Africa Physiotherapy Market Analysis

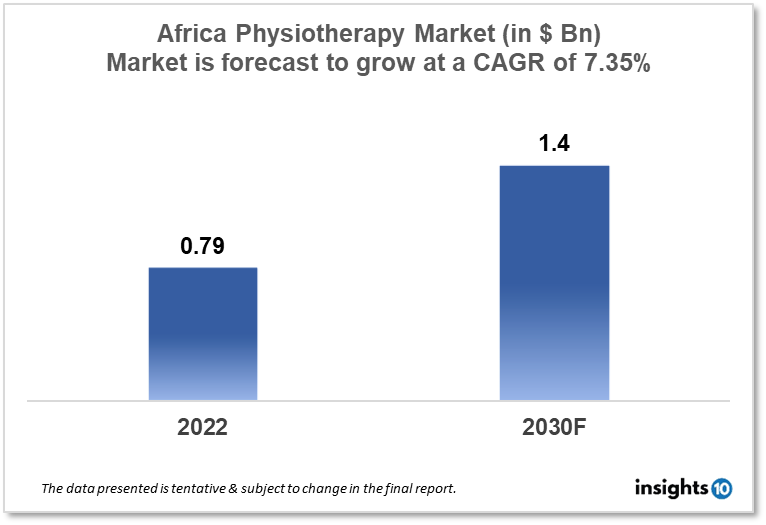

Africa's physiotherapy market size was valued at $0.79 Bn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 7.35% from 2022 to 2030 and will reach $1.4 Bn in 2030. Africa's physiotherapy market is expected to grow due to the increasing prevalence of injuries, the ageing population, and the rising number of chronic diseases. The market is segmented by Product Type, Application Type, and End User. The major players in the African physiotherapy market are Zimmer MedizinSysteme, BTL, EMS Physio Ltd., and Whitehall Manufacturing.

Buy Now

Africa Physiotherapy Market Executive Summary

Africa's physiotherapy market size was valued at $0.79 Bn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 7.35% from 2022 to 2030 and will reach $1.4 Bn in 2030. Healthcare expenditure in Africa varies widely by country. Some countries, such as South Africa, have relatively high levels of healthcare expenditure, while others, such as many low-income countries, have very low levels of healthcare expenditure. South Africa spent 8.5% of its GDP on healthcare, which is considered relatively high by African standards. Other countries with relatively high healthcare expenditure as a percentage of GDP include Egypt (4.2%), Algeria (3.9%), and Morocco (3.8%). On the other hand, many low-income countries in Africa have very low levels of healthcare expenditure.

In Africa, there is a high rate of injury and disability in Africa, due to factors such as poor road safety, lack of protective equipment in workplaces, and high rates of violence. Physiotherapy may reduce the impact of these injuries and improve the function and quality of life of people who have been injured. Furthermore, physiotherapy can play a key role in maternal and child health, helping to prevent and treat conditions such as low back pain, neck pain, and other common pregnancy-related musculoskeletal problems.

In addition, Africa is facing a growing burden of chronic diseases such as diabetes, hypertension, and obesity, which can cause musculoskeletal problems. Physiotherapy plays a key role in managing these conditions, through the use of exercise, manual therapy, and other techniques. Hence, the demand for physiotherapy in Africa is rising during the forecast period.

Market Dynamics

Market Growth Drivers

The physiotherapy market in Africa is being driven by the aging population. Ageing leads to loss of muscle mass, a drop in bone density, stiffer joints, and internal imbalances. For older persons to restore the physical function needed for daily functioning, exercise under the guidance of a physiotherapist is strongly advised. This therapy benefits seniors, including lowered risk of heart disease, enhanced mood and self-esteem, decreased risk of falling, and more. The aforementioned factors make physiotherapy equipment necessary for the elderly population.

Furthermore, the prevalence of chronic diseases such as obesity, diabetes, arthritis, osteoporosis, and hypertension is increasing in Africa, and to maintain or prevalent such conditions rehabilitative physiotherapy services will be required. Hence the demand for physiotherapy services is increasing during the forecast period. Moreover, Due to the increasing prevalence of different injuries and joint pain, the market for physiotherapy in Africa region is anticipated to expand in the coming years.

Market Restraints

The regional market cannot expand since there is a shortage of qualified employees to operate the therapeutic equipment. The growth rate of the African physiotherapy equipment market is also being hampered by other issues, including subpar payment methods and a lack of understanding of the benefits of physiotherapy in certain regions of Africa.

Competitive Landscape

Key Players

- EMS Physio

- ITO Co.

- Enraf-Nonius B.V.

- BTL

- Whitehall Manufacturing.

- Dynatronics Corporation

- RICHMAR

- Performance Health

- Storz Medical AG

- Zimmer MedizinSysteme

Healthcare Policies and Regulatory Landscape

Policy changes and Reimbursement scenario of Africa Physiotherapy Market

In South Africa, the South African Health Products Regulatory Authority (SAHPRA) is responsible for regulating medical devices, including physiotherapy equipment. In Kenya, the Pharmacy and Poisons Board is responsible for regulating the import, sale, and use of medical devices. In addition, many African countries have regulations in place that require medical equipment to be registered and/or certified by a national regulatory body before it can be imported or sold.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Physiotherapy Market Segmentation

By Product: (Revenue, USD Billion):

Based on product, the physiotherapy equipment market is divided into two major segments, namely, equipment and accessories. The equipment segment accounted for the largest share of the physiotherapy equipment market in 2021. The equipment segment is further segmented into electrotherapy equipment, ultrasound equipment, exercise therapy equipment, heat therapy equipment, cryotherapy equipment, combination therapy equipment, continuous passive motion therapy equipment, shockwave therapy equipment, laser therapy equipment, magnetic pressure therapy equipment, traction therapy, and other physiotherapy equipment (hydrotherapy and vacuum therapy). Owing to the increasing use of electrotherapy equipment in the treatment of musculoskeletal disorders and owing to increasing concerns for patients’ safety and minimal/no side-effects during the physiotherapy treatments.

- Equipment

- Electrotherapy equipment

- Ultrasound equipment

- Exercise therapy equipment

- Heat therapy equipment

- Cryotherapy equipment

- Combination therapy equipment

- Continous passive motion therapy equipment

- Shockwave therapy equipment

- Laser therapy equipment

- Magnetic pressure therapy equipment

- Traction therapy

- Other physiotherapy equipment

- Accessories

- Manual Therapy

- Specialized treatment

- Joint Mobilization Techniques

- Suspension Therapy

By Application (Revenue, USD Billion):

Based on application, the physiotherapy equipment market is segmented into musculoskeletal applications, neurological applications, cardiovascular and pulmonary applications, pediatric applications, gynecological applications, and other applications (including sports and palliative care). The musculoskeletal applications segment holds a dominating share attributed to the increasing adoption of physiotherapies to accelerate recovery of accidental injuries, rising incidence of musculoskeletal disorders, and growth in the geriatric population.

By Applications

- Musculoskeletal applications

- Neurological applications

- Cardiovascular and pulmonary applications

- Pediatric applications

- Gynecological applications

- Other applications

By End-user (Revenue, USD Billion):

Based on end users, the physiotherapy equipment market is segmented into physiotherapy & rehabilitation centers, hospitals, home care settings, physician offices, and other end users (community health centers and elderly care facilities). In 2021, the physiotherapy & rehabilitation centers segment accounted for the largest share of the physiotherapy equipment market due to increasing demand for advanced physiotherapy equipment and their wide usage across the care continuum across these centers.

- Physiotherapy & Rehabilitation centers

- Hospitals

- Home care settings

- Physician offices

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.