Africa HIV Therapeutics Market Analysis

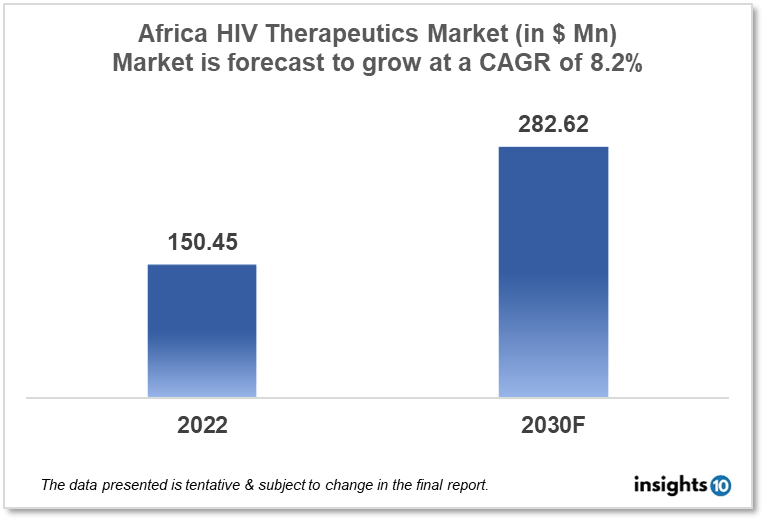

The Africa HIV therapeutics market is expected to reach $282.62 Mn by 2030, up from $150.45 Mn in 2022, with a CAGR of 8.2% from 2022 to 2030. African players such as Fidson Healthcare Plc, Saidal Group, Biopharm, and EVA Pharma dominate the Africa HIV therapeutics market. The African government policies, funding, poverty, and initiatives by international organizations to manage HIV infections propel the market. The Africa HIV therapeutics market is divided into five segments type, product, geography, end user, and distribution channel.

Buy Now

Africa HIV Therapeutics Market Analysis Summary

The Africa HIV therapeutics market is expected to reach $282.62 Mn by 2030, up from $150.45 Mn in 2022, with a CAGR of 8.2% from 2022 to 2030.

Eastern and southern Africa continue to be the most severely affected by HIV, with 20.6 Mn [18.9 Mn-23.0 Mn] people—54% of all HIV patients worldwide. In Western and Central Africa, there will be 5 Mn [4.5 Mn-5.6 Mn] HIV-positive people by the end of 2021. The region has the world's third-highest HIV burden, with five countries accounting for roughly two-thirds of all people living with HIV in the region. Women and girls continue to be disproportionately affected by HIV, accounting for 63% of new HIV infections in the region in 2021. Adolescent girls and young women (aged 15 to 24 years) have three times the number of new HIV infections as males of the same age.

The region is making progress toward the 95-95-95 targets. By 2021, 80 % of people living with HIV were aware of their HIV status, 98 % of those who were aware of their HIV-positive status were receiving treatment (78 % of all people living with HIV), and 88 % of those on treatment had suppressed viral loads (69 % of all people living with HIV).

Market Dynamics

Market Growth Drivers Analysis

Several initiatives and organisations have been formed to support HIV treatment and care in Africa. The African Society for Laboratory Medicine (ASLM), for example, works to improve laboratory services across the continent in order to aid in the diagnosis and treatment of HIV and other infectious diseases. The Joint United Nations Programme on HIV/AIDS (UNAIDS) has set the goal of ending the African AIDS epidemic by 2030 through a combination of prevention, treatment, and care efforts. This includes expanding HIV testing and counselling services, addressing stigma and discrimination, and strengthening health systems to support HIV treatment and care.

Recent progress is reflected in the expansion of differentiated service delivery models, which have assisted in mitigating the impact of the COVID-19 pandemic on access to services, but children living with HIV are falling behind: only 35% had access to antiretroviral therapy in 2021. These elements may entice new entrants into the African HIV therapeutics market.

