Africa Dental Care Market Analysis

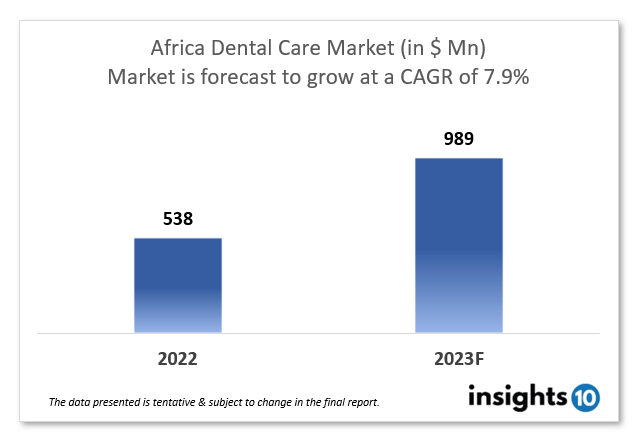

Africa Dental Care Market size is at around $538.21 Mn in 2022 and is projected to reach $988.82 Mn in 2030, exhibiting a CAGR of 7.9% during the forecast period. Africa is a fertile region with an annual growth rate of 3% across countries in the region, the gradient of the growth differs among countries. Major players like Dental365, Smile Dental, and The Dental Spa not only provide best-in-class care but also addresses health financing through funds and grants to assist people in financial hardship to access timely dental care. This report by Insights10 is segmented by treatment type, age group, and clinical setup, and by demography.

Buy Now

Africa Dental Care Market Executive Summary

The economy of the African region is diverse and complex. Some countries have strong economies with high GDP per capita, while others are among the poorest in the world. The African continent has been experiencing steady economic growth in recent years, with an average annual growth rate of around 3%. However, this growth has been unevenly distributed, with some countries experiencing much higher growth rates than others. There are also many challenges facing the African economy, such as high levels of poverty, inequality, and unemployment. Many African countries are heavily dependent on the export of raw materials, which makes their economies vulnerable to fluctuations in global commodity prices. There are some bright spots, such as the growth of the service sector and the increasing number of small and medium-sized enterprises, which are becoming an important source of employment and income for many people.

There is a wide range of economic development across the African continent, with some countries being considered relatively well-off while others are not. Some of the African countries that are considered to have relatively strong economies include - South Africa, which has the largest economy in Africa and is considered a middle-income country, Egypt which has a large and diversified economy that is heavily dependent on tourism, agriculture, and industry, Nigeria which is the largest economy in Africa and has a growing middle class, Kenya which has a growing economy and is considered one of the most developed countries in East Africa. Mauritius has a diversified economy and is considered one of the most developed countries in Africa. On the other hand, there are many African countries that are considered to be relatively poor and underdeveloped like Burundi, Eritrea, Liberia, Sierra Leone, Central African Republic.

The healthcare systems in Africa vary greatly by country and region. Many countries struggle with limited resources and a shortage of healthcare professionals, leading to inadequate access to healthcare for many people. However, there are also many efforts underway to improve healthcare in Africa, such as the establishment of new clinics and hospitals, and the training of more healthcare workers. Africa Dental Care Market size is at around $538.21 Mn in 2022 and is projected to reach $988.82 Mn in 2030, exhibiting a CAGR of 7.9% during the forecast period of 2022-2030. Many non-governmental organizations (NGOs) like the Global Dental Relief, Dentaid, Academy of Dentistry International Foundation, SmilesForEveryone, and international organizations like the World Health Organization are working to improve healthcare in Africa by providing funding, medical supplies, and other resources. Access to healthcare in Africa is limited, but there are efforts being made to improve the situation. The status of dental care services in the African region varies widely by country and region. In general, access to dental care is limited in many African countries due to a shortage of trained dental professionals, a lack of infrastructure and equipment, and a lack of funding for healthcare services.

Many African countries have a shortage of dentists and dental hygienists, which makes it difficult for people to access dental care. Additionally, many rural areas in Africa do not have access to dental clinics or hospitals, which makes it even harder for people living in these areas to receive dental care. Also, dental care is not covered by public health insurance, which means that people have to pay out of pocket for dental services, which can be expensive and out of reach for many people. There are some efforts underway to improve access to dental care in Africa. Some non-governmental organizations (NGOs) and international organizations are working to improve dental care in Africa by providing funding, training for dental professionals, and other resources. Additionally, some governments are also investing in their healthcare systems and dental care in order to improve the accessibility of services.

Market Dynamics

Market Growth Drivers

With advancements in technology, dental clinics, and organizations may be able to offer new and more advanced treatments, attracting more patients and driving growth. Increased adoption of private insurance in the Africa Region may result in more people having access to dental care, promoting industry growth. As a result of urbanization, more people are relocating to African cities, which may raise the demand for dental services because individuals are more inclined to use them. Dental clinics and corporations that invest in successful marketing tactics and promote public knowledge about the value of dental treatment may be able to attract more patients and drive growth. Demand for dental treatments may increase as people in Africa become more aware of the importance of oral health and the link between oral health and overall health. Government assistance and investment in the dental sector can help to increase the availability and quality of dental services in the country, driving demand for dental services. Economic growth can lead to higher disposable income, which can assist drive demand for dental services as more individuals can afford dental treatment.

