10 Ways in which Current Macro Upheavals in China will Impact Global Life Sciences Industry

The globalization of China's life science sector analyzes the Chinese government's backing for the healthcare industry and its effects on global political and economic ties as well as on worldwide scientific innovation.

Buy Now Download Sample Report

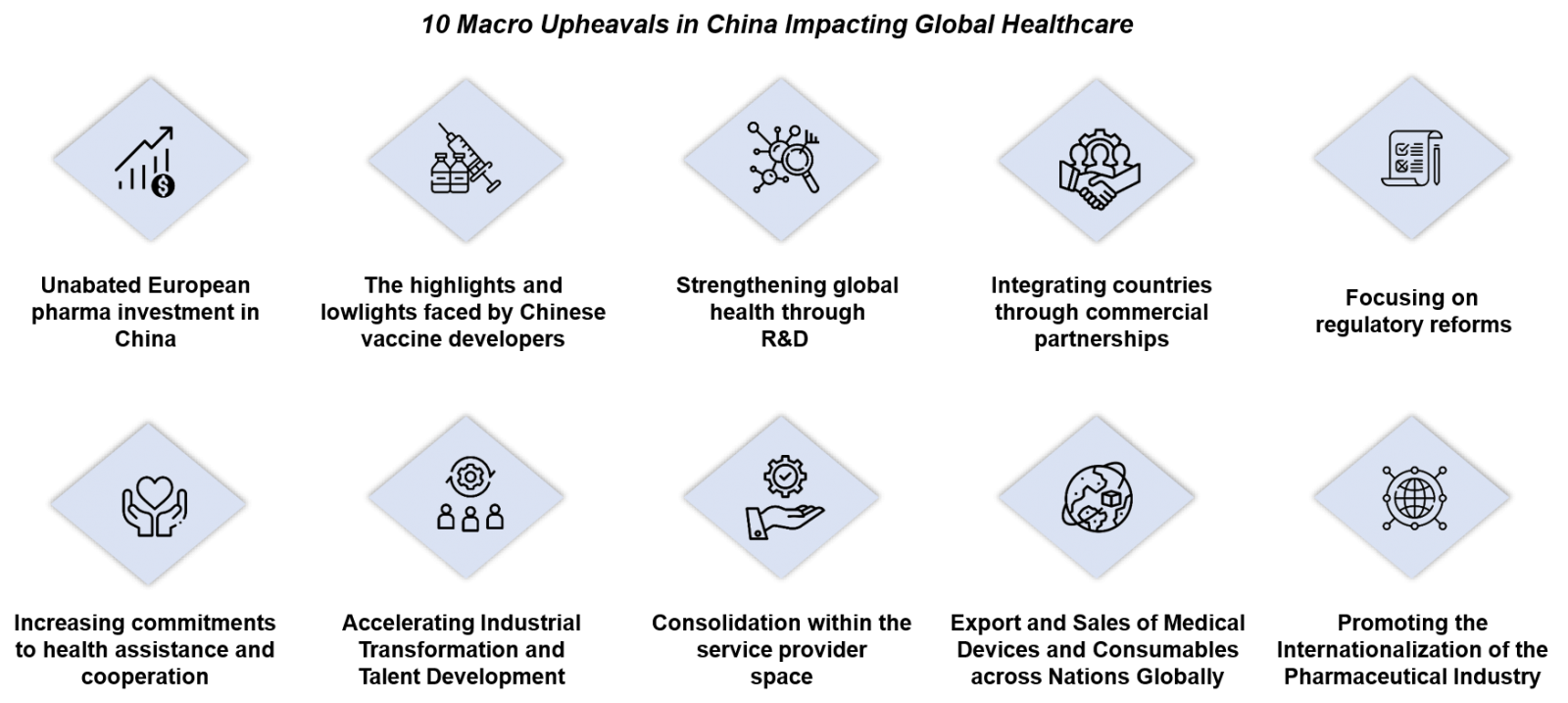

Macro Upheavals Impacting Global Healthcare

Unabated European Pharma Investment in China

- Big Pharma players are investing in China-specific projects and growing their footprint across the mainland as China represents an ever-increasing share of their global profits

- In order to more effectively and comprehensively connect with Chinese medication developers, Boehringer Ingelheim (BI) built a new hub in Shanghai to consolidate its R&D and business development operations in China

- Additionally, Novo Nordisk unveiled ambitious intentions to combine their Chinese and international businesses with an emphasis on clinical development

- Novo Nordisk’s "China Essentials" program seeks to simultaneously submit clinical trial applications for new drugs in China and other countries for the first time, with a goal of 90% by 2025

The Highlights and Lowlights Faced by Chinese Vaccine Developers

- An intriguing microcosm of the status of development of the entire business can be seen in the highs and lows encountered by Chinese vaccine developers in their quest to deploy a COVID-19 vaccine

- While Chinese companies were among the first in the world to introduce vaccine candidates into the clinic, validating the advancements made by the country's overall biopharmaceutical industry and significantly raising the stature of Chinese scientific research abroad, it was ultimately a Big Pharma-backed vaccine from Pfizer and German biopharma player BioNTech that first crossed the finish line

