APAC Anti-Depressants Drugs Market Analysis

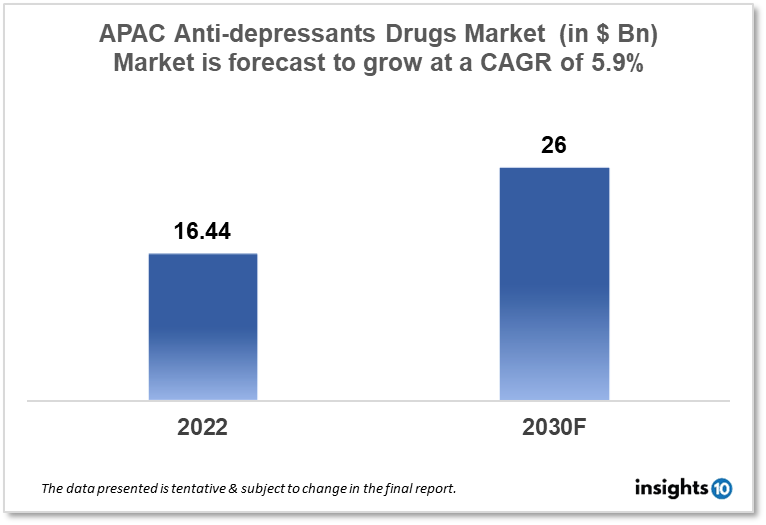

APAC Anti-depressant drugs market size was valued at $16.44 Bn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 5.9% from 2022 to 2030 and will reach $26 Bn in 2030. The market is segmented by drug class, indication, route of administration, end-user, distribution channel, and geography. The APAC Anti-depressant drug market will grow because depression and other mental health disorders are a significant public health concern in the APAC region. The key market players are Mayne Pharma Group Limited (AUS), Aurobindo Pharma (IND), WOCKHARDT (IND), Currax Pharmaceuticals LLC (IND), Sun Pharmaceutical Industries Ltd. (IND), Zydus Cadila (IND), Jiangsu Hengrui Medicine (CHN), and others.

Buy Now

APAC Anti-Depressants Drugs Market Executive Summary

APAC Anti-depressant drugs market size was valued at $16.44 Bn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 5.9% from 2022 to 2030 and will reach $26 Bn in 2030. The prevalence and incidence of depressive disorders in the APAC region vary widely depending on the country and the specific population being studied. However, depression is a significant public health concern in the region, and it is estimated that millions of people are affected by the condition.

The prevalence of depression is relatively high in some countries in the region, particularly among women and older adults. For example, in Japan, the estimated prevalence of depression is around 6-7% of the population, while in South Korea, the prevalence is around 5%. In other countries, such as China and India, the prevalence of depression is thought to be somewhat lower, although it is still a significant concern. For example, in India, it is estimated that around 4.5% of the population is affected by depression, while in China, the prevalence is thought to be around 3-4%. Antidepressant medications, which assist regulate mood and lessen depressive symptoms, are one of the main therapies for depression. the use of antidepressant drugs in the APAC region has been increasing in recent years. This is partly due to the growing awareness of mental health issues in the region, as well as increased access to healthcare and pharmaceuticals.

In some countries, such as Japan and South Korea, the use of antidepressant drugs is relatively high. For example, in Japan, the prevalence of antidepressant use has been estimated to be around 2.5% of the population, which is higher than in many other developed countries. In other countries, such as China and India, the use of antidepressant drugs is still relatively low, although it is increasing. This is partly due to cultural attitudes towards mental health and a preference for alternative therapies, as well as limited access to healthcare and pharmaceuticals in some regions. Due to the rising incidence of depression and the rising desire for efficient treatments, the market for antidepressant medications has been gradually expanding over time. The market for antidepressant medications is significantly impacted by depression. The need for antidepressant medications is anticipated to rise as the prevalence of depression keeps rising. Also, the rise in public awareness of mental health problems and the accessibility of efficient therapies are propelling market expansion.

Market Dynamics

Market Growth Drivers Analysis

- Increasing prevalence of depression and other mental health disorders: Depression and other mental health disorders are a significant public health concern in the APAC region, and the increasing prevalence of these conditions is driving demand for antidepressant medications.

- Growing awareness of mental health issues: Awareness of mental health issues is increasing in many countries in the APAC region, which is leading to greater demand for mental health services and treatments, including antidepressant medications.

- Increasing healthcare spending: Healthcare spending is increasing in many countries in the APAC region, which is leading to greater access to healthcare services and pharmaceuticals, including antidepressant medications.

- Increasing availability of generic medications: Generic medications are becoming increasingly available in many countries in the APAC region, which is driving down the cost of antidepressant medications and increasing access to these treatments.

Market Restraints

- Cultural attitudes towards mental health: In some cultures in the APAC region, mental health issues may be stigmatized or not discussed openly, which can limit demand for mental health treatments, including antidepressant medications.

- Limited access to mental healthcare: Access to mental healthcare can be limited in some areas of the APAC region, particularly in rural or remote regions, which can limit demand for antidepressant medications.

- Regulatory challenges: Regulatory challenges, such as complex and changing drug approval processes, can make it difficult for pharmaceutical companies to bring new antidepressant medications to market in the APAC region.