Market Restraints

Africa as a region has a history of economic uncertainty, making forecasting and planning for future growth challenging. Economic uncertainty, such as poverty and unemployment, may make purchasing dental care more difficult for customers, hence decreasing demand. Dental practices may find it challenging to obtain money to grow or invest in new equipment and technologies. This may limit their ability to grow and compete with other companies. Africa lacks trained dental professionals, and the country's dental care policies are hampered by corruption and bureaucracy that favors the public or social security system over the private sector. Many people are unable to afford private dental care and are unable to receive public dental services due to high wait times, a shortage of dental experts, and poor infrastructure in Africa's public dental care system. Furthermore, the high cost of dental care in private clinics may prevent certain patients from receiving crucial treatment. As a result, untreated oral diseases are common in disadvantaged groups, particularly those in rural areas.

Competitive Landscape

Key Players

- Dental Solutions (KEN)

- Dental Works (KEN)

- DentaCare

- Dentist@Work

- DentaLife

- Pearl Dental Clinic

- Clínica Dental Dr. Carlos Pérez

- Clínica Dental Dr. Jorge Guzmán

- Dental365

- Smile Dental

- The Dental Spa

Healthcare Policies and Regulatory Landscape

South Africa's dentistry services are governed by the Health Professions Council of South Africa (HPCSA). The HPCSA was founded as a statutory authority to govern the health professions in South Africa by the Health Professions Act, of 1974 (Act 56 of 1974). Dental practitioner registration, quality assurance, standards of practice, complaints, and disciplinary proceedings are among the HPCSA's key activities and responsibilities. The Ministry of Health (Ministère de la Santé) regulates dental services in Senegal. The Dentistry Council of Nigeria is Nigeria's dental practice regulatory body (DCN). The DCN is responsible for registering and regulating dental practitioners in Nigeria, as well as ensuring that dental care is administered in compliance with established standards. Dental care in Algeria is overseen by the Ministry of Health and administered by the National Order of Dentists.

Reimbursement Scenario

The status of reimbursement for dental services by private insurance companies in Africa varies depending on the specific insurance plan and the individual's coverage. Although many private insurance policies include some dental care, the extent of coverage varies substantially. Some plans may only cover routine cleanings and fillings, but others may cover more extensive procedures such as orthodontics or oral surgery. Tourists and expats in South Africa are frequently offered restricted coverage alternatives by private insurance providers. Tourists and expats in South Africa often have limited coverage options through private insurance companies, and they may be required to pay for dental treatments out of pocket.

Dental services in Nigeria may be covered by many types of insurance, including health insurance, personal accident insurance, and travel insurance. There are other government-funded healthcare programs in South Africa that provide basic dental treatment, albeit the quality of care can be poor and appointment periods can be lengthy. DentalAid, for example, offers basic dental insurance at $8.69 per month, while GeoBlue insurance is available to foreigners in the US and US citizens abroad. Cigna Global Insurance is a popular alternative for dental insurance among expats. AXA Mansard Insurance, Leadway Assurance Company, United Nigeria Insurance Company (UNIC Insurance), Consolidated Hallmark Insurance, Mutual Benefits Assurance, NEM Insurance, and Law Union are some of the major insurance firms in Nigeria that offer dental coverage. Insurance companies coverage and services differ, so it's essential to check with the specific business to find out what dental procedures are covered under their policy.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Dental Care Market Segmentation

By Product (Revenue, USD Billion):

In terms of product category, the toothbrush had the highest revenue share (26% in 2020). The rising incidence of cavities, sensitivity, and gingivitis has increased toothpaste usage significantly in both emerging and wealthy countries. As a result, toothpaste is now an essential part of good dental health. In the oral care sector, toothpaste thus commands the biggest market share.

- Toothbrush

- Toothpaste

- Mouthwash

- Dental Floss

- Denture Care

By Age Group (Revenue, USD Billion):

Adults lead the oral care market over the projection period based on age group. The overall expansion of the oral care industry is being driven by adults' increasing consumer knowledge of mouth cleanliness and care. Adult oral care products come in a variety on the market.

- Children

- Adults

- Geriatric

By Sales Channel (Revenue, USD Billion):

The specialty stores dominate the oral care market over the projection period based on the sales channel. Specialty shops carry a broad selection of goods. The employees of specialty businesses provide customers with precise product information. With the aid of specialty shops, customers can also find all types of dental care items under one roof.

- Hypermarkets/Supermarkets

- Specialty Stores

- Drug Stores &Pharmacies

- Convenience Stores

- Online Sales Channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.