- Chinese-developed COVID-19 vaccines received approval for routine or emergency use in China and several other nations, including the UAE, Egypt, and Brazil, but not by the US or the EU, which were regarded as the world's two most stringent regulatory bodies

Strengthening Global Health through R&D

- China’s 14th Five-Year Plan calls for an average annual increase in R&D spending across the industry of more than 10% in addition to the requirements for the innovative development of the pharmaceutical industry in the fundamental principles, these requirements are also reflected in terms of development goals

- By 2025, the share of newly sold innovative items in the increase in operating revenue for the entire industry will further rise

- The National Natural Science Foundation of China (NSFC) and the China Grand Challenges project were established to promote scientific and technical innovation that may address important issues facing emerging nations

- The initiative has supported research on AIDS vaccine development, child and maternal mortality, tuberculosis (TB) treatments, vaccines, and more at prestigious universities, research centers, and hospitals in China

Integrating Countries through Commercial Partnerships

- Chinese and British agencies convene as part of a bilateral Global Health Dialogue that determines areas of shared interest for potential future cooperation

- The Chinese government is assisting the Africa Centres for Disease Control and Prevention (CDC) and has also inked MOUs with the WHO and numerous bilateral partners to address some healthcare constraints

- Private health sector businesses, organizations engaged in health research, and other entities are being engaged by China and foreign partners

- This might entail setting up a platform for cooperation in global health and technical professionals and should develop a mutual understanding as a foundation for more productive collaboration

Focusing on Regulatory Reforms

- China is collaborating with international partners to remove obstacles that prevent more high-quality and reasonably priced Chinese healthcare products from entering the global market, which could have a larger impact on world health

- To provide technical support and support reforms that bring Chinese regulations and standards in clinical trials, drug approval, and manufacturing into line with international norms, WHO and the National Medical Products Administration which is China's main regulatory agency for drugs and medical devices have come together

- Chinese businesses can more easily pursue concurrent domestic certification and WHO prequalification of their products

Increasing Commitments to Health Assistance and Cooperation

- China is promoting global health by covering the agreements for working with African nations, like FOCAC for health co-operation

- Under FOCAC, a forum for China-Africa health development has been established, and agreements have been made to offer health aid to African nations

- As part of efforts to boost international cooperation, the Chinese government has signed MOUs with several multilateral organizations, most notably the WHO for global health

- China is actively developing better health policies, demonstrating its commitment to playing a greater role in global health, and beginning to demonstrate the thematic goals, kinds of cooperation, and levels of engagement that the government envisions

Accelerating Industrial Transformation and Talent Development

- The development of the pharmaceutical industry in China depends on encouraging technical collaboration in the pharmaceutical area between business, academia, research facilities, and hospitals, as well as on maximizing the potential of those working in that sector globally

- In order to improve collaboration with scientific research institutions and jointly create a national strategic scientific force in the field of biomedicine, the 14th Five-Year Plan emphasizes its support for innovative pharmaceutical firms

- Additionally, the strategy calls for funding the establishment of independent pharmaceutical R&D organizations, assisting in the creation of premier clinical research facilities, and enhancing the capabilities of clinical research design and research services

Consolidation within the Service Provider Space

- The biopharma boom in China has also energized the CRO and CDMO space, with demand greatly outstripping supply across many fundamental services, through acquisitions, Chinese pharmaceutical businesses are expanding their market share and entering the global pharmaceutical outsourcing sector

- In order to increase its CDMO capability and market reach in Europe, WuXi AppTec made an agreement with Bristol Myers Squibb to purchase the latter's production plant in Couvet, Switzerland in 2021

- To improve its CMC capabilities in the UK and China, Pharmaron purchased a commercial API production plant from Recipharm at the beginning of 2022

- These transactions represent a grown Chinese CRO and CMO market, which grew at a CAGR of 30.8% from 2016 to 2021, much faster than the global average of 9.5%

Export and Sales of Medical Devices and Consumables across Nations Globally

- In numerous healthcare sub-sectors, China is the 2nd largest healthcare market in the world, offers the potential to global exporters

- The most active and vitally essential segment of the Chinese healthcare market for international enterprises continues to be medical equipment

- Medical equipment with advanced technology is typically imported, while low to mid-range market segments are dominated by native products

- China's medical device industry is anticipated to grow at a CAGR of 6.2% from 2020 to 2025, bringing about USD38.4 billion by 2025

- The diagnostics, imaging, and consumables subsectors of the Chinese medical device industry accounted for about 50% of the market's value

Promoting the Internationalization of the Pharmaceutical Industry

- In terms of going worldwide, China is promoting to support businesses in synchronizing the registration of novel medications in China and abroad as well as conducting international multi-center clinical research for developed nations

- The globalization of China's pharmaceutical business includes the process of internationalization that also involves the exit of native pharmaceutical firms and the admission of foreign pharmaceutical firms

- This is carried out by actively enticing multinational corporations to establish R&D centers and innovative drug manufacturing bases in China, as well as by using cooperative development and technology licensing to realize the entry of foreign pharmaceutical companies, in order to drive the development of the domestic pharmaceutical industry companies

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.