- Increasing competition: The antidepressant market in the APAC region is becoming increasingly competitive, with many pharmaceutical companies vying for market share, which can lead to price pressure and reduced profitability.

Competitive Landscape

Key Players

- Mayne Pharma Group Limited (AUS)

- Aurobindo Pharma (IND)

- WOCKHARDT (IND)

- Currax Pharmaceuticals LLC (IND)

- Sun Pharmaceutical Industries Ltd. (IND)

- Zydus Cadila (IND)

- Jiangsu Hengrui Medicine (CHN)

- Takeda Pharmaceuticals (JPN)

- H. Lundbeck A/S

- GlaxoSmithKline plc

- Eli Lilly and Company

- Pfizer Inc.

- AstraZeneca

- Bristol-Myers Squibb

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

- Mylan N.V.

Recent developments

In 2020, Japanese pharmaceutical company Takeda entered into a partnership with Australian digital health company Medibio to develop and commercialize a digital diagnostic tool for depression.

Healthcare Policies and Regulatory Landscape

Policy changes and Reimbursement scenario

Japan: Antidepressants are regulated by the Ministry of Health, Labour and Welfare (MHLW) in Japan. To be approved for sale, drugs must go through a rigorous process that includes clinical trials and review by the MHLW. In Japan, antidepressants are typically covered by health insurance, with patients required to pay a portion of the cost out of pocket.

China: Antidepressants are regulated by the National Medical Products Administration (NMPA) in China. To be approved for sale, drugs must go through a rigorous process that includes clinical trials and review by the NMPA. In China, reimbursement policies for antidepressants vary by region, with some regions providing coverage for a limited number of medications.

India: Antidepressants are regulated by the Central Drugs Standard Control Organization (CDSCO) in India. To be approved for sale, drugs must go through a rigorous process that includes clinical trials and review by the CDSCO. In India, reimbursement policies for antidepressants vary by region, with some regions providing coverage for a limited number of medications.

Australia: Antidepressants are regulated by the Therapeutic Goods Administration (TGA) in Australia. To be approved for sale, drugs must go through a rigorous process that includes clinical trials and review by the TGA. In Australia, antidepressants are typically covered by the Pharmaceutical Benefits Scheme (PBS), with patients required to pay a portion of the cost out of pocket.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Anti-Depressants Drugs Market Segmentation

Drug Class

The market is divided into monoamine oxidase inhibitors, atypical antidepressants, tricyclic, serotonin, and norepinephrine reuptake inhibitors, selective serotonin reuptake inhibitors, and others based on pharmacological class. In 2021, the selective serotonin reuptake inhibitors (SSRIs) market segment held the biggest market share. The strength of the pipeline of top players to assess new potential candidates in this drug class, combined with the clinical advantage of SSRIs over conventional medications in the management and treatment of depression, is anticipated to accelerate the segment's growth.

- Tricyclic Antidepressants (TCAs) - Amitriptyline (Elavil), Amoxapine (Asendin), Desipramine (Norpramin), Doxepin (Silenor), Imipramine (Tofranil), Nortriptyline (Pamelor), Protriptyline (Vivactil), Trimipramine (Surmontil)

- Selective Serotonin Reuptake Inhibitors (SSRIs) - Citalopram (Cipramil), Dapoxetine (Priligy), Escitalopram (Cipralex), Fluoxetine (Prozac or Oxactin), Fluvoxamine (Faverin), Paroxetine (Seroxat), Sertraline (Lustral), Vortioxetine (Brintellix)

- Serotonin-Norepinephrine Reuptake Inhibitors (SNRIs) - Desvenlafaxine (Pristiq), Duloxetine (Cymbalta), Levomilnacipran (Fetzima), Venlafaxine (Effexor XR)

- Monoamine Oxidase Inhibitors (MAOIs) - Socarboxazid (Marplan), Phenelzine (Nardil), Selegiline (Emsam), Tranylcypromine (Parnate)

- Serotonin Antagonist and Reuptake Inhibitors (SARI) - Etoperidone (Axiomin, Etonin), Lorpiprazole (Normarex), Mepiprazole (Psigodal), Nefazodone (Serzone, Nefadar), Trazodone (Desyrel)

- Others

Indication

By Indication, the major depressive disorder segment was the major contributor in 2021 and is expected to maintain its lead during the forecast period, owing to an increase in the prevalence of major depressive disorder and initiatives taken by governments and private organizations about the development of drugs. However, the obsessive-compulsive disorder segment is expected to witness considerable growth during the forecast period, owing to an increase in the prevalence of mental disorders and an increase in the number of approval for anxiety drugs.

- Major Depressive Disorder

- Anxiety Disorders

- Attention Deficit Hyperactivity Disorder

- Others

Route of Administration

Based on the route of administration the market is segmented into:

- Oral

- Injectable

- Others

End-Users

Based on end users the market is segmented into:

- Hospitals

- Homecare

- Speciality Centres

- Others

Distribution Channel

Hospital pharmacies, retail pharmacies, and online pharmacies are the three types of pharmacies that make up the market based on the distribution channel. In 2019, the hospital pharmacies segment dominated the world market. Nonetheless, the expansion of the retail pharmacy market might be attributed to patients' increasing demand for these establishments. Due to the growing prevalence of online pharmacies in emerging countries, the segment of online pharmacies is estimated to see a profitable CAGR over the forecast timeframe.

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.