Market Restraints

Despite this progress, new HIV infections must be reduced faster if the region is to eliminate AIDS as a public health threat by 2030. Regional gains also obscure slower progress in places like Madagascar and South Sudan, where new HIV infections have increased since 2010. The regional HIV response faces significant challenges, including the lingering effects of the COVID-19 pandemic, which disrupted services and caused some countries to reallocate scarce health resources away from the HIV response. Civil unrest, drought, and flooding also impede HIV service provision and undermine countries' commitment to continue prioritising HIV response. These factors may discourage new entrants to enter Africa's HIV therapeutics market.

Competitive Landscape

Key Players

- FHI 360 (EGY)

- EVA Pharma (EGY)

- Aspen Pharmacare (ZAF)

- Adcock Ingram (ZAF)

- Cipla Medpro (ZAF)

- Saidal Group (DZA)

- Biopharm (DZA)

- Fidson Healthcare Plc (NGA)

- Merck & Co.

- AbbVie

- Bristol Myers Squibb

Recent Notable Updates

January 2023: The US government spent over $7.8 Bn on the President's Emergency Plan for AIDS Relief (PEPFAR) to help Nigeria fight HIV/AIDS. The investment provided antiretroviral treatment to over 1.9 Mn Nigerians (ART).

December 2022: EVA Pharma is launching an HIV awareness campaign in collaboration with Egypt's Ministry of Health and UNAIDS. The Egyptian Ministry of Health and Population's National AIDS Control Program has launched a new campaign to combat HIV discrimination and address societal fears about the disease in collaboration with the Joint United Nations Programme on HIV/AIDS (UNAIDS) and leading pharmaceutical company EVA Pharma. The "Zay Ay Marad" ("Like Any Disease") campaign was launched in conjunction with World AIDS Day. The programme aims to coordinate efforts with all parties to combat the disease, reduce infections, and keep Egypt's low-infection rate, all while working to eradicate AIDS in Egypt and meet the 2030 Sustainable Development Goals.

March 2022: ViiV Healthcare's injection, which was approved by the US Food and Drug Administration, provides two months of HIV protection and contains the active ingredient cabotegravir. The ground-breaking announcement was made at the World Health Organization (WHO), and it is hoped that it will increase HIV prevention globally. The first injection to provide long-term HIV protection is being rolled out in South Africa and Brazil as an alternative to daily medication.

Healthcare Regulations

Regulation of HIV therapeutics in Africa varies widely depending on the country and the specific region. The Egyptian Drug Authority (EDA) is the regulatory body in charge of the approval and oversight of medicines, including HIV therapeutics, in Egypt. The South African government has established the South African Health Products Regulatory Authority (SAHPRA) to oversee the registration, licencing, and regulation of all health products in the country, including HIV therapeutics. In Algeria, the National Agency for Food and Drug Administration and Control (NAFDAC) is in charge of registering, licencing, and regulating all medicines and health products. The Pharmacy and Poisons Board (PPB) in Kenya is the regulatory body in charge of the registration and oversight of pharmaceutical products, including HIV therapeutics.

Reimbursement Policies

Access to HIV treatment and care in Africa has improved significantly in recent years, but challenges remain, and the reimbursement of HIV therapeutics varies across different countries and regions on the continent. Many countries, including those with the highest HIV burdens, such as South Africa, Nigeria, and Uganda, have national health insurance schemes or other programmes that cover HIV treatment, such as antiretroviral therapy (ART) and other medications used to treat HIV-related conditions. These programmes are frequently supported by a mix of government, international aid, and private insurance funds. However, access to HIV treatment and care remains limited in many parts of Africa, particularly in rural areas where health infrastructure is often inadequate, and treatment costs can be prohibitive for many people. In some cases, patients may be required to pay for HIV therapeutics out of pocket, or they may not have access to the most recent medications or treatments.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

HIV Therapeutics Segmentation

By Types (Revenue, USD Billion):

- Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs)

- Coreceptor Antagonists

- Entry and Fusion Inhibitors

- Integrase Inhibitors

- Protease Inhibitors (PIs)

- Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs)

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.