Landscape

The Dental Council was founded as a regulating authority in New Zealand under the Health Practitioners Competence Assurance Act of 2003. The Singapore Dental Council is the governing organization for dental services in Singapore (SDC) The Japan Dental Association (JDA) is a confederation of all practicing dentists in Japan's provinces. The Indonesian Dental Association (IDA) is the governing authority for dental services in Indonesia. Compliance with healthcare legislation, particularly those imposed by the Professional Regulation Commission (PRC) in the Philippines. Likewise, each country in the APAC region has its own regulating body that is responsible for regulating and maintaining the standards of the dental profession, including registering and accrediting dental professionals, enforcing ethical guidelines, and investigating complaints against dental practitioners. For details of country-specific regulatory bodies and guidelines refer to country-specific reports by Insights10.

Reimbursement Scenario

Some of the government initiatives help people with financial difficulties access dental services through public or private care facilities by providing grants and care centers. Paying out of pocket is a common concern for people in the APAC region due to the variable importance put on public health financing mechanisms to cover dental costs. The aesthetic aspects of dental services such as orthodontics and veneers are typically excluded from the reimbursements pan APAC region due to priority given to essential needs. However public dental services providers in most APAC countries fail to meet the complete needs of the population leading to the emergence and dominance of private dental service providers and relying on grants or self-opted insurance policies. Private dental insurances typically cover the costs of root canal treatment, bridgework, prosthetic dental devices, dentures, emergency dental treatment for pain relief, wisdom teeth extraction, apicectomy, routine dental treatment and examinations, cleaning and polishing, tooth extractions, fillings, and crowns and inlays – depending on the risk premium and dental health status of the individual Detailed breakdown of the reimbursement by dental insurance policy and amount of coverage can be found in the country sample report by Insights10.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Dental Care Market Segmentation

By Product (Revenue, USD Billion):

In terms of product category, the toothbrush had the highest revenue share (26% in 2020). The rising incidence of cavities, sensitivity, and gingivitis has increased toothpaste usage significantly in both emerging and wealthy countries. As a result, toothpaste is now an essential part of good dental health. In the oral care sector, toothpaste thus commands the biggest market share.

- Toothbrush

- Toothpaste

- Mouthwash

- Dental Floss

- Denture Care

By Age Group (Revenue, USD Billion):

Adults lead the oral care market over the projection period based on age group. The overall expansion of the oral care industry is being driven by adults' increasing consumer knowledge of mouth cleanliness and care. Adult oral care products come in a variety on the market.

- Children

- Adults

- Geriatric

By Sales Channel (Revenue, USD Billion):

The specialty stores dominate the oral care market over the projection period based on the sales channel. Specialty shops carry a broad selection of goods. The employees of specialty businesses provide customers with precise product information. With the aid of specialty shops, customers can also find all types of dental care items under one roof.

- Hypermarkets/Supermarkets

- Specialty Stores

- Drug Stores &Pharmacies

- Convenience Stores

- Online Sales Channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.