Africa Electronic Health Records Market Analysis

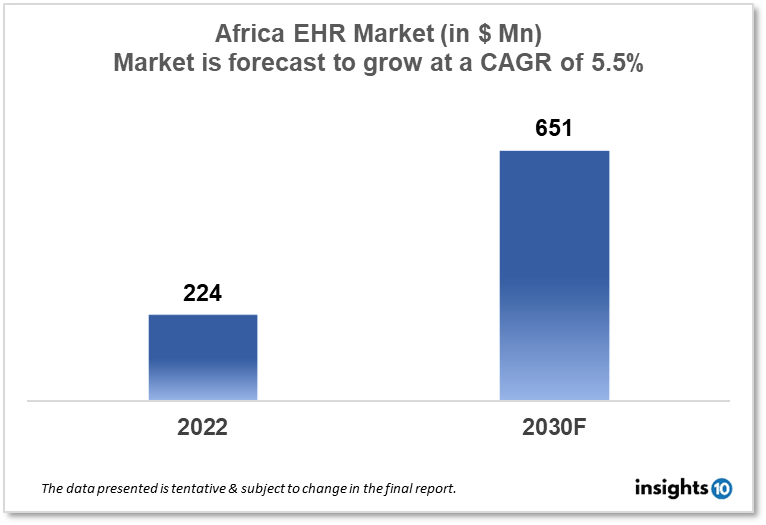

The Africa Electronic Health Record (EHR) market size was valued at $424 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 5.5% from 2022 to 2030 and will reach $651 Mn in 2030. The market is segmented by product type, application type, and end user. The Africa EHR market will grow because healthcare professionals and patients can benefit from ambulatory care facilities through EHR. The key market players are Cerner, Allgeier, Cerner, GE Healthcare, and others.

Buy Now

Africa Electronic Health Record (EHR) Executive Summary

The Africa Electronic Health Record (EHR) market size was valued at $424 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 5.5% from 2022 to 2030 and will reach $651 Mn in 2030. In Africa, healthcare expenditure varies widely among countries on the continent. The countries with the highest healthcare expenditure as a percentage of gross domestic product (GDP) in Africa were Seychelles (8.4%), South Africa (8.2%), and Lesotho (7.9%). However, other countries in Africa have lower healthcare expenditures as a percentage of GDP. For example, in 2017, healthcare expenditure in Kenya was 5.5% of the GDP, and in Ethiopia, it was 4.3% of the GDP.

In terms of electronic health records (EHRs), there is a growing interest in Africa in using EHR systems to improve the accessibility and quality of healthcare services. Many countries on the continent are investing in the implementation of EHR systems, particularly in public hospitals and clinics.

The African Union has launched a campaign to promote the use of EHRs in Africa, and several international organizations are providing funding and technical assistance for EHR projects in the region. Nowadays, an EHR system can quickly sift through data to analyze past and present prescriptions, lab results, treatment plans, diagnoses, medical procedures, and even the foods that a patient should avoid when taking specific medications prior to or after receiving medical treatment or undergoing a procedure. These figures highlight the fact that most medical errors aren't necessarily the result of a doctor's carelessness, negligence, or wilful misbehavior, but rather of a confusing lack of communication and access to comprehensive medical records and histories. Through better-coordinated care enhanced by data sharing and instant accessibility to any member of a patient's health care team, the development of electronic health record/electronic medical record technology can help to reduce medical errors. Hence, demand for the EHR market in the African region is rising.

Market Dynamics

Market Growth Drivers

The adoption of various technologies, including Artificial Intelligence (AI), Data Science, etc., in the healthcare sector to manage enormous amounts of patient data would likely accelerate market expansion in the future. Electronic health records frequently use AI to enhance patient data extraction and provide individualized therapy referrals.

A sizable amount of patient data was also generated as a result of numerous advancements in medical imaging and the expansion of clinical diagnostics centers. Because of this, AI-powered EHR systems support data integration and offer a variety of solutions with different characteristics.

Additionally, enormous EHR data sets are maintained and patient medical experiences are documented with the help of technology like artificial intelligence (AI), machine learning, and natural language processing (NLP). As a result of the greater integration of AI in EHR systems, market growth is predicted to pick up between 2022 and 2030.

Market Restraints

Due to the less developed economies, the majority of the countries are dependent on suppliers for healthcare products. In addition, there is high uncertainty about the spread of COVID-19 in Africa and other low-income countries such as Egypt, Algeria, Morocco, South Africa, Nigeria, Senegal, and Tanzania. The widespread outbreak of COVID-19 in Africa has led to disruption in healthcare services. Therefore, the necessity of laboratory capacity and medical supplies, and the detection of the virus in African countries is a challenge

The uptake of EHR systems in Africa is low compared to other regions, due to a number of factors, including lack of funding, lack of trained personnel, and lack of infrastructure. Additionally, many African countries still lack a solid legal and regulatory framework for the use of EHRs.

Competitive Landscape

Key Players

- Cerner Corporation

- Allscripts

- McKesson Corporation

- Epic Systems

- GE Healthcare

- Siemens Healthineers

Healthcare Policies and Regulatory Landscape

Policy changes and Reimbursement scenario

The regulations and guidelines for electronic health records (EHRs) vary widely among countries in the African region. Some countries have established regulations and guidelines for the use of EHRs, while others have yet to develop a legal and regulatory framework for the use of EHRs.

In South Africa, the National Health Laboratory Service (NHLS) has developed a national EHR system, which is used in public sector facilities and is being expanded to the private sector. The system is governed by the National Health Act, which provides the legal framework for the collection, use, and disclosure of personal health information.

In Kenya, the Ministry of Health has developed a national EHR system for use in public sector facilities. The system is governed by the Kenya Health Information System Strategy, which provides guidelines for the collection, use, and disclosure of personal health information.

In Ethiopia, the Ministry of Health has developed a national EHR system for use in public sector facilities. The system is governed by the Health Information System Policy, which provides guidelines for the collection, use, and disclosure of personal health information.

In Nigeria, there is no national EHR system, but some private and public hospitals have implemented EHR systems in their facilities. There is no specific legislation governing the use of EHRs, but they are governed by general data protection regulations.

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Electronic Health Records Market Segmentation

By Product (Revenue, USD Billion):

Web-based and cloud-based software is more affordable since it saves on additional costs like license fees, regular upgrades, and device upkeep. Additionally, it reduces the need for IT workers because SaaS providers help with software installation, configuration, testing, operation, and upgrades. The cost-effectiveness of cloud-based EHR systems in small healthcare organizations will therefore fuel developments as well as the expansion of the category. MHealth services

- Web/Cloud-based EHR software

- On-premise EHR software

By Application Type (Revenue, USD Billion):

Large amounts of patient health data may be stored and processed by EHRs, which aids doctors in automating both financial and operational operations with rapid and simple access. Therefore, integrated EHR and practice management software navigates all tasks, making it easier for front-line healthcare providers to do their jobs, and will therefore drive the segment's revenue during the anticipated time period.

- E-prescription

- Practice management

- Referral management

- Patient management

- Population health management

By End User (Revenue, USD Billion):

By 2027, the category of ambulatory surgical centres is expected to rise at a 7.1% annual rate. The acceptance of EHR in these facilities will be fueled by ambulatory surgical centres' growing preference for digital technologies to efficiently manage workflow. These are outpatient facilities offering planned surgeries and same-day surgical services.

- Hospitals

- Specialty centers

- Clinics

- Ambulatory surgical centers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.