Algeria Dental Care Market Analysis

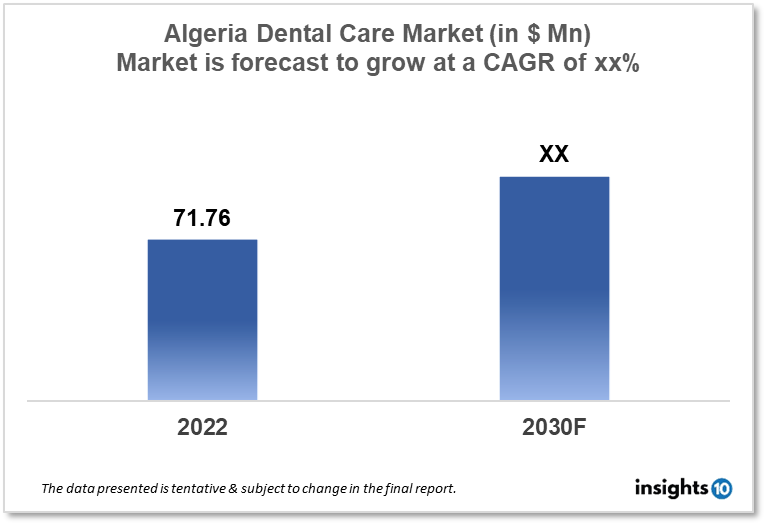

Algeria's Dental Care Market size is at around $71.76 Mn in 2022 and is projected to reach $xx Mn in 2030, exhibiting a CAGR of xx% during the forecast period. Aya Dental Care and Smile Again Dental Clinic are the major players that capture the dental services market. Due to the high prevalence of dental caries and periodontal diseases, the looming threat of poor oral status is the driver for increased demand for high-quality dental services. This report is segmented by treatment type, age group, clinical setup, and by demography.

Buy Now

Algeria Dental Care Market Executive Summary

Algeria's Dental Care Market size is at around $71.76 Mn in 2022 and is projected to reach $xx Mn in 2030, exhibiting a CAGR of xx% during the forecast period. The Algerian healthcare sector continues to grow. With a good deal of patience and commitment, there is considerable opportunity for American companies in Algeria. Algeria’s healthcare sector relies heavily on imported goods. Press reporting suggests that cardiovascular diseases, cancer, hypertension, diabetes, respiratory illnesses, and allergies are on the rise. The population is increasingly aware of cutting-edge medical procedures such as laser corrective eye surgeries, panoramic dental radiology, and plastic surgery. U.S. technology and products are regarded as high quality and reliable. Algerian demand for quality medical equipment and disposables is considerable.

Despite the government's difficult fiscal circumstances, health received 7.3% of the overall national operating budget in 2021 Algeria's Ministry of Health, Population, and Hospital Reform receives the fourth-highest share of the national government budget. 2019, budget law established a $3.27 Bn health budget. The 2020 finance law boosted this to $3.33 Bn. The inadequate licensing of generic medications in Algeria, as well as the absence of clear coordination between the Ministry of Health and the Algerian patent office, create an uncertain environment for the registration and marketing of brand-name health products. The ban on the importing of hundreds of foreign-produced medications adds to the uncertainty. Companies should be aware that it is normal for items to be held up for weeks or months by Algerian customs. The public health care system includes 185 hospitals, 13 university hospitals, polyclinics, and health care facilities. Furthermore, the country has 91 operational clinics that can handle around 2,000 patients. Some clinics are also being built, while others are still in the planning stages. It should be noted that the majority of physicians and hospital employees, both public and private, speak French.

The public health system is supported by an all-inclusive state contribution, the National Employees Social Insurance Fund (Caisse Nationale d'Assurances Sociales des Travailleurs Salariés), and family contributions. This is how curative and preventive health care, such as consultations, medicine, and hospitalization, is delivered. However, in the private health care system, the patient is in command of the health care services supplied. In Algeria, people frequently seek dental care at both state and private facilities. Individual dentists or dental clinics may provide public dental treatment through government-run hospitals and clinics, or government-run hospitals and clinics may provide private dental care. Many Algerians may have access to dental care through their work or health insurance plan.

Market Dynamics

Market Growth Drivers

Some potential growth factors for dental clinics in Algeria include:

- As people in Algeria become more aware of the importance of oral health and the link between oral health and overall health, the demand for dental services may increase

- Government support and investment in the dental sector can help to improve the availability and quality of dental services in the country, which in turn can drive demand for dental services

- Economic growth can lead to increased disposable income, which can help to drive demand for dental services, as more people are able to afford to pay for dental care

- An increase in population and an aging population can also drive demand for dental services

- The incorporation of new technology in dental clinics can improve the quality of dental services, which can attract more patients to dental clinics

Market Restraints

Some areas in Algeria may have limited access to dental care, which can limit the growth of dental clinics. Potential limiting factors for dental clinics in Algeria could include:

- A shortage of qualified dental professionals can limit the growth of dental clinics, as they may not have enough staff to meet the demand

- Low reimbursement rates from insurance companies or government programs can make it difficult for dental clinics to stay profitable and grow

- Some people in Algeria may have limited awareness of the importance of oral health or may hold cultural beliefs that do not prioritize oral health, which can limit the demand for dental services

- Economic and political instability can limit the growth of dental clinics as it can make it difficult for people to afford dental care and for clinics to stay in business

- Limited access to necessary infrastructure and equipment can limit the ability of dental clinics to provide high-quality services and grow their patient base

Competitive Landscape

Key Players

- Aya Dental Care

- Smile Again Dental Clinic

- Algiers Dental Associates

- CHU Tlemcen

- Clinique Dentaire Chu Annaba - Algeria

Healthcare Policies and Regulatory Landscape

In Algeria, dental treatment is governed by the Ministry of Health and managed by the National Order of Dentists. The National Order of Dentists is in charge of the country's dental profession's regulation and oversight, including dentist registration and licensing, as well as the establishment of standards for dental education and practice. To establish a dental practice in Algeria, you must meet the following requirements: Earn a dental degree from a recognized dental school. Obtain a National Order of Dentists license to practice dentistry. Comply with any other regulations imposed by the Ministry of Health.

Reimbursement Scenario

If working in Algeria, the employer should join the Caisse Nationale d'Assurances Sociales des Travailleurs Salariés. Following that, a monthly contribution of 1.5% will be withdrawn from the salary, with the employer contributing 12.5%. In Algeria, all employees are entitled to social security. However, private health insurance can be obtained. There are numerous insurance providers to select from, including Allianz Care, April MTC, April MHI, and Cigna Global.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Dental Care Market Segmentation

By Product (Revenue, USD Billion):

In terms of product category, the toothbrush had the highest revenue share (26% in 2020). The rising incidence of cavities, sensitivity, and gingivitis has increased toothpaste usage significantly in both emerging and wealthy countries. As a result, toothpaste is now an essential part of good dental health. In the oral care sector, toothpaste thus commands the biggest market share.

- Toothbrush

- Toothpaste

- Mouthwash

- Dental Floss

- Denture Care

By Age Group (Revenue, USD Billion):

Adults lead the oral care market over the projection period based on age group. The overall expansion of the oral care industry is being driven by adults' increasing consumer knowledge of mouth cleanliness and care. Adult oral care products come in a variety on the market.

- Children

- Adults

- Geriatric

By Sales Channel (Revenue, USD Billion):

The specialty stores dominate the oral care market over the projection period based on the sales channel. Specialty shops carry a broad selection of goods. The employees of specialty businesses provide customers with precise product information. With the aid of specialty shops, customers can also find all types of dental care items under one roof.

- Hypermarkets/Supermarkets

- Specialty Stores

- Drug Stores &Pharmacies

- Convenience Stores

- Online Sales Channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.